In a sobering analysis for cryptocurrency enthusiasts, veteran trader Peter Brandt casts doubt on the continuation of the current Bitcoin (BTC) bull run, suggesting that a possible peak has already been reached with serious retracements potentially on the horizon.

This assessment, deeply rooted in historical price cycle data, presents a grim outlook for the near future of Bitcoin‘s market value.

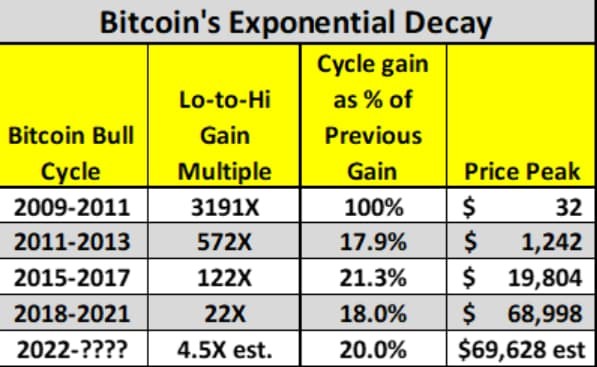

Bitcoin’s Exponential Decay. Source. Peter Brandt Blog

Brandt’s data implies that Bitcoin might have already reached its peak for the current cycle and could see a significant downturn, potentially revisiting the mid-$30,000 range seen in previous lows.

However, he also remains optimistic that such a pullback could set up a future rally, akin to historical patterns observed in the gold market, where after significant corrections, long-term gains followed.

BTCUSD chart. Source. Peter Brandt Blog/TradingView

Despite his significant investment in Bitcoin, Brandt candidly reflects on the necessity of confronting the data head-on. He states, “The fact is that the bull market cycles in Bitcoin have lost a tremendous amount of thrust over the years,” highlighting the need for data-driven decision-making.

However, the current evidence suggests a 25% likelihood that Bitcoin has reached its peak for this cycle, indicating that investors might need to brace for possible declines or adjust their strategies accordingly.

Insights from experts like Brandt are invaluable for investors in the highly volatile cryptocurrency market. They emphasize the critical role of data-driven decision-making in navigating an ever-evolving financial landscape.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.