Ripple, the company behind the XRP Ledger (XRP) development, will unlock 1 billion tokens on May 1, worth $503.6 million. This is part of Ripple’s monthly sell-offs, which could negatively impact the XRP price in the following weeks.

Historically, Ripple has been unlocking 1 billion tokens through escrows, finalized on the first day of every month since 2017. So far, the company has been using ‘Ripple (22)’ and ‘Ripple (23),’ according to XRPScan, as reported in April’s unlock.

However, these accounts show empty escrows on April 30, similar to what happened in March, a few days before April’s unlock. Finbold will further monitor Ripple’s known accounts and report accordingly in the coming days.

Ripple (22) and Ripple (23) accounts, Escrows. Source: XRPScan, on April 30.

What happened after Ripple’s XRP token unlock in April

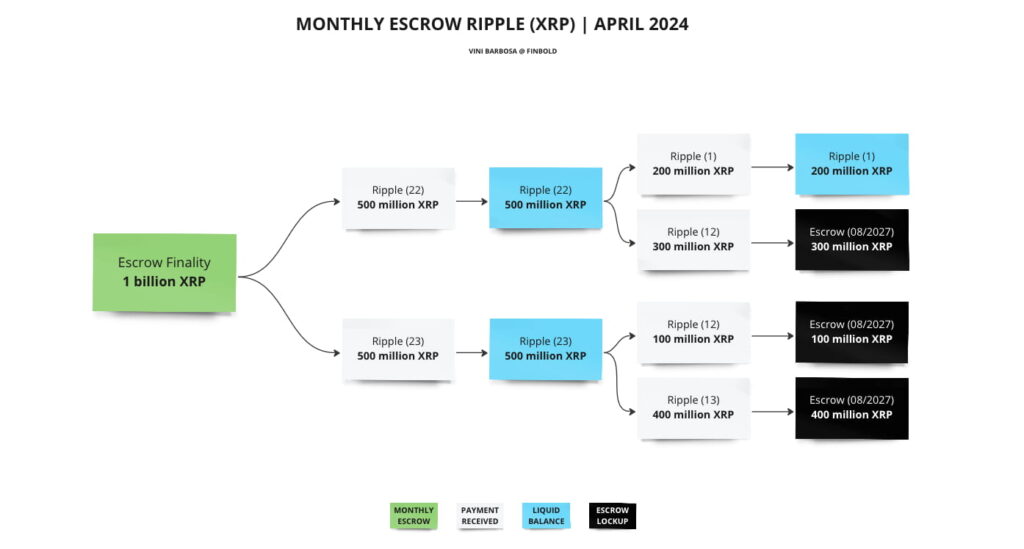

The escrow system unlocked 1 billion XRP on April 1, from ‘Ripple (22)’ and ‘Ripple (23)’ accounts. Later, Ripple reserved 200 million tokens for the sell-off and re-locked the rest in escrows for August 2027.

Monthly Ripple (XRP) unlock – April, 2024. Source: Finbold

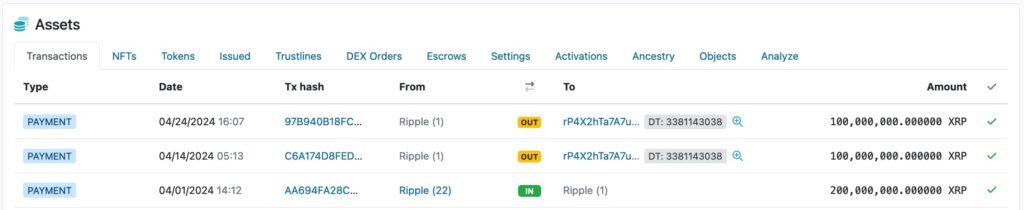

As developed, ‘Ripple (22)’ sent 200 million XRP to ‘Ripple (1)‘, the treasury account. On April 14, the company dumped $48.5 million worth of tokens after Iran’s offensive against Israel. Later, on April 24, Ripple got rid of the remaining 100 million XRP reserved for the sell-off.

Ripple (1) account summary and transactions. Source: XRPScan

XRP price analysis amid sell-offs

Notably, Ripple’s previous sell-offs mostly coincide with losing days for the XRP price. Finbold placed each of the company’s selling activities year-to-date on XRP’s daily chart.

Interestingly, only three of the ten days had a slightly positive price action. Yet, even these ‘green’ days were made of shy gains, while the negative ones were more impactful.

In particular, XRP lost 20% from January 1 to January 31 and gained 16.6% in February, with two of the three positive days. In March, the first half was very positive, but March 13’s sell-off caused a huge drop of over 17% until March 20.

April was marked by negative volatility amid geopolitical tensions and Ripple’s dumps. The first sell-off, however, was on a positive day.

XRP/USD daily chart with Ripple sell-offs year-to-date. Source: TradingView (Finbold)

As of this writing, XRP has lost 20% year-to-date, currently trading at $0.50 per token in a key psychological support.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.