Despite many cryptocurrency experts firmly believing that the upcoming Bitcoin (BTC) halving will usher in an explosive rally for the flagship decentralized finance (DeFi) asset, the co-founder of crypto exchange BitMEX and prominent investor, Arthur Hayes, doesn’t share their optimism.

Specifically, Hayes has admitted that the halving would “pump prices in the medium term” but has also argued that the Bitcoin “price action directly before and after [the halving] could be negative,” because of the role of the narrative surrounding it, according to his blog post on April 8.

As he pointed out:

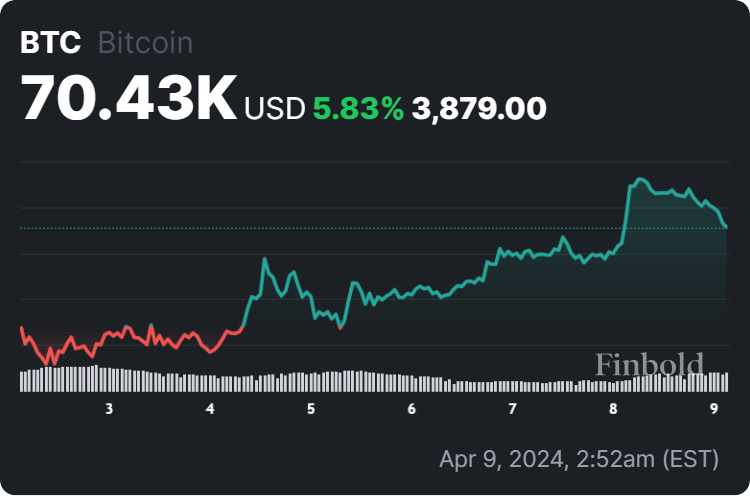

Bitcoin price 7-day chart. Source: Finbold

It is also worth noting that professional crypto trader Ali Martinez has recently observed that Bitcoin appeared to be breaking out of its symmetrical triangle chart pattern and that holding above $70,800 would make $85,000 its next target, but the maiden crypto has dropped below this level.

All things considered, Arthur Hayes might be right in his projection of a crypto fire sale around the BTC halving date but fewer new Bitcoins entering the market should decrease the potential sell pressure and increase network security, which should aid in the asset’s price increase in the longer term.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.