As the majority of assets in the cryptocurrency sector open the new week trading in the red, Bitcoin (BTC) is leading the trend, with flagship decentralized finance (DeFi) asset back in the $62,000 zone weeks after hitting a new all-time high (ATH) at $73,738, leaving investors to wonder about its near-term future.

Specifically, Bitcoin is down 15.26% from its ATH, which it reached on March 14 this year, and the upcoming month of May, which is traditionally a challenging month for the crypto sector, could spell more trouble for its largest asset by market capitalization.

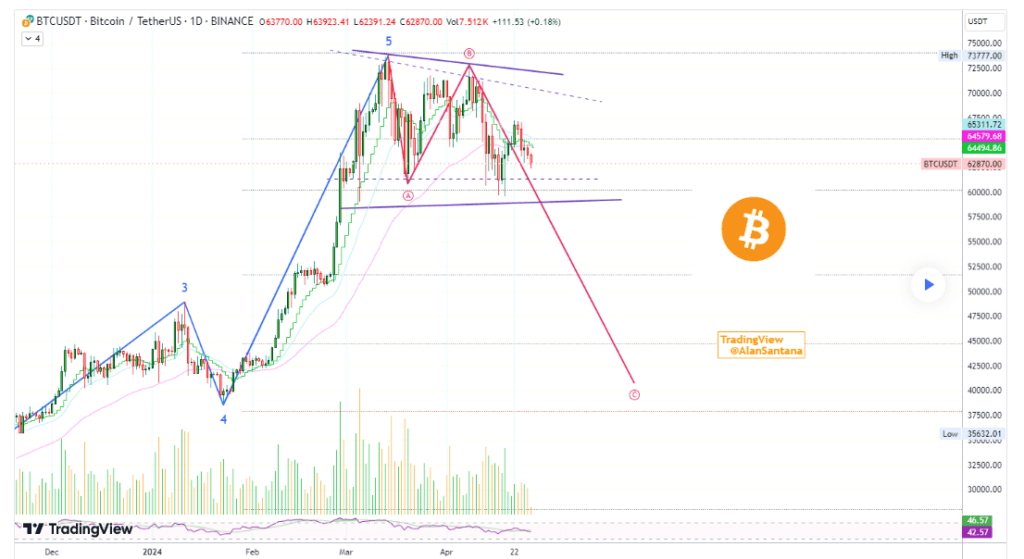

Bitcoin price analysis chart. Source: Alan Santana

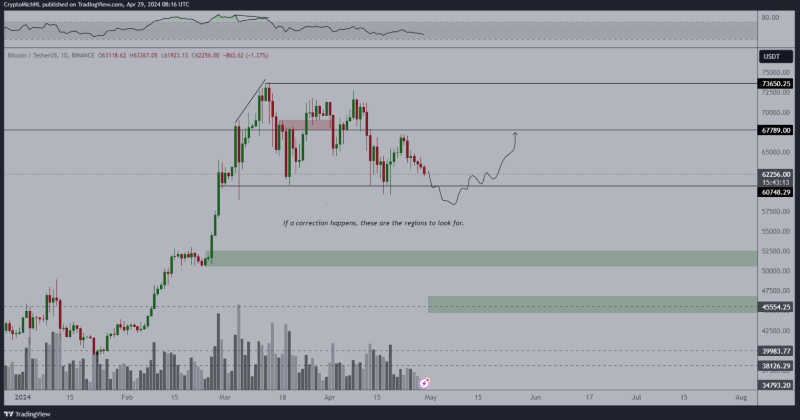

It is also worth noting that his peer, Michaël van de Poppe, has recently highlighted that “the markets are still in a state of boredom and, if you look at BTC valuations, in a bear market,” adding that “Bitcoin is stuck in a range, through which we’re likely expecting some more downside.”

Bitcoin price action analysis. Source: Michaël van de Poppe

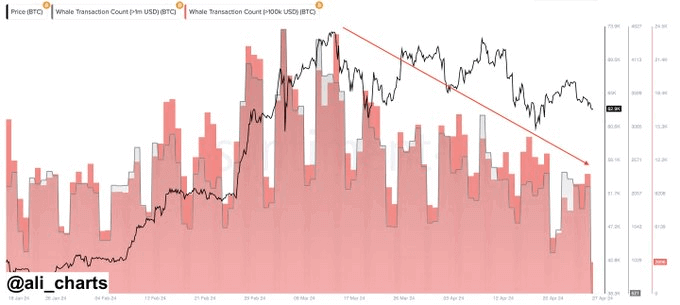

At the same time, another renowned crypto analyst, Ali Martinez, has observed a noticeable dip in the Bitcoin whale activity since mid-March, arguing that a surge in whale transactions could be the necessary catalyst to reignite the buying interest in Bitcoin.

Bitcoin whale transaction chart. Source: Ali Martinez

Bitcoin price analysis

Meanwhile, the maiden digital asset was at press time changing hands at the price of $62,310, recording a decline of 1.95% in the last 24 hours, dropping 5.84% across the previous seven days, and accumulating a loss of 11.25% on its monthly chart, according to the most recent information on April 29.

Bitcoin price 30-day chart. Source: Finbold

So, why is Bitcoin down? Notably, one of the reasons could be the upcoming meeting of the Federal Open Market Committee (FOMC), which van de Poppe said is “likely causing the markets to correct before it and reverse back up afterward with some likely hope that rate cuts are coming.”

All things considered, the trends don’t look optimistic for Bitcoin’s price in the near future, but, as Santana has noted, the original crypto would eventually slowly climb up by 30-50% before a significant bullish momentum kicks in within the first six months of 2025, the year when he expects a new ATH.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.