With less than five days left until the monumental fourth Bitcoin (BTC) halving event, during which the reward for mining the original cryptocurrency will reduce in half, many crypto analysts are optimistic that a price rally will follow, including one that sees Bitcoin soaring to $80,000 shortly afterward.

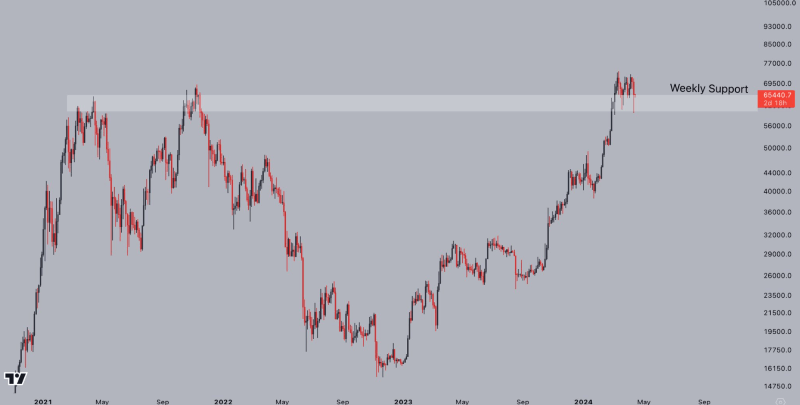

Specifically, Bitcoin’s 3-day chart remains bullish despite this weekend’s consolidation below the critical psychological level at $70,000, and $80,000 could be in store soon, according to the observations shared by pseudonymous crypto industry expert CryptoJelleNL in an X post on April 15.

Bitcoin price chart pattern analysis. Source: CryptoJelleNL

Indeed, the estimated Bitcoin halving date currently stands at April 19, 2024, 18:07 Universal time Coordinated (UTC), which means that there are only four days left until one of the digital asset’s historically most bullish catalysts takes place, and its massive week has only just started.

Bitcoin halving date ETA. Source: NiceHash

BTC price prediction

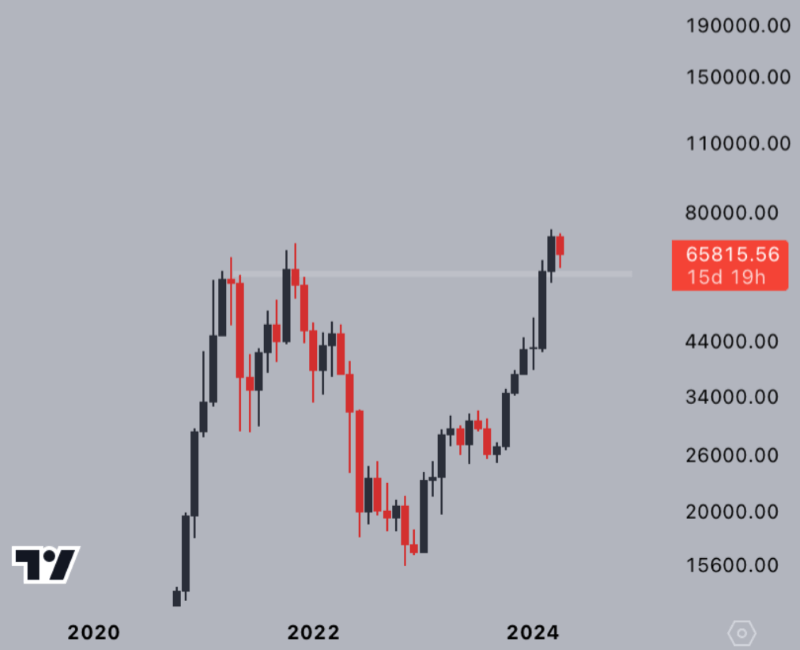

On top of that, the crypto trading analyst earlier pointed out that the flagship decentralized finance (DeFi) asset was still holding above its previous cycle highs, suggesting that “everything is going to be okay” during this time around and adding a chart to drive the point home.

Bitcoin price previous cycle highs. Source: CryptoJelleNL

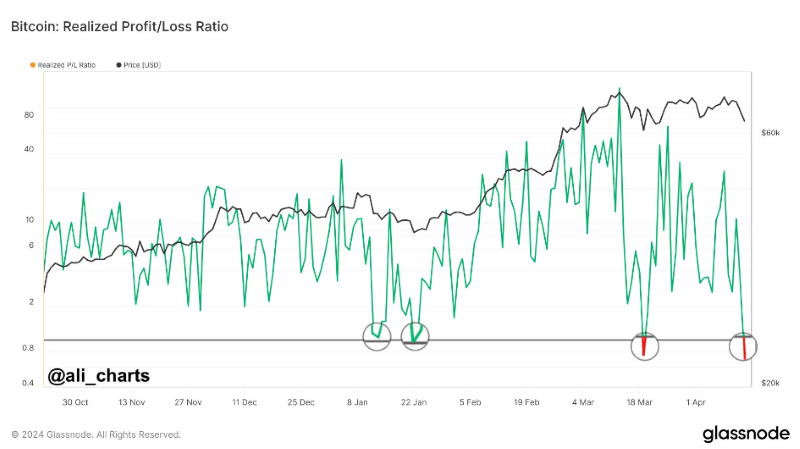

On top of that, another renowned crypto expert, Ali Martinez, has highlighted that the Bitcoin realized profit/loss ratio has fallen below 1, suggesting that investors are currently realizing more losses than profits,” which has traditionally indicated a local bottom for BTC over the past six months.

Bitcoin realized profit/loss ratio. Source: Ali Martinez

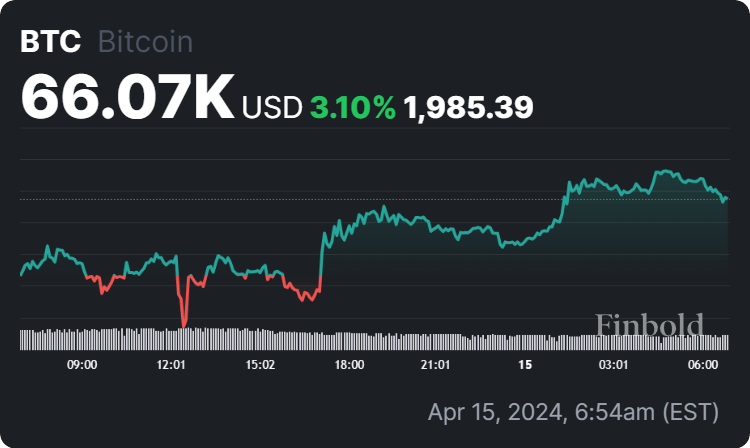

For now, Bitcoin is trading at $66,070, suggesting an increase of 3.10% in the last 24 hours, as it moves to recover from the 8.43% drop from across the previous seven days and the loss of 3.24% accumulated on its monthly chart, as per the most recent price data.

Bitcoin price 24-hour chart. Source: Finbold

All things considered, the largest asset in the crypto market is approaching one of its most important events, which is almost certain to have an immense impact on its price. However, setting a precise Bitcoin price prediction is difficult so doing one’s own research before investing is critical.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.