As the price of Bitcoin (BTC) continues to decline, bears are trying to break it below the critical level of $60,000, and, should they succeed, it could spell trouble for the flagship decentralized finance (DeFi) asset and possibly the rest of the cryptocurrency market.

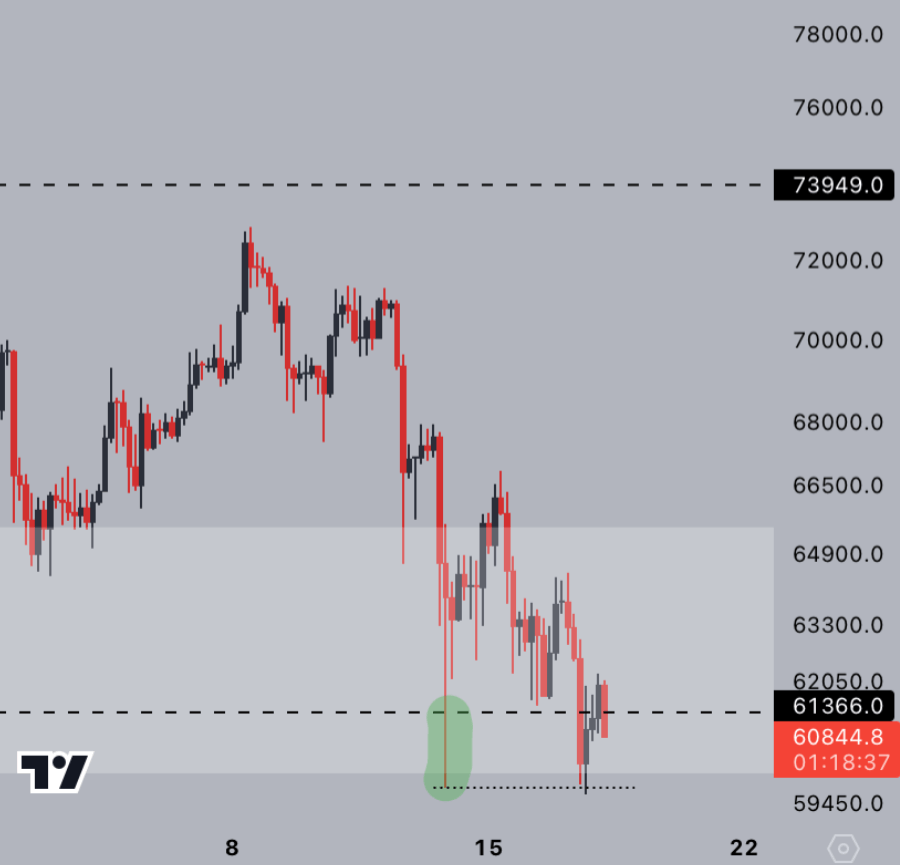

Indeed, Bitcoin has recently “reclaimed the range lows & now tests them again” as the “fight goes on” between bulls and bears, according to the chart pattern observations shared by pseudonymous crypto industry expert CryptoJelleNL in an X post on April 18.

Bitcoin bulls vs. bears. Source: CryptoJelleNL

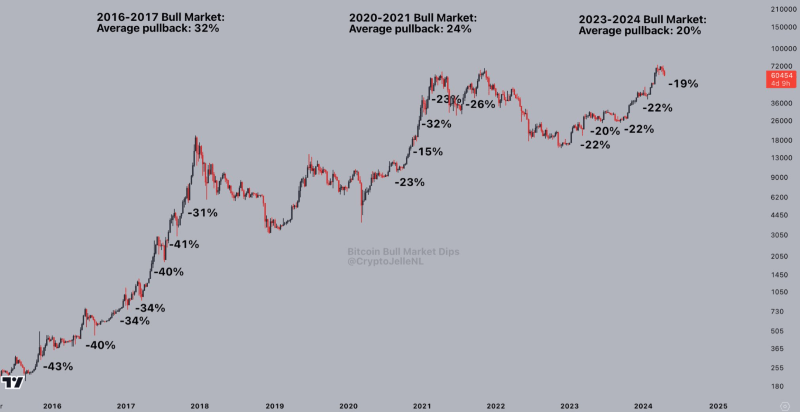

Previous Bitcoin bull markets. Source: CryptoJelleNL

At the same time, it is also worth noting that another renowned crypto trading expert, Michaël van de Poppe, has likewise observed “a waiting game on Bitcoin currently, as momentum is relatively gone,” adding that he was “expecting to continue retracement and consolidation.”

