As summer 2024 approaches, investors are closely evaluating which asset–Bitcoin (BTC) or gold holds more promise.

With their divergent roles in investment portfolios, Bitcoin as a growing digital asset and gold as a traditional safeguard against economic shifts, Finbold sought insights from ChatGPT, OpenAI‘s advanced AI model, to determine which might excel in the coming months.

Amid a landscape riddled with economic and geopolitical uncertainties, the debate between Bitcoin and gold becomes increasingly relevant. Each asset offers distinct advantages: Bitcoin presents high growth potential, while gold is viewed as a stable hedge against inflation and volatility.

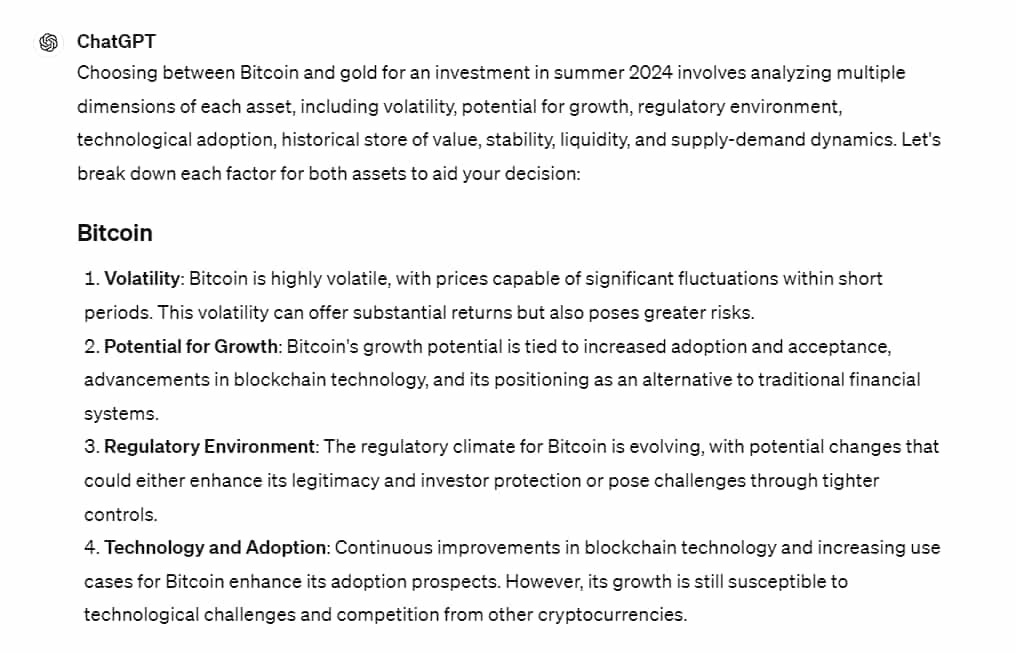

ChatGPT Bitcoin investment prospects. Source: Finbold and ChatGPT

Conversely, for those seeking stability and lower risk, gold might be the preferred choice.

ChatGPT gold investment prospects. Source: Finbold and ChatGPT

Including both assets in a diversified portfolio could also be a wise approach to balance potential risks and rewards.

Bitcoin and gold recent price performance

Bitcoin and Gold YTD price chart. Source: TradingView

As of 2024, the year-to-date performance for Bitcoin and gold presents a clear contrast in investment returns. Bitcoin has seen a significant rise, with a YTD increase of 52%, showcasing its volatile yet high-growth nature. The current price of Bitcoin stands at approximately $64,342.

On the other hand, gold, known for its stability and role as a safe haven asset, has gained 11.5% YTD, with its current price at about $2,301 per ounce.

This performance highlights the divergent characteristics and investor appeal between the two assets: Bitcoin attracts those seeking rapid growth and high returns, albeit at higher risk, while gold appeals to investors looking for a more stable and secure investment amidst economic fluctuations.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.