Bitcoin (BTC) is experiencing a sell-off from institutional investors, with outflows from Bitcoin spot ETFs occurring for the third consecutive day. Meanwhile, the Depository Trust & Clearing Corporation (DTCC) will no longer provide collateral value for cryptocurrency-based exchange-traded funds (ETFs).

Bitcoin has seen increased demand from institutional investors through the Bitcoin spot ETFs approved in February.

Notably, these financial instruments registered massive capital inflows in the following weeks of approval, led by BlackRock’s (NYSE: BLK) IBIT. In the meantime, BTC reached a new all-time high of $73,805 on March 14, now retraced to $63,000.

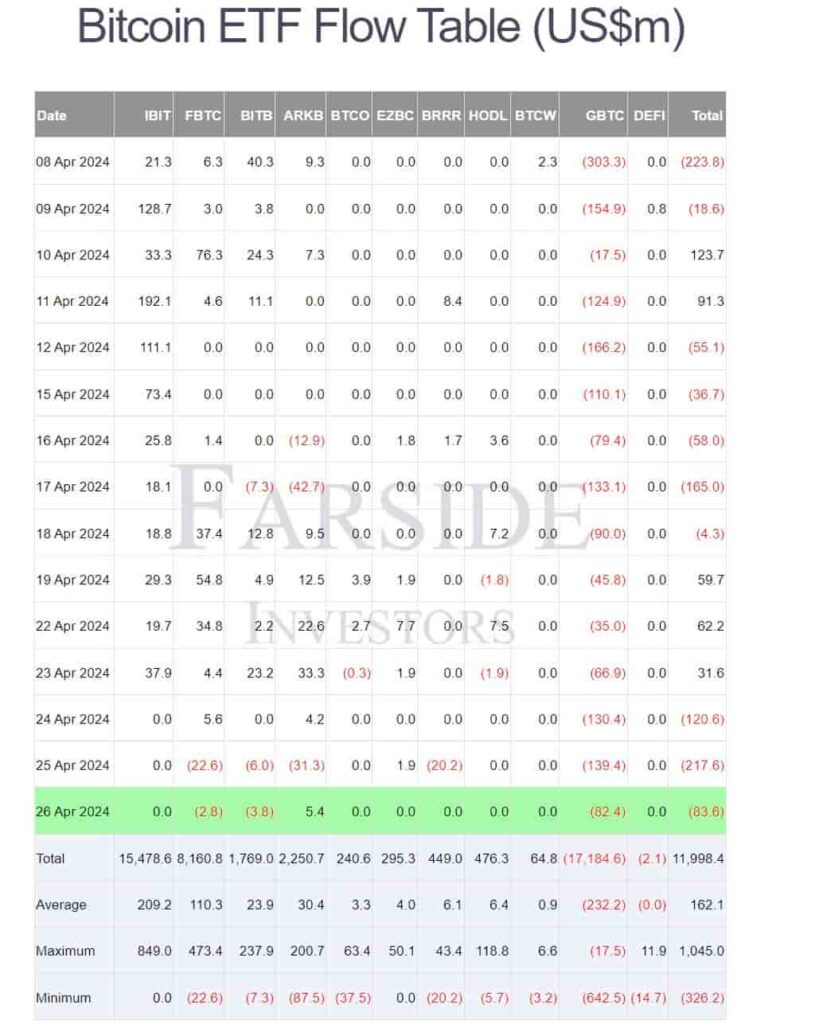

Bitcoin ETF Flow Table (US$m). Source: Farside

DTCC: ‘No collateral value’ for Bitcoin- and crypto-based ETFs

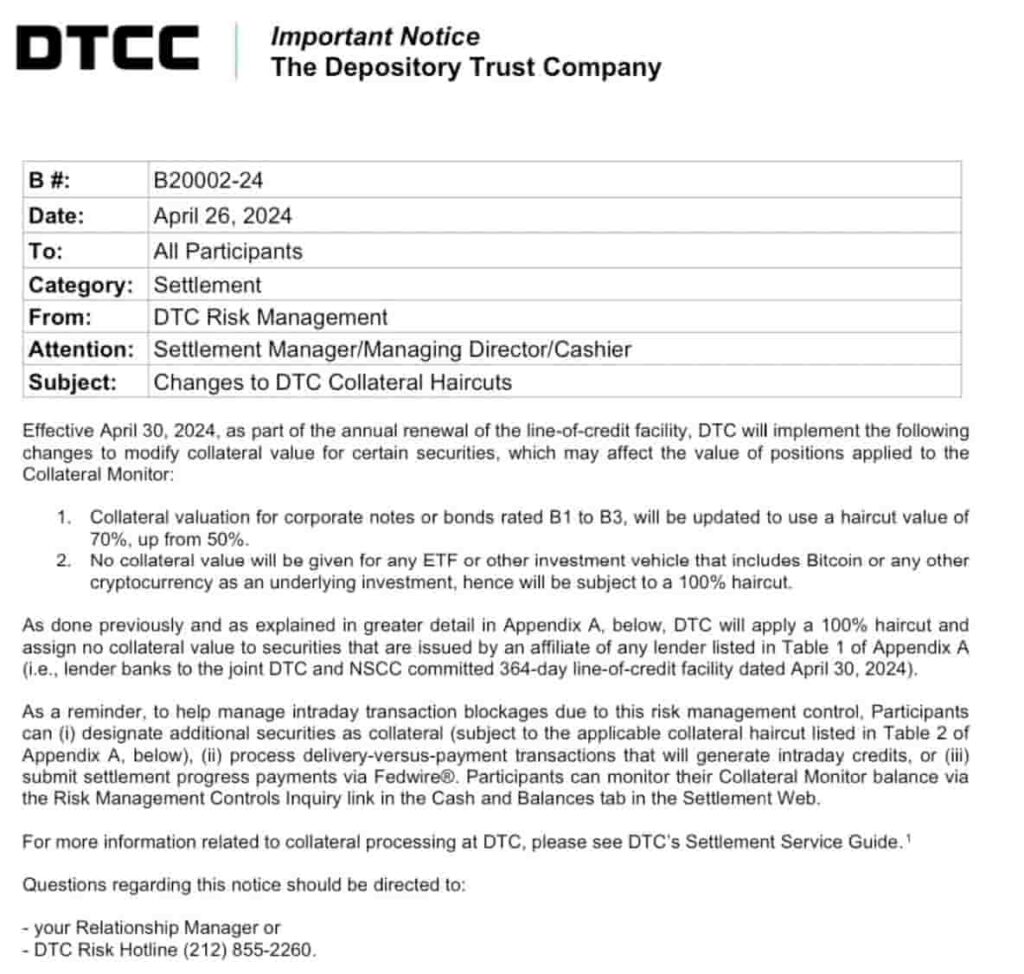

In the meantime, the DTCC emitted an “important notice” to all participants of the Depository Trust Company (DTC) on April 26 regarding settlements. Essentially, the DTC will no longer recognize collateral value for loans from Bitcoin and cryptocurrencies, effective April 30, 2024.

“No collateral value will be given for any ETF or other investment vehicle that includes Bitcoin or any other cryptocurrency as an underlying investment, hence will be subject to a 100% haircut.”

Important Notice, The Depositary Trust Company. Source: DTCC

The DTCC and its subsidiary, DTC, are critical financial infrastructure institutions in the U.S. They provide custody, clearing, and settlement services for securities transactions. The DTC holds trillions in securities, acting as a central depository. It settles trades and facilitates collateral management.

Overall, the Federal Reserve oversees the DTCC, and the DTC’s decisions can significantly impact market liquidity and the viability of investment vehicles.

Bitcoin price analysis amid ETFs outflow and sell-off alert

