While the cryptocurrency market decides its next move, liquidation pools in the two leading cryptocurrencies threaten a potential short squeeze. Bitcoin (BTC) and Ethereum (ETH) could pump next week if the market liquidates short positions betting against these finance giants.

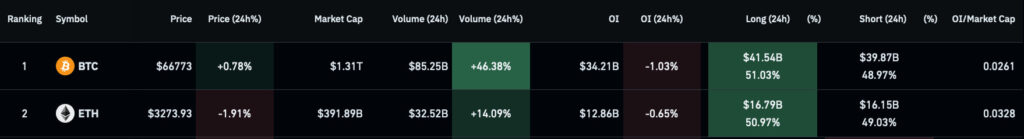

Bitcoin lost a trading range support on April 1 and is down nearly 7% month-to-date, at $66,773. Meanwhile, Ethereum had a similar pattern, down nearly 10% month-to-date, trading at $3,273 by press time.

Derivatives market data of Bitcoin and Ethereum. Source: CoinGlass

In this context, cryptocurrency Futures traders have favored opening short positions against the two most valuable cryptocurrencies. Therefore, Finbold retrieved data from CoinGlass on April 5 to understand the risks and potential of a short squeeze pump.

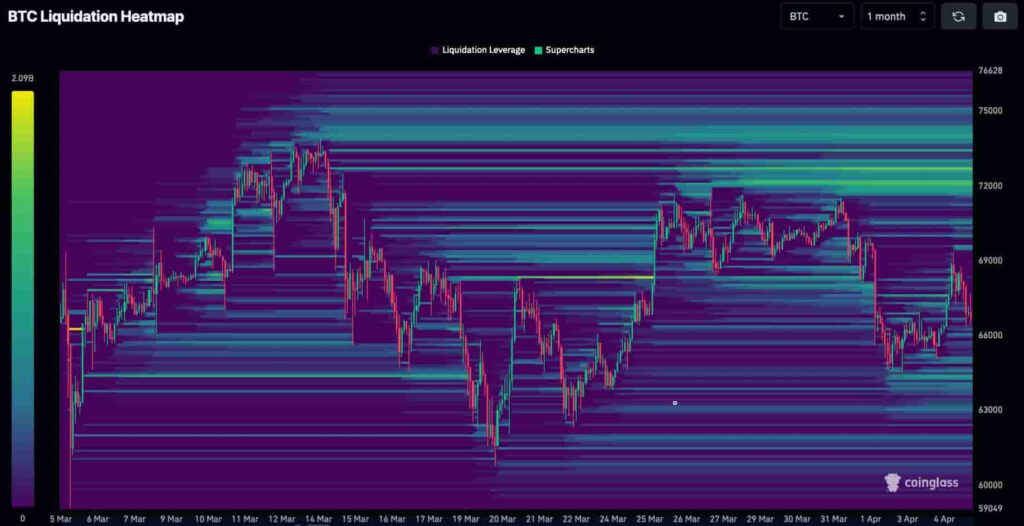

Bitcoin (BTC) liquidation heatmap in a 1-month time frame. Source: CoinGlass

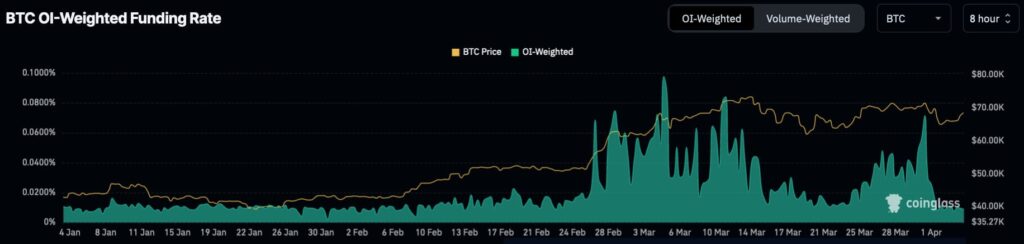

However, derivatives market data for Bitcoin is not conclusive in the occurrence of a short squeeze. That is due to BTC displaying relatively low funding rates, which indicates Bitcoin’s open interest is balanced among short and long positions. Thus, market makers and professional traders could wait for a higher imbalance before making the big move.

BTC OI-weighted funding rate, 8-hour chart. Source: CoinGlass

Pump potential for Ethereum (ETH) next week

As for Ethereum, the leading Web3 and DeFi cryptocurrency, has two relevant margin liquidity pools. First, at slightly below the $3,700 mark, ETH displays one of the highest accumulated short liquidations in one month. Next, aiming at a target of around $4,100 per Ether.

Ethereum (ETH) liquidation heatmap in a 1-month time frame. Source: CoinGlass

Nevertheless, Ethereum’s funding rate hints at the same as Bitcoin’s. The low-weighted imbalance suggests it might take a bit longer for a short squeeze to occur. On that note, a dominating bearish sentiment amid increased volume could potentially accelerate this event.

ETH OI-weighted funding rate, 8-hour chart. Source: CoinGlass

In summary, Bitcoin and Ethereum have considerable potential to face a short squeeze and a price surge next week. Moving to the aforementioned most optimistic targets would result in over 12% and 25% gains for BTC and ETH, respectively.

Still, traders should wait for higher funding rates for both cryptocurrencies to increase the odds of such a liquidation event.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.