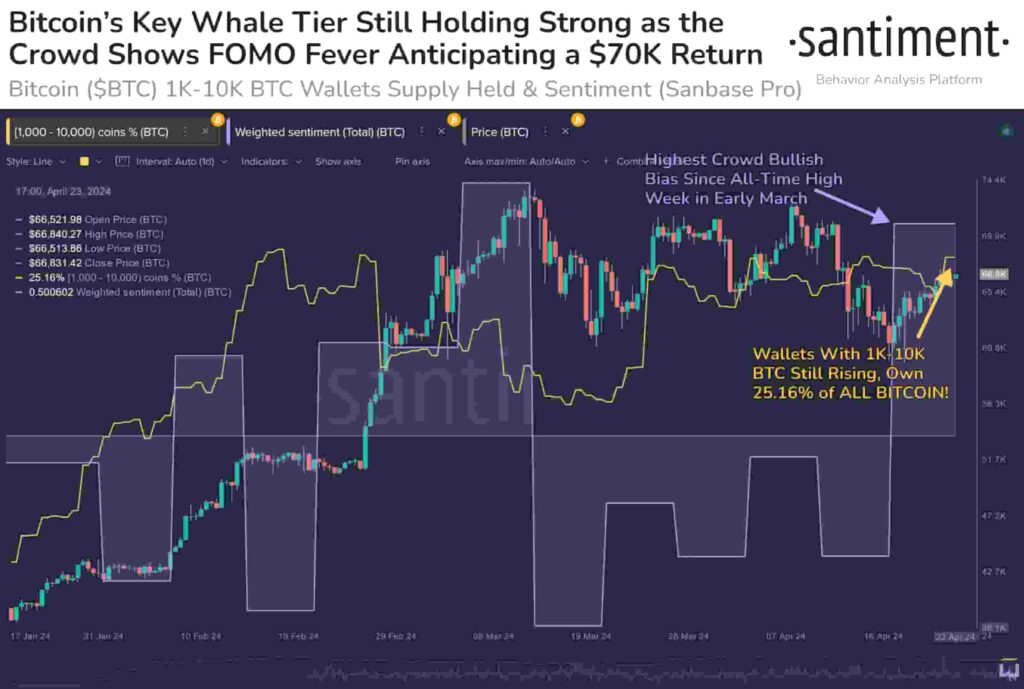

Bitcoin (BTC) whale activity and the weighted sentiment of the crowd suggest a bullish bias is taking over the cryptocurrency. As the ‘Fear Of Missing Out’ (FOMO) rises, BTC could set a clear way upwards to $70,000 this week.

The Santiment‘s verified analyst, Brian Q, published an insight on April 23 highlighting the convergence of these two indicators.

Notably, Bitcoin Whales‘ percentage of the supply is back to higher grounds, above 25%, indicating significant whale accumulation. Meanwhile, the crowd’s bullish bias is the highest since March’s new BTC all-time high, measured by Santiment‘s weighted sentiment index.

Bitcoin 1K-10K BTC Wallets Supply Held & Sentiment. Source: Santiment/BrianQ

Bitcoin key levels as FOMO takes over

In the meantime, the prominent cryptocurrency trader and analyst CrypNuevo on X sees a key resistance before the $70,000. As posted on April 24, Bitcoin could revisit and test the $67,300 level before trying bigger moves.

This level has seen significant liquidations above a short-term downtrend line, trapping Bitcoin traders. Additionally, CrypNuevo points out HyblockCapital‘s 7-day liquidation heatmap as a validation of the $67,300 key level to watch.

$BTC update:Slow week so far, but very clean Price Action.I see liquidity at $67.3k based on a resistance trendline that is gathering stop losses and liquidations right above it – liquidation heatmap also confirms this.1h 50EMA acting as support that should take us there ? pic.twitter.com/TIkXkFDCjO

— CrypNuevo ? (@CrypNuevo) April 24, 2024Furthermore, CoinGlass‘s one-month leverage liquidation heatmap highlights remarkable market interest above the $71,000 level. The billionaire trading liquidity pools in this area could act as a magnet for Bitcoin’s price action, fueling the reported FOMO and bullish bias from the crowd.

BTC Liquidation Heatmap, 1-month chart. Source: CoinGlass

Conversely, on-chain analyst Ali Martinez warns of strong resistance at current levels and a potential retracement once Bitcoin reaches $70,000. The analyst is particularly concerned about the $65,500 support level, a breakout of which could invalidate the observed FOMO.

From a fundamental perspective, Bitcoin users have seen record transaction fees above $100, creating barriers to the crowd’s activities. As reported by Finbold, the term “Bitcoin fees” is trending these days, and the issue potentially affects retail’s perception of digital assets. Efficient alternatives to the leader started gaining attention, surging as relevant investment opportunities.

Cryptocurrencies are volatile and highly responsive risk assets, demanding a solid strategy and adaptability capacity from speculators who navigate them. The ‘Fear Of Missing Out’ is a powerful sentiment that often leads to bad decision-making.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.