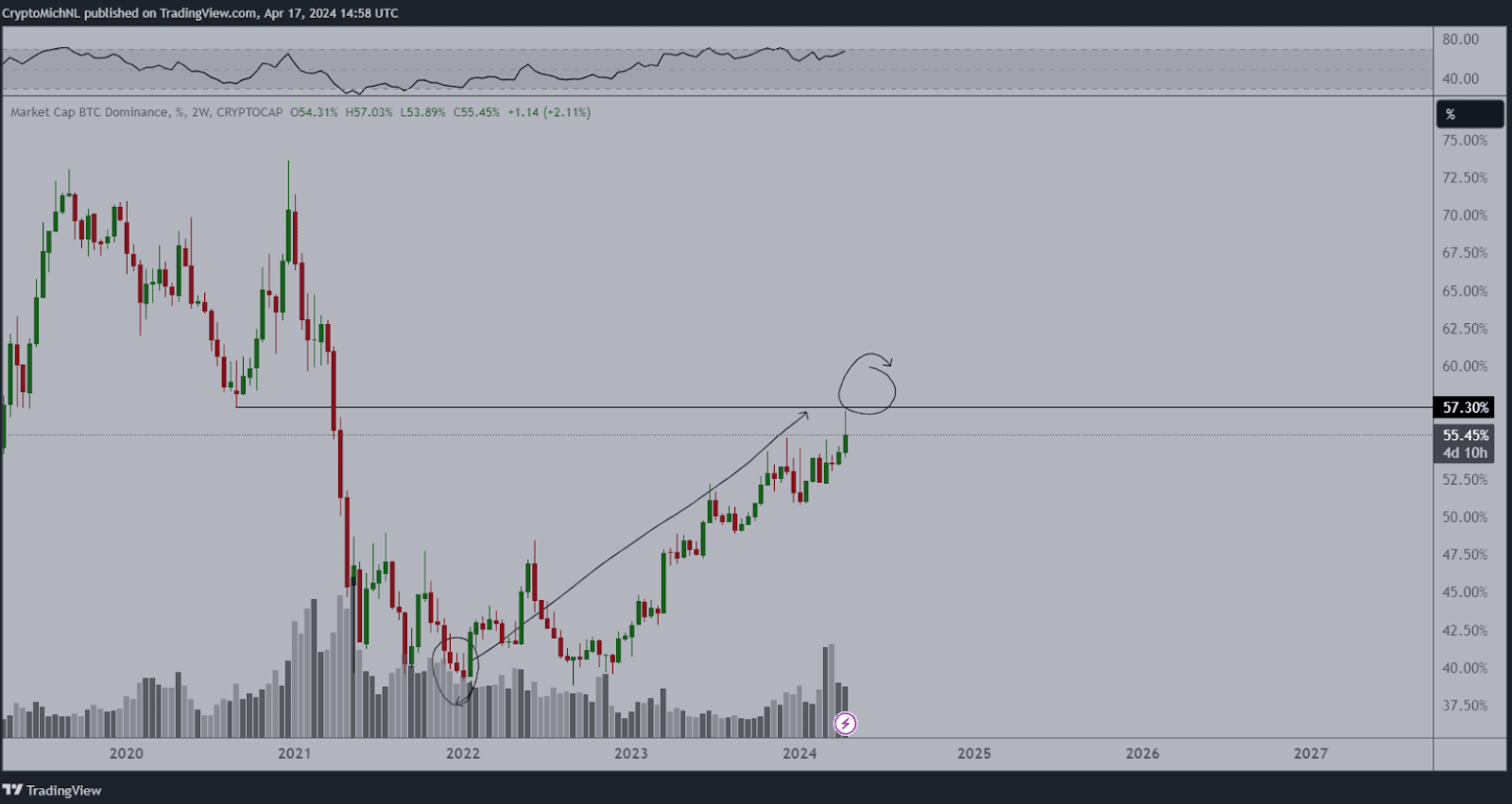

In addition, he has also pointed out that “capitulation is often the period of reversal,” acknowledging the possibility that “Bitcoin dominance has peaked after this consolidation and a reversal is on the horizon,” and demonstrating with a chart of Bitcoin’s dominance.

Bitcoin dominance chart. Source: Michaël van de Poppe

BTC price prediction

In the meantime, crypto market analyst Ali Martinez has also highlighted that Bitcoin had entered a consolidation phase within a defined trading channel, recognizing $61,000 as a critical support level that could push BTC down to $56,200 or trigger a rally toward $66,500.

Bitcoin price action analysis. Source: Ali Martinez

That said, another important development to factor in the future price of the maiden crypto asset is its upcoming halving, which will take place on April 19 and has historically led to a marked increase in Bitcoin’s price due to the heightened demand driven by a reduction in supply.

Bitcoin price analysis

At press time, Bitcoin was changing hands at the price of $61,470, which suggests a decline of 3.15% in the last 24 hours, a more significant 12.94% drop across the previous seven days, adding up to the 3.09% loss on its monthly chart, as per the most recent data.

Bitcoin price 7-day chart. Source: Finbold

So, why is Bitcoin down? Notably, some of the reasons could include a decrease in demand for the crypto asset amid the strengthening of the United States Dollar Index due to delayed rate cuts and geopolitical turmoil in the Middle East, which has emerged as a deterrent to investor enthusiasm.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.