Bitcoin (BTC) production costs have reached record highs post-halving, as the same mining effort now renders half the revenue. Thus, Bitcoin’s price must meet the production cost threshold to avoid industry turmoil and increased centralization for the leading cryptocurrency.

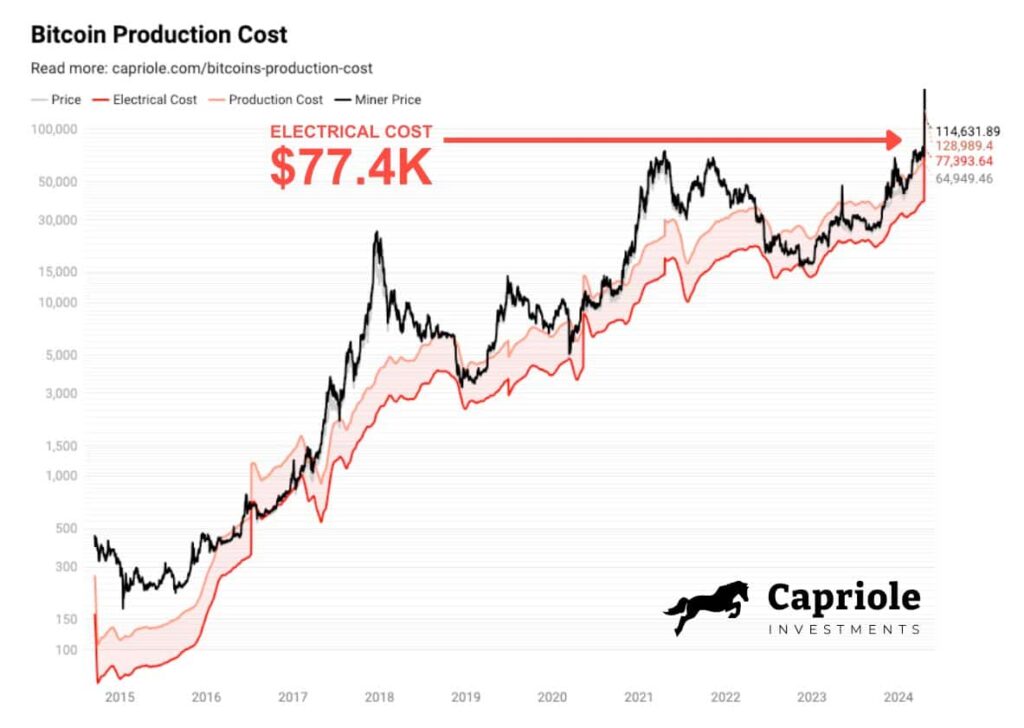

Charles Edwards, founder of Capriole Investments, reported an electrical cost of $77,400 per Bitcoin mined on April 22. Therefore, as of this writing, Bitcoin miners spend $11,000 more in electricity for each mined BTC, currently worth $66,175.

Furthermore, Capriole‘s production cost is staggering at $128,989, resulting in $52,000 estimated losses to produce a single BTC.

Bitcoin Production Cost and Electrical Cost. Source: Capriole Investments

MacroMicro’s average mining cost and Luxor’s Hashprice index

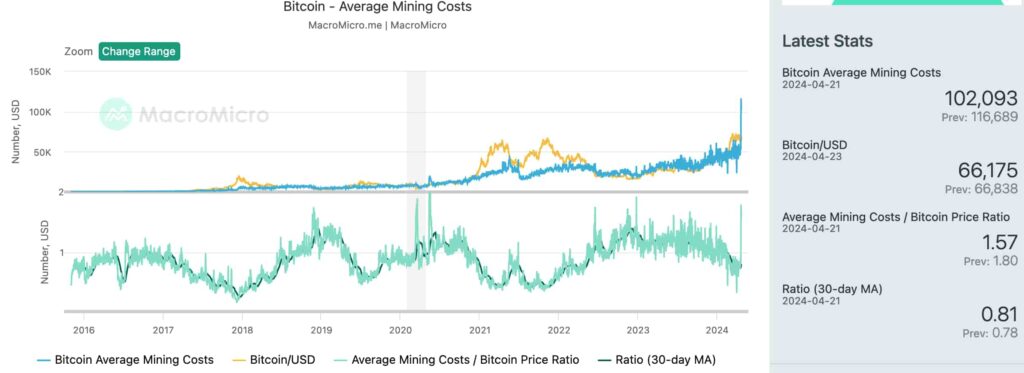

Meanwhile, data from MacroMicro shows a less-worse cost/price ratio of 1.57, according to estimates from Cambridge University. As per this data, Bitcoin’s average mining cost was above $102,000 on April 21, at historical highs in production costs, with miners theoretically losing around $36,000 for each BTC they issue.