Autism Capital explained this could mean less liquidity and more risk for investors, potentially causing the observed capital outflows.

Therefore, Bitcoin spot ETFs could become a less appealing investment vehicle for institutional investors. With a lower demand for this use case, BTC could be on the brink of a sell-off and capital migration from this class of investors to financial products more aligned with their goals. For example, migrating to Gold, Silver, or similar funds that can work as collateral for further institutional settlements and operations.

Since early March, the leading cryptocurrency has been trading in a $14,300 range between $59,500 and $73,800. In this context, the bottom and top of this range make for key support and resistance levels, respectively. As of this writing, BTC was trading at $62,914, potentially forming a short-term downtrend, eyeing the range’s support zone.

BTC/USD daily price chart. Source: TradingView/Finbold

Will Bitcoin capitalization outflow to other cryptocurrencies?

Recent developments in the cryptocurrency landscape may also influence a possible capital migration from Bitcoin to other assets.

In particular, the FBI seizure of the Samourai Wallet could favor migration to privacy-by-default cryptocurrencies, like Monero (XMR) and similar. Furthermore, the record network fees above $100 per transaction could drive the demand for low- and zero-fee peer-to-peer money protocols, like Nano (XNO), Bitcoin Cash (BCH), Litecoin (LTC), and similar altcoins.

Additionally, institutional players could eye for layer-1 blockchains like Ethereum (ETH), Solana (SOL), Radix (XRD), and similar due to the increased interest in the tokenization of real-world assets (RWA).

Investors must cautiously and closely monitor the so-called “digital gold” moving forward and make decisions accordingly.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.