On April 20, 2024, the Bitcoin (BTC) network marked a significant milestone when block 840,000 was mined at 12:09 am UTC. This block, crucial to the fourth-ever Bitcoin halving, set a new record for the highest fees ever recorded in the maiden cryptocurrency’s history.

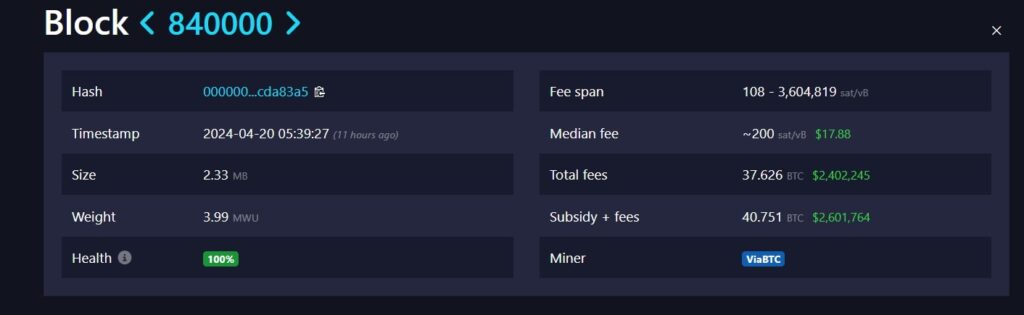

The historic block saw a total of 37.62 BTC ($2,402,358) in transaction fees alone, with the highest individual transaction fee reaching 3,604,819 satoshis per virtual byte (sat/vB). Including the miner’s subsidy of 3.125 BTC, the total payout to the mining pool ViaBTC for this single block amounted to 40.7 BTC, roughly $2.6 million.

Total payout for block 840000.Source:mempool.space

Catalyst for the Fee Surge: Runes Protocol Launch

The surge in transaction fees coincided with the launch of the Runes Protocol, which also contributed to the fees soaring above $100 for the first time.

Picks for you

3 cryptocurrencies to turn $100 into $1,000 in Q4 2024 7 mins ago Can Bitcoin be stopped? Here's what ChatGPT-4 says 16 hours ago Here's when Solana could crash to $33, according to analyst 16 hours ago Bitcoin analyst warns of 'Bart Simpson' pattern and BTC price correction 17 hours agoThis led to intense competition among users to inscribe and secure rare satoshis on this significant block, driving fees to historic heights.

Popular Bitcoin market analyst Dylan LeClair has pointed out the significant role that the Runes Protocol played in the astronomical surge in fees during the halving event.

#Bitcoin fees are so crazy because of a new token protocol that went live on block 840,000 that uses Op_Return called Runes.It is pure degenerate speculation- there is nothing being promised nor any utility other speculation.Miners will churn through it eventually. pic.twitter.com/Fw3plYN5Ee

— Dylan LeClair ? (@DylanLeClair_) April 20, 2024Sustained High Fees and Network Congestion

In the aftermath of the halving and the launch of the Runes Protocol, the Bitcoin network experienced severe congestion, with the minimum transaction fee escalating to over 1,050 sat/vb (approximately $94).

This spike in fees coincided with a backlog of over 237,000 pending transactions and memory usage that exceeded 300 MB, peaking at 1.15 GB.

Furthermore, in the nine blocks following the halving, Runes minters paid nearly 78.6 BTC in fees (about $4.95 million) to acquire rare tokens.

This trend continued with several subsequent blocks also generating over a million dollars in fees, underscoring the lasting impact of the halving and Runes Protocol on the network’s fee economy.

Almost $1M in txn fees to miners on every Bitcoin block since the halving. Wild. https://t.co/acKVRyB3r2

— Hunter Horsley (@HHorsley) April 20, 2024According to the Rune explorer, about 1,726 Runes had been “etched” – the term given for their creation on the chain – at press time. Total transactions were approaching 259,651, with millions collected in fees.

Understanding the Runes Protocol

Runes is a token standard introduced on the Bitcoin blockchain. It is designed to facilitate the creation of fungible tokens in a more efficient and user-friendly manner.

This standard was introduced by Casey Rodarmor, who is also known for his work on Bitcoin Ordinals. This new protocol facilitates token creation on Bitcoin’s blockchain using an innovative Unspent Transaction Output (UTXO) model, moving away from the traditional BRC-20 standard. By allowing users to “etch” tokens directly onto the blockchain

The introduction of Runes could potentially attract more users and developers to explore and expand upon Bitcoin’s utility, paving the way for innovative uses that could go beyond traditional financial transactions.

Disclaimer:The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.