Bitcoin – Average Mining Costs. Source: MacroMicro

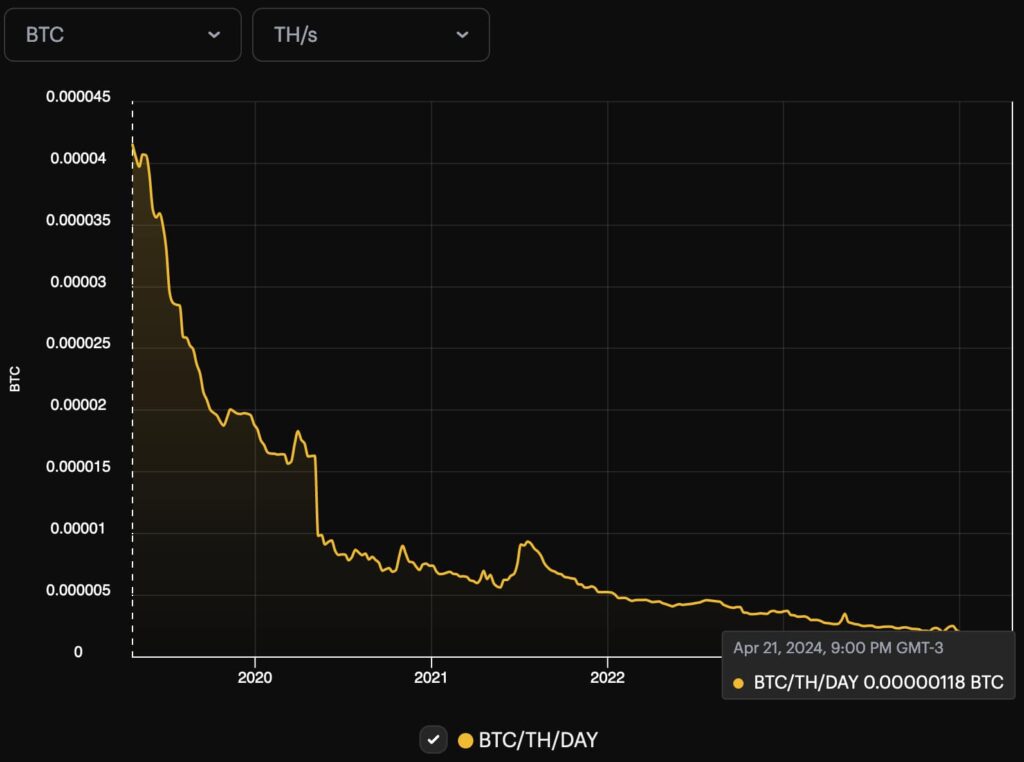

Interestingly, another useful metric for determining whether Bitcoin miners are underwater is the Hashprice Index, coined by Luxor. This index estimates the expected reward for each Terahash per second (TH/s) miners produce in hashrate.

With the halving, Luxor‘s Hashprice index reached an all-time low of 0.00000118 BTC (118 sats) per TH/s daily. It is worth noting that the mining difficulty adjustment increase also directly affects the Hashprice index, demanding more TH/s for the same amount of produced Bitcoin.

Bitcoin Hashprice Index. Source: Luxor

Bitcoin mining company’s earnings underwater

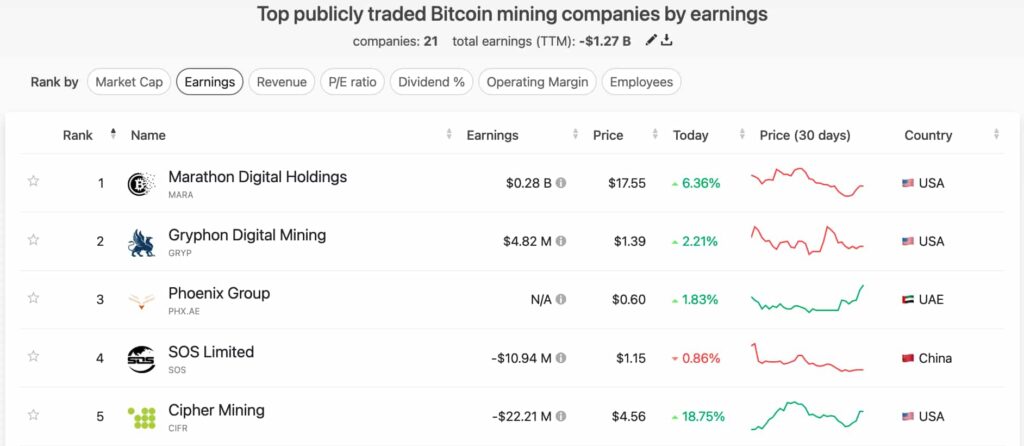

Notably, with the exception of Marathon Digital Holdings (NASDAQ: MARA) and Gryphon Digital Mining (NASDAQ: GRYP), all publicly traded Bitcoin mining companies reported losses in their activities. Data from CompaniesMarketCap shows that the 21 registered companies accumulated $1.27 billion in losses from their earnings report.

However, these reports are all from pre-halving results when Bitcoin’s production costs were half what they currently are. In addition, when the Hashprice index was at least two times higher.

Top publicly traded Bitcoin mining companies by earnings. Source: CompaniesMarketCap

In conclusion, current data suggests potential industry turmoil that could cause some Bitcoin mining companies to close. To prevent that, the Bitcoin price would need to rally above the estimated production costs, now at all-time highs.

If the production costs remain higher than the mining rewards, measured in U.S. dollars, the Bitcoin network could centralize in a few big miners. Experts have warned about that for years, mentioning the Economy of Scale dynamics inherent to Bitcoin, which threatens the system’s security.