Following the Bitcoin (BTC) halving, average network fees skyrocketed to record highs above $100 this weekend. Searches and mentions of “Bitcoin fees” surged in Google Trends and Santiment as users experienced locked balances and financial losses.

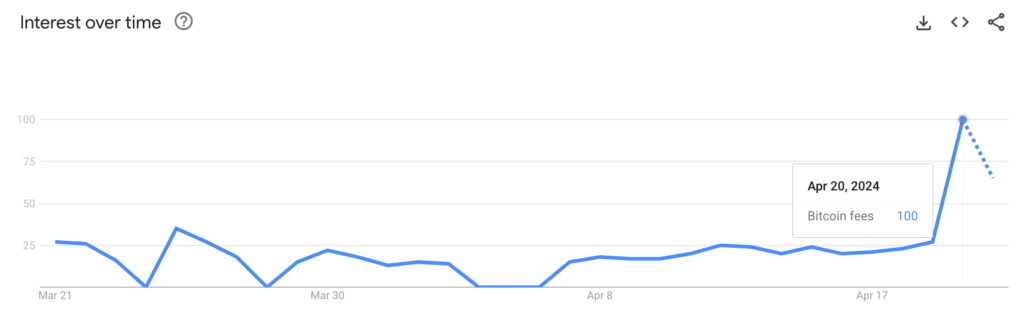

Notably, on April 20, the one-month interest rate for “Bitcoin fees” rose to its maximum in Google Trends. Until then, searches scored a consistent sub-25 interest—a low interest also kept in higher time frames.

Interest over time on ‘Bitcoin fees’. Source: Google Trends

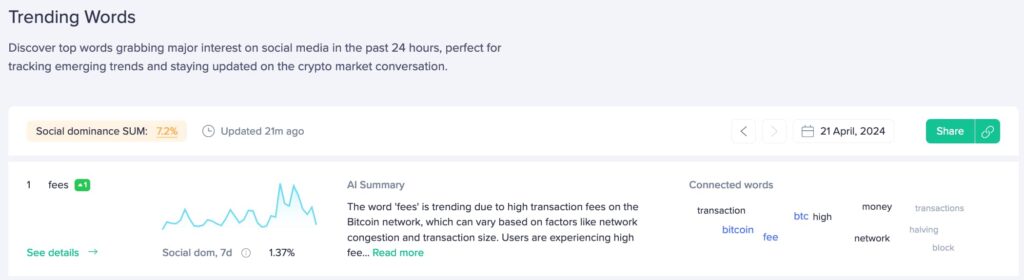

The social aggregator platform Santiment registered a similar interest, with the word “fees” leading 24-hour social trends. Interestingly, “fees” trends on April 21 with the following connected words:

Trending words. Source: Santiment

Bitcoin fees all-time high: Consequences and alternatives

On April 20, BitInfoCharts registered an all-time high of $127.97 for Bitcoin fees in USD, or 0.002 BTC.

Bitcoin Average Transaction Fee, historical chart. Source: BitInfoCharts

Bitcoin’s high fees generate dust

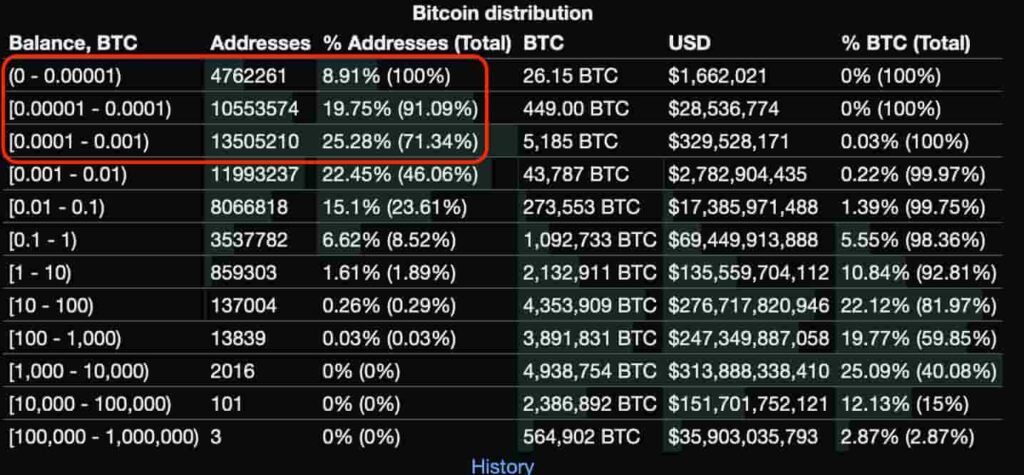

As a result, over 53.94% of all Bitcoin addresses became unable to use the network, considering they have balances inferior to 0.001 BTC, which is half the registered average transaction fees.

Bitcoin rich list, distribution. Source: BitInfoCharts

This is known as “dust” in the cryptocurrency space and among payment providers. Dust refers to unspendable funds if the system’s fees remain above the available balance or UTXO.

Bitcoin alternatives

Cryptocurrency enthusiasts have reported issues, meaningful losses, and discontent with the situation inherent to Bitcoin’s software design.

For example, Vik Sharma, founder of the prominent cryptocurrency wallet Cake Wallet, mentioned the Bitcoin alternatives he uses as fees remain high. In particular, Sharma said he is mostly using Monero (XMR), but also Litecoin (LTC), Bitcoin Cash (BCH), Nano (XNO), and Polygon‘s USDT – all available in Cake Wallet.

I carry some #bitcoin and other coins around in my @cakewallet to make quick payments to employees, vendors, etc. But with these insane #BTC fees, now I'm paying in mostly #XMR, but also #LTC, #BCH, #NANO, and #USDT on #Polygon. Lightning can't come fast enough to Cake.

— Vik Sharɱa ?? (@vikrantnyc) April 21, 2024Each of these cryptocurrencies has different proposed solutions for fees. Among them, Nano stands out with a zero-fee protocol by design, as previously reported by Finbold. Meanwhile, LTC and BCH could potentially see a short squeeze next week.

As of this writing, Bitcoin fees returned to an average of around $25 per transaction, nearing the world’s average daily income.