Bitcoin (BTC) once again has its sights set on the $70,000 mark after a brief correction that momentarily threatened to push the leading cryptocurrency lower.

Despite trading below $70,000, prevailing market sentiment strongly suggests that the overall sector remains in a bull run, with the top crypto poised for another potential record high, particularly in light of the upcoming halving event.

As a result, crypto trading expert TradingShot has suggested that Bitcoin, buoyed by the imminent halving, is primed for an unprecedented surge, possibly signaling the onset of its most aggressive bull cycle to date.

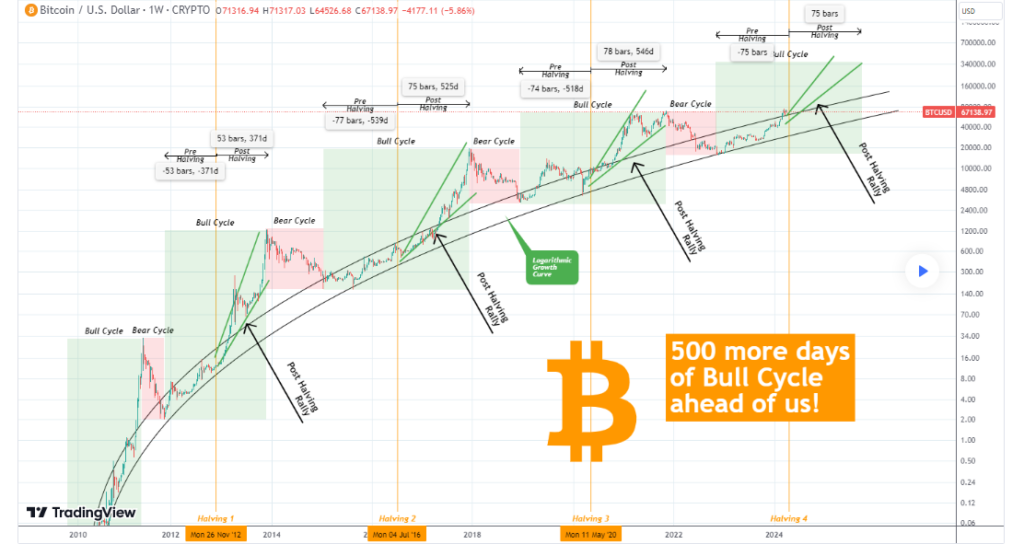

Bitcoin price analysis chart. Source: TradingView

Notably, traders utilize the logarithmic growth curve to discern long-term trends and price targets for Bitcoin. It offers insights into the magnitude and pace of Bitcoin’s price appreciation, aiding investors in making informed investment decisions.

This departure from the norm just ahead of the halving event is perceived as a bullish signal, particularly when considering Bitcoin’s historical buying zone.

Accuracy of the golden ratio

A pivotal aspect of the analysis revolves around the halving’s golden ratio, a metric that has proven accurate in past cycles. As per the expert, this ratio suggests that the period from the bottom of the preceding bear cycle to the halving event is proportionally equivalent to the period from the halving to the peak of the ensuing bull cycle.

According to TradingShot, the golden ratio’s implications are profound, hinting that Bitcoin may be on the cusp of an extended bull cycle spanning at least 500 days.

“It has [golden ratio] held beautifully on the 3 previous Cycles and there is no reason not to expect it to unfold this time also. This indicates that we have at least another 500 days of Bull Cycle ahead of us and the best part is that those will be in the form of the most aggressive part of the Cycle, the Post-Halving Parabolic Rally (green Megaphone),” the analyst noted.

Notably, the upcoming halving remains a pivotal event, particularly considering Bitcoin’s previous performance leading up to such occurrences. Historically, Bitcoin has achieved record highs after halving events, making this one worth monitoring.

Despite a brief correction, Bitcoin has seen minor gains recently, fueled by several potential bullish catalysts. One such catalyst is the news that BlackRock (NYSE: BLK), the world’s largest asset manager, has included major U.S. banks as participants in its spot Bitcoin exchange-traded fund (ETF). The filing shared online listed notable names like Goldman Sachs (NYSE: GS), Citadel Securities, UBS, and Citigroup (NYSE: C).

At the same time, Bitcoin and the broader crypto market experienced gains following indications from the Federal Reserve suggesting the likelihood of interest rate cuts before the end of 2024.

Bitcoin price analysis

At the time of writing, Bitcoin was trading at $68,195, posting daily gains of approximately 0.5%.

Bitcoin seven-day price chart. Source: Finbold

Meanwhile, investor focus on Bitcoin remains fixed on significant support levels, notably $65,000, as they will play a crucial role in shaping the asset’s next trajectory.

Disclaimer:The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.