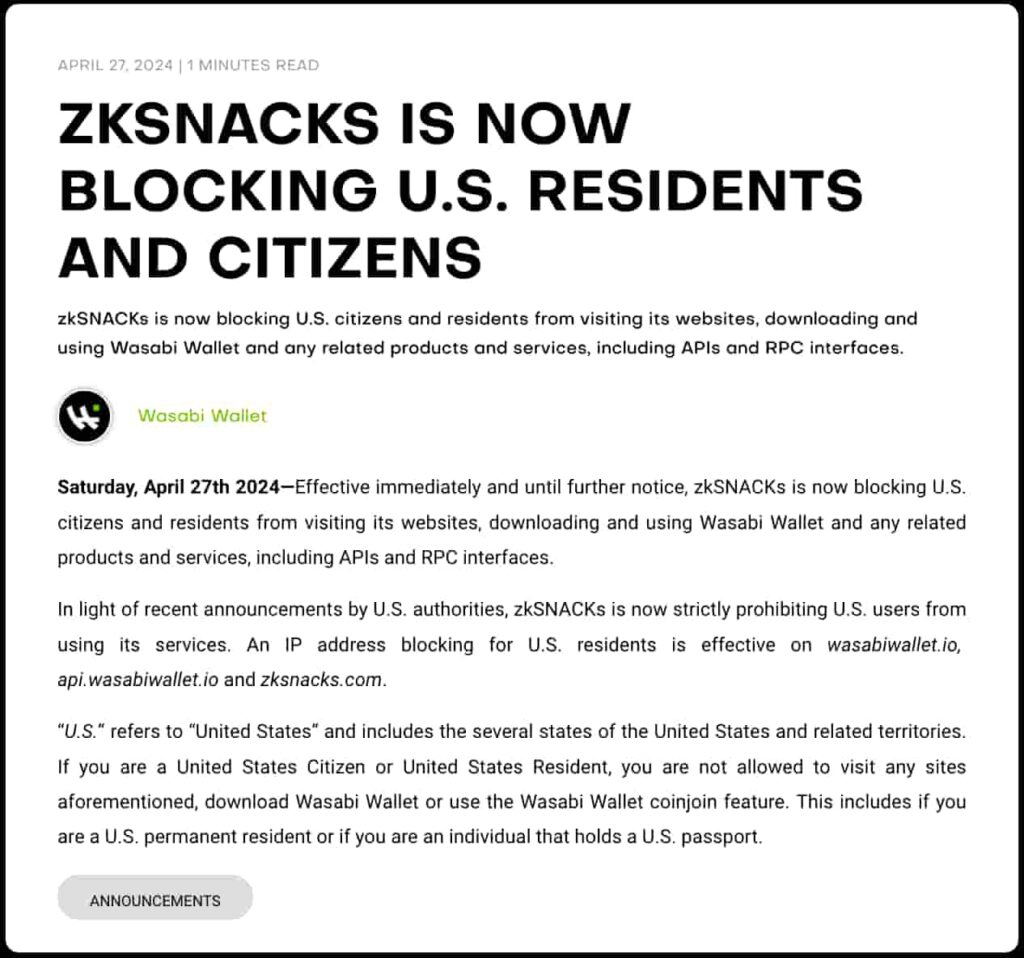

The Wasabi Wallet provider, zkSNACKs, announced it now prohibits U.S. citizens and residents from using its services. This decision came to light on April 27 amid a United States regulatory and enforcement crackdown on Bitcoin (BTC) wallets.

Notably, Wasabi Wallet is one of the most popular Bitcoin wallets focused on privacy solutions.

As announced, zkSNACKs has started “blocking U.S. citizens and residents from visiting its websites, downloading and using Wasabi Wallet, and any related products and services, including APIs and RPC interfaces.”

zkSNACKs announcement. Source: Wasabi Wallet

United States war on privacy and Bitcoin wallets

On April 24, the Federal Bureau of Investigations (FBI) seized Samourai Wallet’s website and arrested its developers. This is another privacy-focused Bitcoin wallet, a direct competitor to the zkSNACKs flagship product.

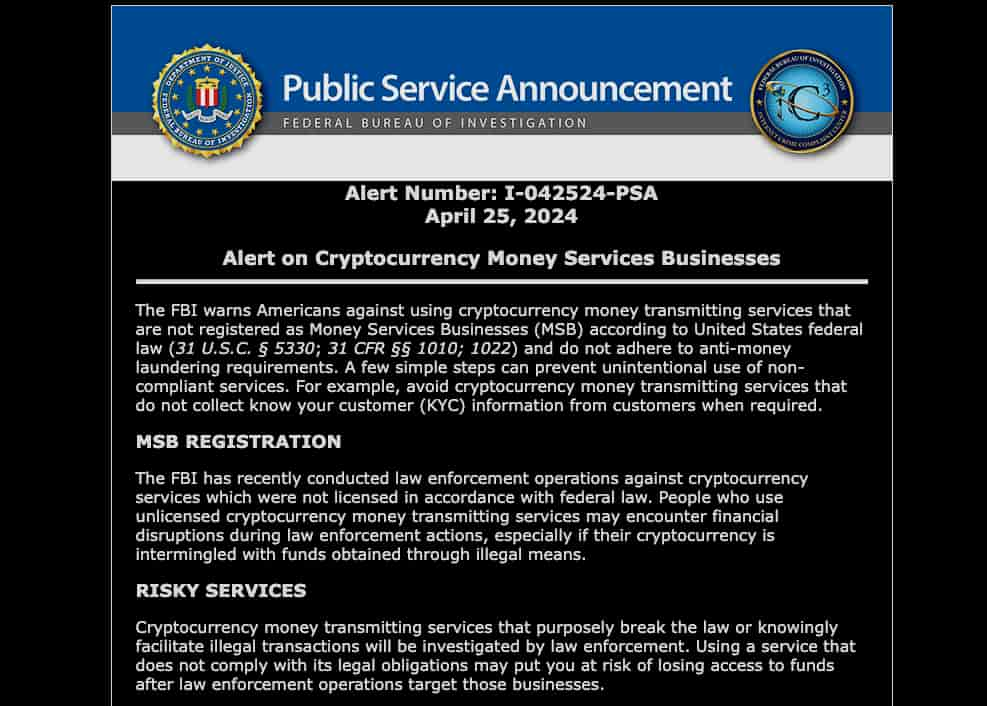

Moreover, the FBI issued a warning against what it called “cryptocurrency money transmitter businesses” a day later.

Public Service Announcement. Source: FBI

The surprising enforcement action against Samourai, followed by the warning and further court decisions related to Tornado Cash, suddenly raised doubts about what is considered a “money transmitter business,” threatening Bitcoin and cryptocurrency wallets amid regulatory uncertainty.

As a result, ACINQ—a Lightning Network service provider and developer of Phoenix Wallet, another Bitcoin wallet—announced its departure from the United States on April 26. Wasabi Wallet communicated its decision to prohibit and block U.S. citizens and residents right after.

Recent announcements from US authorities cast a doubt on whether self-custodial wallet providers, Lightning service providers, or even Lightning nodes could be considered Money Services Businesses and be regulated as such.

— ACINQ (@acinq_co) April 26, 2024In closing, recent law enforcement has brought regulatory uncertainties to Bitcoin wallet and privacy service providers in the United States. This has caused some companies to leave the country or block its citizens and residents from using their services, potentially affecting the long-term demand for Bitcoin in the U.S.