The cryptocurrency market shambled on the first day of May, following a rising fear that started on April 30. In the last 24 hours, long-position traders lost nearly $400 million in leverage liquidations.

Notably, recent price action liquidated 137,016 traders for $464.54 million realized losses from long and short positions. However, only $64.67 million were from short-sellers, while $399.88 million were from bullish traders with long positions.

Of these, $168.22 million in losses occurred in the last four hours, with $153.17 million coming from the bulls. Finbold retrieved this data from CoinGlass on May 1 at 09:30 a.m. UTC.

Liquidation Heatmap & Total Liquidations. Source: CoinGlass

$250 billion erased from crypto as long-position traders got ‘rekt’

On April 30, the cryptocurrency market started with a $2.29 trillion capitalization, according to TradingView‘s total crypto cap index. On May 1, the index dropped to as low as $2.04 trillion, with nearly $250 billion (10.87%) in losses from the whole ecosystem.

Fear, uncertainty, and doubt (FUD) surged as the dominating sentiments, with long-position traders accumulating massive losses.

Crypto total market cap index. Source: TradingView/Finbold

Bitcoin price amid massive liquidation

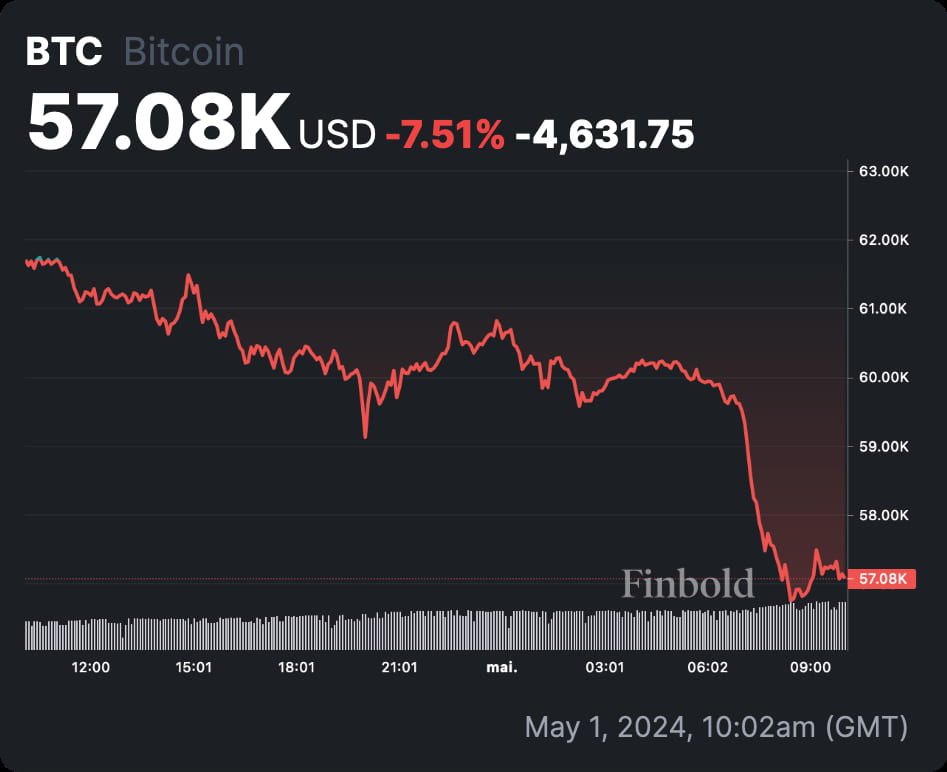

Bitcoin led the crash of the month’s turn, accumulating over 7.5% in daily losses. As of this writing, BTC trades in the $57,000 zone.

Bitcoin (BTC) 24-hour price chart. Source: Finbold

Meanwhile, long-position traders are concerned as the leading cryptocurrency lost a key support level of $60,000. Analysts’ projections vary from a bounce back to previous levels to further long squeezes at $54,000 and $50,000. Interestingly, the former is a key psychological support, increasing the likelihood of it becoming a target.

Now, Investors eye the Federal Reserve interest rate decision. Essentially, 99.5% of the market expects rates to continue between 525 and 550 basis points. A hawkish approach could bring further turmoil as traders would opt to diminish their exposure to risky assets.

Last week, Bitcoin ETF investors took a hit from DTCC’s decision not to recognize collateral value from these funds. Both developments in the United States could have mined cryptocurrency traders‘ confidence, contributing to today’s $400 million worth of liquidations.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.