On Thursday, Bitcoin (BTC) experienced further declines amid ongoing pressure from higher U.S. interest rates and escalating geopolitical tensions in the Middle East.

Analysts are closely watching BTC’s price movements as it approaches a critical moment, the Bitcoin halving which is expected to happen sometime around April 19 or 20.

Despite attempts to stabilize above the $65,000 threshold, BTC’s price has struggled, signaling a bearish trend.

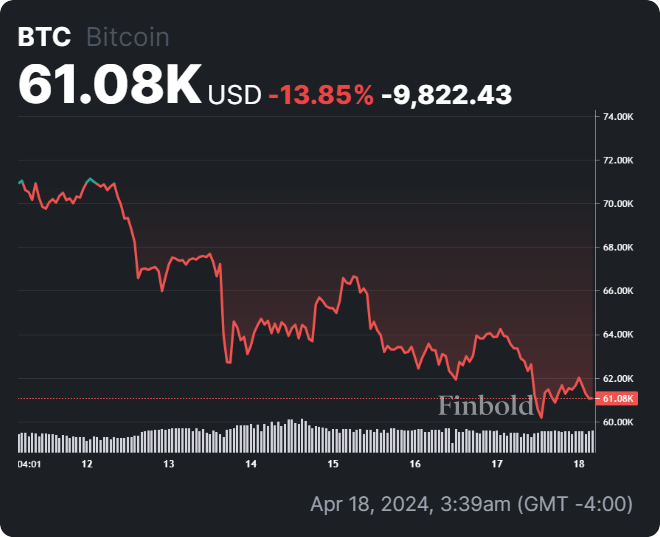

Bitcoin seven-day price chart. Source: TradingView/Ali Charts

Bitcoin price analysis

After reaching a daily high of approximately $62,210, Bitcoin price today has retraced and is struggling to maintain its price above $61,000. At press time, BTC was trading at $61,080, marking a correction of 3.49% in the last 24 hours.

Furthermore, the cryptocurrency has experienced a notable decline of 13.85% over the past week.

Bitcoin 7-day price chart. Source: Finbold

Essentially, Bitcoin’s climb towards $70,000 faced challenges despite the introduction of spot crypto exchange-traded funds (ETFs) in Hong Kong, offering some hope for investors affected by China’s crypto ban in 2021.

Whether these ETFs will spark a Bitcoin surge like in the U.S. is uncertain. With BTC’s current downward trend, investors are now focused on how the upcoming halving event will impact the market.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.