The cryptocurrency market, alongside other risk assets, has experienced a short-term sell-off amid escalating geopolitical tensions in the Middle East. Indeed, this situation has interrupted the recent bullish momentum.

Despite these conditions, several cryptocurrencies are demonstrating potential for increased buying pressure, which could impact their market capitalization. Notably, a surge in buying pressure would likely hinge on any bullish momentum anticipated by the market, considering events such as the upcoming Bitcoin (BTC) halving.

In this context, Finbold has identified two digital assets likely to reach a market cap of $50 billion by 2024. Some of these assets are already approaching the threshold.

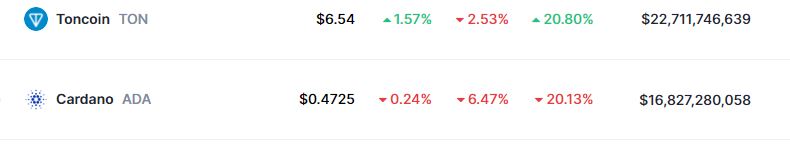

TON market capitalization. Source: CoinMarketCap

XRP

Prior to the recent market sell-off, XRP was holding steady above the $0.60 support zone. Notably, the token has largely consolidated below the $1 level, with several fundamental factors aligning in its favor.

Specifically, its focus on remittance and established partnerships with financial institutions position it for potential growth. Although the ongoing legal battle between Ripple and the Securities and Exchange Commission (SEC) introduces some uncertainty, a successful resolution could pave the way for broader adoption, potentially propelling XRP’s market cap toward the $50 billion mark.

Meanwhile, Ripple’s monthly token unlocks, alongside occasional additional sell-offs, could contribute to capitalization through inflation of the circulating supply.

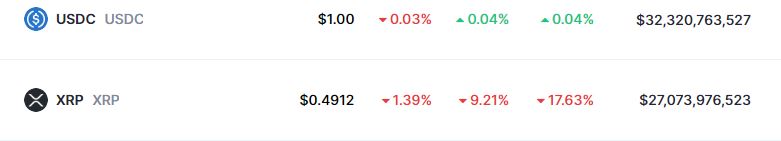

As of press time, XRP had a market capitalization of $27.07 billion, indicating that the token would need an upside of approximately 84% to reach $50 billion.

XRP market capitalization. Source: CoinMarketCap

With barely two weeks left in April, the mentioned cryptocurrencies’ approach to the $50 billion mark will likely heavily rely on possible bullish momentum. Any rally will significantly hinge on how the markets react to geopolitical tensions.

Disclaimer:The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.