Bitcoin’s (BTC) price has continued to drop in the short term, with the asset facing threats of dipping below the $60,000 mark. Indeed, the situation has resulted in overall market uncertainty, especially considering the crypto industry is mere hours away from the Bitcoin halving event.

Given the recent market trajectory, cryptocurrency analyst CryptoCon, in a post on X (formerly Twitter) on April 17, suggested that the current correction is a necessary step towards stabilizing its price in the long term.

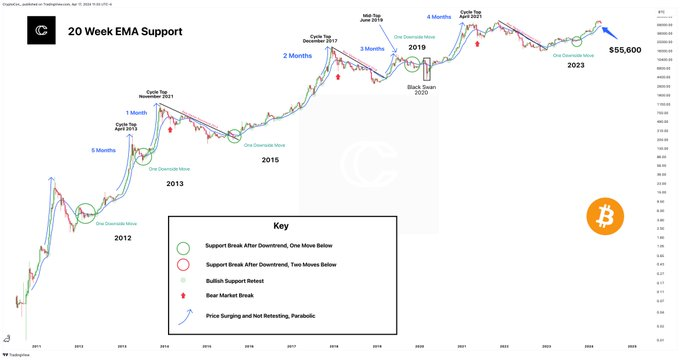

With the projected drop in price, the analyst highlighted key levels to watch before Bitcoin finds some stability moving forward. CryptoCon noted that the 20-week Exponential Moving Average (EMA) is a key indicator to monitor.

Bitcoin price analysis chart. Source: TradingView/CryptoCon

Bitcoin 30% correction avoidance

Additionally, the analyst noted that Bitcoin has notably avoided any 30% corrections throughout the current market cycle, leading some to become accustomed to a seemingly relentless upward trajectory.

Yet, as the expert highlighted, corrections are an intrinsic part of any market cycle, including those influenced by the introduction of Exchange-Traded Funds (ETFs).

At the same time, the expert pointed out that data indicates that the market has reached overextended levels, underscoring the necessity of the recent pullback. However, the analyst expressed optimism about Bitcoin’s overall trajectory, emphasizing that the current market movements are healthy for its long-term price action.

In the meantime, it’s worth noting that Bitcoin’s current retracement has aligned with historic pre-halving volatility. However, the 2024 event comes at a unique time when BTC has already hit an all-time high, diverging from the historical pattern of reaching a new all-time high after the halving.

Besides the impact of the halving event, Bitcoin has been subject to geopolitical tensions in the Middle East, alongside a slowdown in the exchange-traded fund space. Notably, the crypto has also failed to show a resurgence despite the approval of a spot Bitcoin ETF in Hong Kong. Consequently, it remains uncertain if Bitcoin will record a rally after the halving event.

Bitcoin price analysis

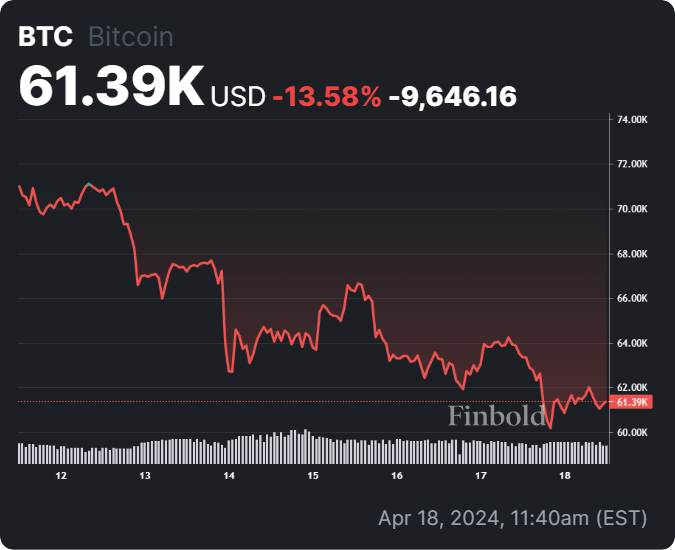

At press time, Bitcoin was trading at $61,390 with daily losses of over 3%, while on the weekly timeframe, BTC was down over 13%.

Bitcoin seven-day price chart. Source: Finbold

Overall, Bitcoin is facing a formidable test of sustaining its valuation above the $60,000 mark, as a drop below this level will signal a potential sustained downward trajectory.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.