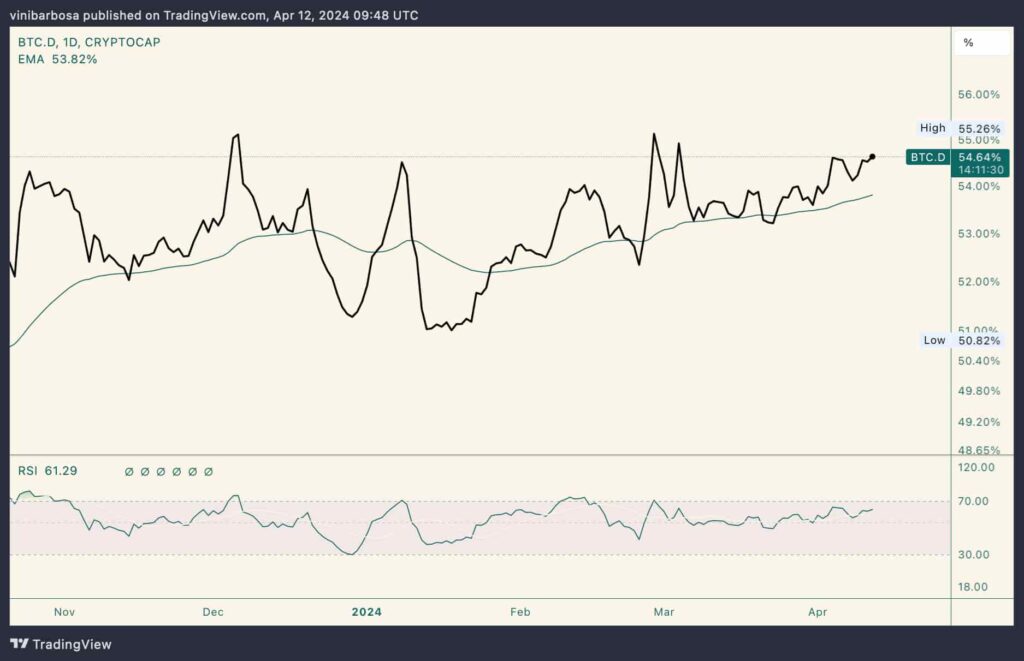

Bitcoin’s (BTC) dominance is back to local resistance, nearing 55%, while the altcoins lost strength against the leading cryptocurrency. As this occurs, crypto traders favored opening short positions against cryptocurrencies that could soon skyrocket with a short squeeze.

Notably, the Bitcoin Dominance Index (BTC.D) is 54.64%, currently above the 50-day exponential moving average (EMA). The BTC.D nears a local top at 55.26% as Bitcoin gains strength against altcoins, mostly of which traders have been increasingly shorting.

Bitcoin Dominance Index (BTC.D). Source: TradingView

As a result, some of these cryptocurrencies accumulate relevant liquidation pools upwards, potentially triggering short squeezes next week.

ADA Liquidation Heatmap. Source: CoinGlass

Furthermore, futures contracts open interest for Cardano remains at significant historical levels, with proportional low prices. There is circa $400 million in these contracts, according to data retrieved from CoinGlass on April 12.

ADA Futures Open Interest (USD). Source: CoinGlass

Dogecoin (DOGE)

Another cryptocurrency with historically high open interest is Dogecoin (DOGE). The leading meme coin has over $1.55 billion with opened positions in the derivatives market, indicating high volatility ahead.

DOGE Futures Open Interest (USD). Source: CoinGlass

Interestingly, many of these are made of short positions, opened in a similar price range. The mass-shorting has created a dense liquidity pool at $0.21, which market makers could target for a short squeeze.

ADA Liquidation Heatmap. Source: CoinGlass

Dogecoin traded at $0.198 by press time. Therefore, a run to these liquidations would reward DOGE traders with 6% gains.

However, having accumulated liquidity is not enough to ignite short squeezes. These trading events are caused by a conjunction of factors playing together and usually require a fundamental motivation like bullish news as a trigger.

For that reason, traders and investors must follow news and developments related to these cryptocurrencies while making financial decisions.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.