As May approaches, anticipation is building around the potential approval of an Ethereum (ETH) spot ETF. This development has captured the attention of traders and investors, with Ethereum’s status as the second-largest cryptocurrency by market cap suggesting significant potential benefits.

However, despite the excitement, ETH has been struggling to keep pace with Bitcoin (BTC) in recent times. This 3-year low ETH/BTC exchange rate challenges what enthusiasts call “the flippening”- a hypothetical scenario where Ethereum surpasses Bitcoin as the dominant cryptocurrency by market capitalization.

Several factors are contributing to this underperformance. One key reason is the decline in activity on Ethereum’s network. The number of active users and the overall transaction volume on ETH’s decentralized applications (DApps) have both dropped significantly.

Ethereum 1-month price prediction. Source: CoinCodex

This translates to a potential rise of 3.15% from its current price. While positive, the upward trend is expected to be relatively modest.

Ethereum price analysis

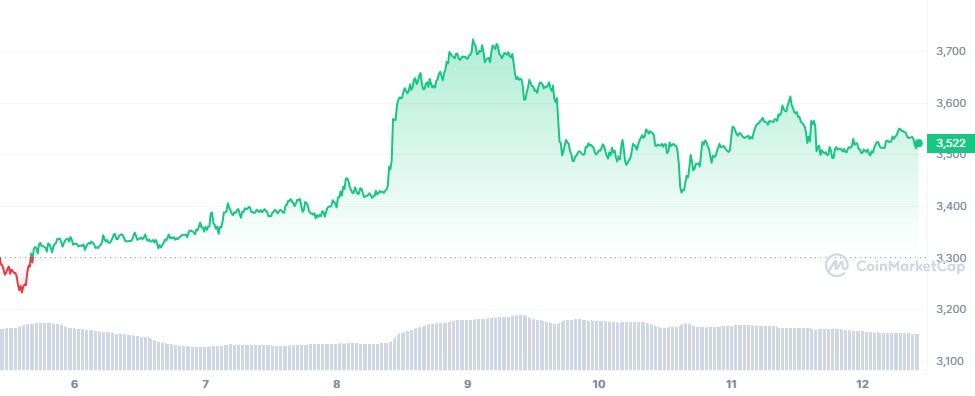

At press time, Ethereum’s price today stands at $3,522. Despite experiencing a slight decline of 2.08% for the day, ETH has seen an increase of 6.71% over the past week.

However, this upward momentum contrasts with a decrease of 11.48% over the past month.

ETH 7-day price chart. Source: CoinMarketCap

Nevertheless, ETH had 17 green days in the last 30 days, accounting for 57% of the month. Additionally, the price has increased by 88.14% over the year.

Despite recent fluctuations, the overall trend suggests resilience and potential for further growth in the near future.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.