With the cryptocurrency market currently in a bull cycle, investors are actively seeking opportunities to earn profits, leading to a search for viable strategies and digital assets worth investing in.

Although some segments of the crypto market believe that the sector might have reached its peak for the current phase, an on-chain crypto analyst who goes by the pseudonym 0xReflection, in an X (formerly Twitter) post on April 9, contends that there is still room for profit in this cycle.

According to the analyst, with Bitcoin (BTC) halving only days away, investors can potentially turn a modest $1,000 investment into a staggering $1 million during this crypto cycle.

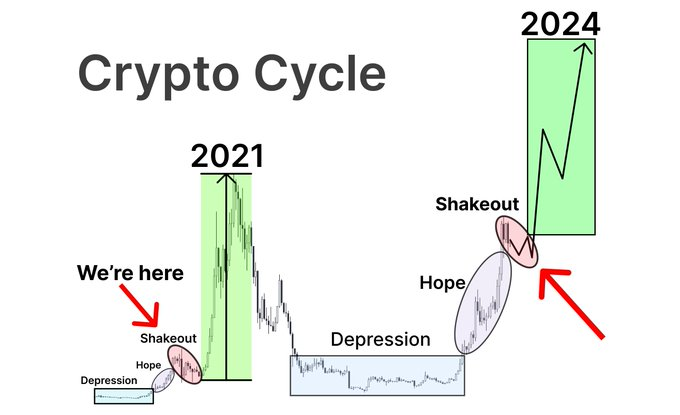

Crypto market cycles. Source: X/0xReflection

One prominent cycle is the bull run cycle, characterized by pumps in major cryptocurrencies like Bitcoin, followed by a “shakeout” period of temporary price dips and culminating in an altcoin season. Recent analysis indicates that the market has moved beyond the initial phase of the bull run cycle and is now entering the second stage.

Crypto market cycles. Source: X/0xReflection

The expert’s insights focus on capitalizing during the market’s “shakeout” stage when prices dip before experiencing significant growth.

In this scenario, savvy investors typically anticipate a shakeout stage preceding every alt season, providing a prime opportunity to acquire altcoins at discounted prices.

“Many are hesitant to enter the market now because it’s in a state of uncertainty. But, every alt season is usually preceded by a shakeout stage, allowing major players to buy alts at dirt-cheap prices. I believe it’s the last chance to grab alts, just before 100x soar,”

Altcoins to capitalize on

Additionally, the analyst suggested eight altcoins across various narratives, each with the potential for massive gains. These include Zero1, an ecosystem based on decentralized artificial intelligence (DeAI), focusing on data governance, and Naka, a fast and affordable Bitcoin layer two blockchain tailored for DeFi applications.

Other selections include AQTIS, a finance platform that utilizes AI and math to manage investments and returns, and Map Protocol Network, an EVM-compatible blockchain that facilitates cross-chain interactions.

The list also included NetMind, Polytrade, Entangle and Blocksquare.

These picks are from sectors such as AI, layer 2 solutions, Real-World Assets (RWA), Bitcoin Layer 2, and GameFi, reflecting diverse opportunities within the space.

It’s worth noting that the highlighted altcoins have low market capitalization and liquidity, rendering them risky investments. Moreover, the overall market remains susceptible to inherent volatility, a factor likely to impact the return on investment.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.