Bitcoin (BTC) fees skyrocketed to their highest level, above $100, as the halving occurred, racking up over $2.4 million in mining fees. As a result, users, enthusiasts, and investors may turn to low-fee cryptocurrencies for efficient alternatives, potentially increasing their market demand.

The 12,000-followers cypherpunk influencer, who goes by the alias Untraceable on X (formerly Twitter), believes an extended high-fee period for BTC can drive the cryptocurrency market focus to altcoins, possibly igniting an altseason.

The longer Bitcoin transaction fees remain absudly high, the more likely an altseason will come as people start using other coins instead of Bitcoin.

— ᴜɴᴛʀᴀᴄᴇᴀʙʟᴇ (@DontTraceMeBruh) April 20, 2024In this context, one particular cryptocurrency shines with a unique approach to transaction fees in permissionless payment networks. The currently $1 Nano (XNO) has developed a feeless protocol using alternative data prioritization methods.

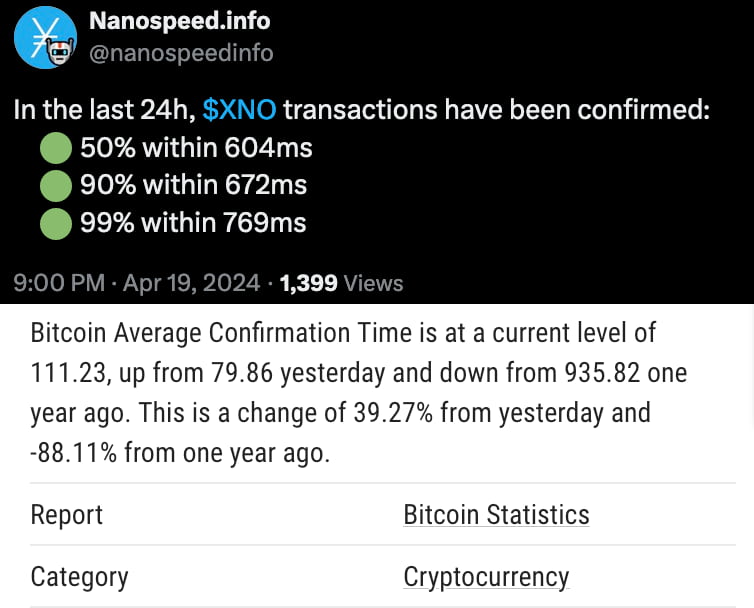

Nano and Bitcoin average confirmation time. Source: Nanospeed.info and yCharts

Is the Nano feeless network vulnerable to spam?

Interestingly, the feeless design decision has received much criticism over the years from competing cryptocurrency supporters and services. Some believe fees are crucial to prevent spam attacks and prioritize “legit transactions.” On that note, LeMahieu explained that this makes Bitcoin fees volatile while mentioning XNO’s unique methods of handling prioritization.

They’re going to be volatile as long as people are using them for prioritization and flow control.I’m not aware of anyone other than nano doing prioritization without using a fee.

— Colin LeMahieu (@ColinLeMahieu) April 13, 2024Over the years, open-source developers have implemented alternative prioritization mechanisms to the nano-node. Mira Hurley partially explained these solutions in a thread on X, published in December 2022. In short, transactions are prioritized based on an account’s activity frequency and how much XNO it holds.

1/ How does Nano's transaction prioritization work? Read the tweets below to learn how Nano prioritises transactions without resorting to fees.The Bucketing System: Prioritizing Transactions through Time and Balance ? pic.twitter.com/JLwrgojHfA

— Mira Hurley (@mira_hurley) December 12, 2022This was recently tested during a spam attack that the network successfully managed despite some users reporting occasional delays of more than one minute for finality.

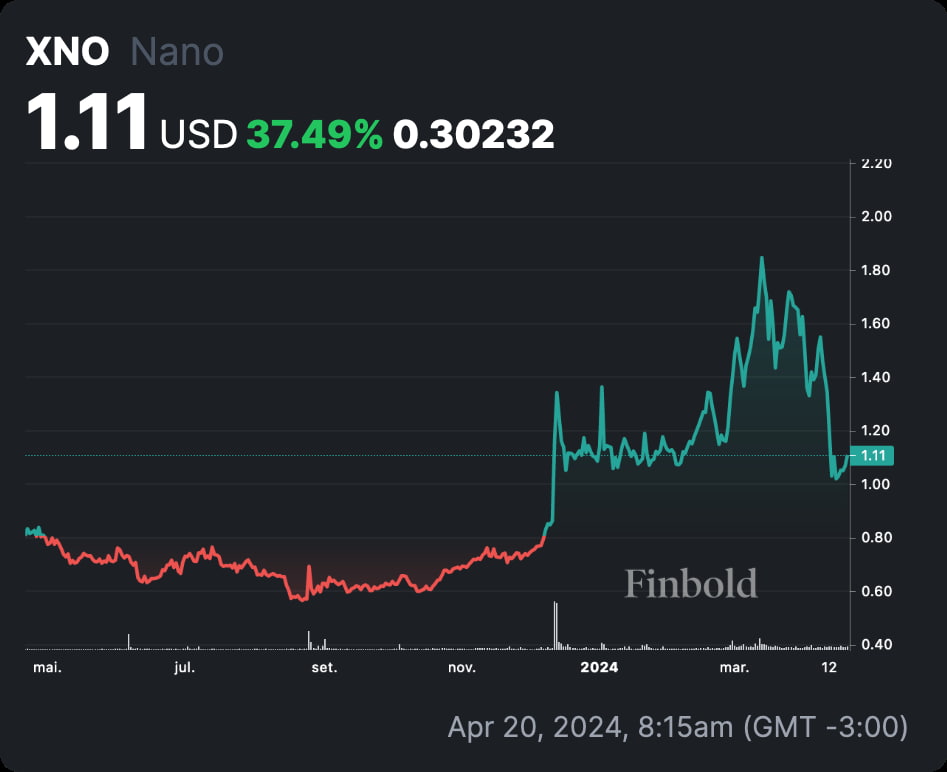

$1 cryptocurrency opportunity? Nano (XNO) price analysis

As of writing, XNO trades slightly above the $1 psychological level, at $1.11, up 37.49% year-over-year. The zero-fee cryptocurrency reached a yearly high of $1.85 in March, according to the Finbold index.

With a fully circulating supply of 133.24 million XNO, nano has a small market cap of nearly $150 million. This positions the digital commodity outside of the 300 most valuable cryptocurrencies.

Nano (XNO) 1-year price chart. Source: Finbold

The currently low capitalization means XNO holds high risks from an investment perspective. Thus, investors must do their due diligence and properly measure the risk-reward ratio before making significant financial decisions.

Low-cap cryptocurrencies are prone to higher volatility than the crypto market’s usual price fluctuations and require extra caution when trading.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.