With Bitcoin (BTC) descending back to the area around $60,000 following the underwhelming results of the first Hong Kong spot Bitcoin exchange-traded funds (ETFs), artificial intelligence (AI) algorithms are pessimistic in terms of its future price for the next month.

Indeed, the six Hong Kong ETFs that offer exposure to Bitcoin and Ethereum (ETH) have significantly missed their targets by a wide margin, reaching a combined trading volume of $11 million, a minuscule fraction of the anticipated $125 million, sending the cryptocurrency market tumbling.

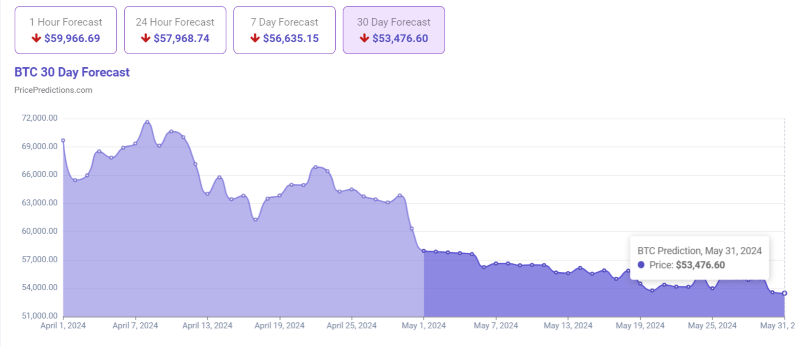

BTC price prediction 1-month chart. Source: PricePredictions

This means that, should the AI algorithms prove correct in their analysis, which takes into account indicators like the Bollinger Bands (BB), relative strength index (RSI), moving average convergence divergence (MACD), and others, Bitcoin could further decline by another 11.51% from its present situation.

Bitcoin price analysis

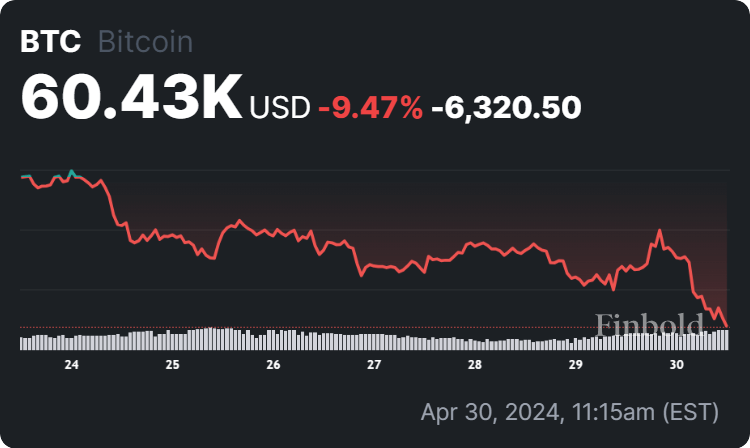

For now, the flagship decentralized finance (DeFi) asset is changing hands at the price of $60,430, which represents a 3.78% drop in the last 24 hours while losing 9.47% across the previous seven days, as well as declining 14.17% on its monthly chart, as per the latest data.

Bitcoin price 7-day chart. Source: Finbold

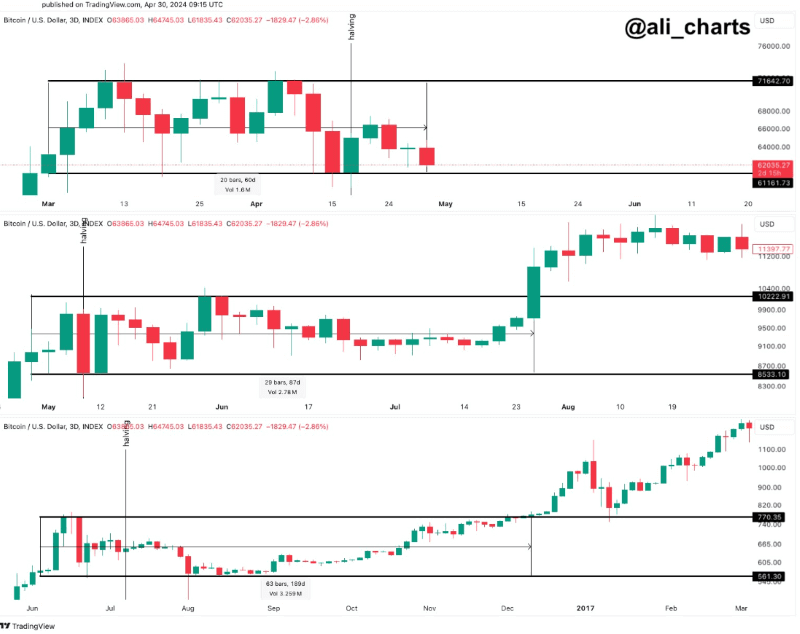

At the same time, crypto experts like Ali Martinez and Michaël van de Poppe see bright future for Bitcoin, with the former observing it had also “consolidated for an extended period around the last two halving events – 189 days in 2016 and 87 in 2020 – before the bull run resumed,” and so far it has consolidated for 60 days.

Bitcoin consolidation patterns around halvings. Source: Ali Martinez

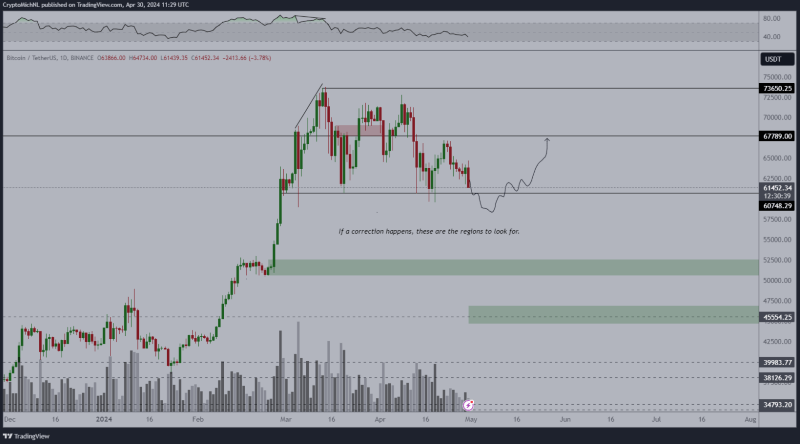

Meanwhile, his peer highlighted several arguments for a potential bottom happening on Bitcoin, including the upcoming Federal Open Market Committee (FOMC) meeting, the unemployment data report, and the trial of Binance CEO Changpeng Zhao, but also said that a recovery would follow.

Bitcoin price action analysis and prediction. Source: Michaël van de Poppe

Ultimately, the largest asset in the crypto market could, indeed, continue to decline toward the low price target set by the AI algorithms, but professional crypto traders do not share their pessimism, at least not in the long run. That said, doing one’s own research and weighing the risks is critical.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.