The cryptocurrency market shifted from bearish to bullish as the week ended, following nonfarm payroll data reported on May 3. After days of continuous short-selling pressure, some cryptocurrencies display skyrocketing potential within the possibility of a short squeeze.

Notably, TradingView‘s total crypto market cap index surged by over $277 billion month-to-date from a local bottom on May 1. On May 4, the index reached a $2.318 trillion capitalization local high, up over 13% in three days.

Total Crypto Market Cap Index, daily chart. Source: TradingView

However, previous fear, uncertainty, and doubt (FUD) led cryptocurrency traders to massively short Bitcoin (BTC) and other cryptocurrencies. Thus, this increases the likelihood of short-squeeze events for BTC and targets higher prices, as reported by Finbold on May 3.

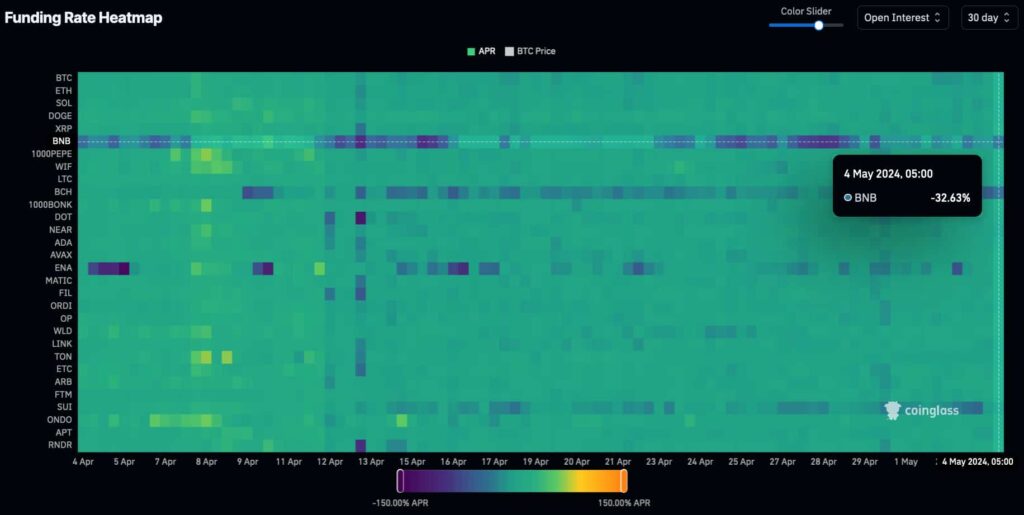

Funding Rate Heatmap: BNB, 30-day, ordered by Open Interest. Source: CoinGlass

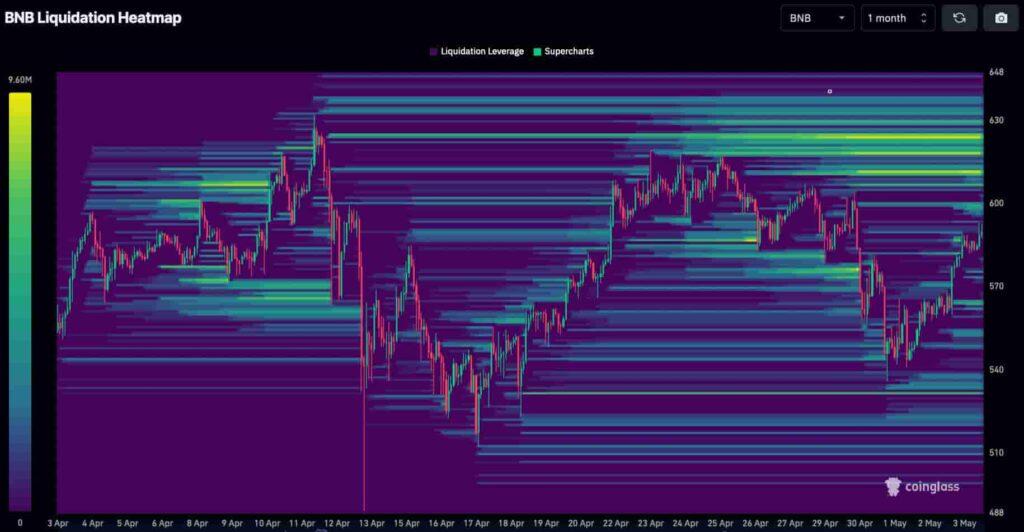

As for the price targets, BNB has short-position liquidity pools from $600 to $630, currently trading slightly below this level.

BNB Liquidation Heatmap, 1-month chart. Source: CoinGlass

Bitcoin Cash (BCH)

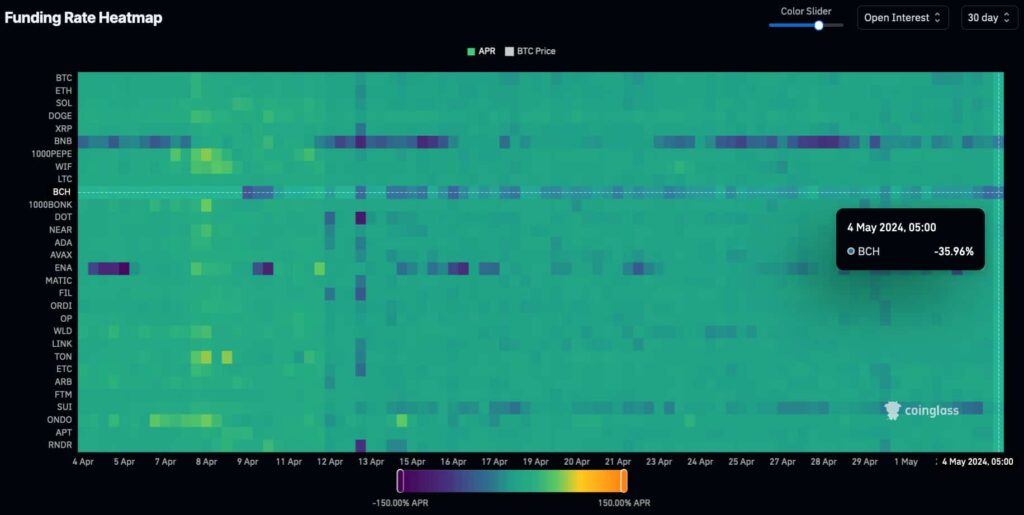

Bitcoin Cash (BCH) has an even higher negative funding rate of 35.96%, the 10th-largest cryptocurrency ordered by open interest.

Funding Rate Heatmap: BCH, 30-day, ordered by Open Interest. Source: CoinGlass

While BCH’s liquidity pools are less concentrated than BNB’s, the coin’s current price is far below the pending liquidations. Interestingly, there are unbalances in a large range from $500 to above $700. This offers a skyrocketing potential that could result in over 40% gains if Bitcoin Cash suffers a short squeeze.

BCH Liquidation Heatmap, 1-month chart. Source: CoinGlass

However, despite the above economic analysis, these cryptocurrencies could still display negative price performance in the next few days. Short squeeze technical indicators do not guarantee the event will happen. Things can quickly change as the market moves, so investors must remain cautious.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.