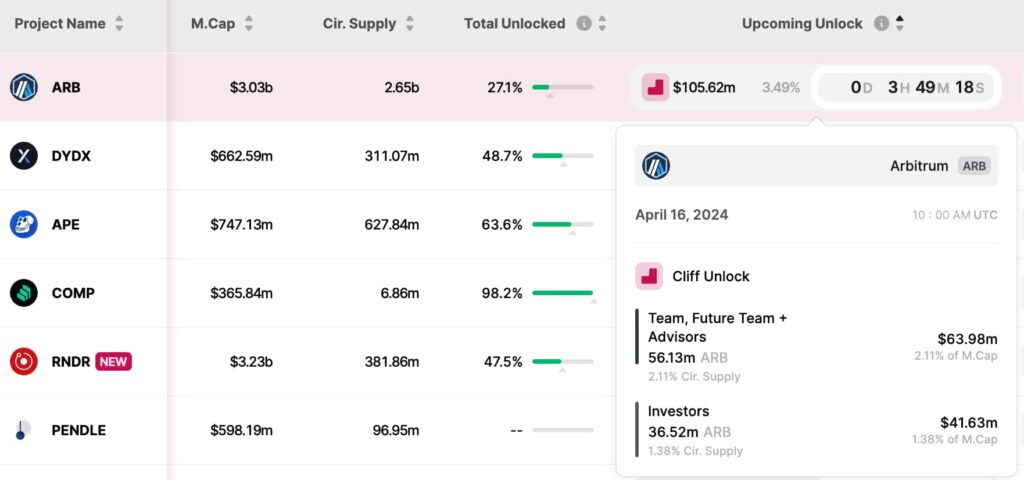

Arbitrum (ARB), one of the most popular second layers for Ethereum (ETH), threatens a significant sell-off this week. The protocol will unlock over $100 million in tokens in the next few hours of press time, on April 16.

Notably, Arbitrum’s contracts will unlock 92.65 million ARB for the team behind the project and the early investors.

The former, composed of “Team, Future Team, and Advisors” will receive 56.13 million tokens worth $63.98 million. Meanwhile, “Investors” will have 36.52 million ARB unlocked, at a $41.63 valuation.

Arbitrum (ARB) and other cryptocurrencies’ cliff unlocks. Source: TokenUnlocksApp

Arbitrum (ARB) price analysis amid unlock sell-off

Previously, Arbitrum massively unlocked 11.1 billion ARB worth over $2 billion on March 16, as reported by Finbold. This activity represented an inflation superior to 75% by that time and could have directly impacted the asset’s price.

The economic effects of such supply inflation are yet to be fully grasped by the cryptocurrency market. However, it is already partially observable in ARB’s daily price chart.

Interestingly, Arbitrum was trading at $2.11 two days before March’s unlock, suffering a 31% loss to $1.44 on March 19’s lowest exchange rate. ARB now trades at $1.14 per token as is 46% down in these 33 days.

Moreover, its daily Relative Strength Index (RSI) reveals a weak momentum for Arbitrum, unrecovered since the previous unlock. In the meantime, other cryptocurrencies registered strong and even overbought RSIs, now challenged with geopolitical tensions escalation.

Arbitrum (ARB) daily price chart. Source: TradingView

In summary, Arbitrum’s team, future team, advisors, and investors will receive over $100 million worth of tokens unlocked. These 92.65 million ARB will enter the 2.65 billion circulating supply. Therefore, economic inflation may create a sell-off pressure with a potential impact on price.

Technical indicators sum up to the fundamental analysis suggesting a bearish momentum for Arbitrum, now fueled by April 16’s unlock. Investors must be cautious and watch further developments to make financial decisions.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.