Bitcoin (BTC) has rallied past the $60,000 mark, marking a significant recovery from its drop below $57,000 prior to the recent Federal Open Market Committee (FOMC) meeting. This rebound could signal the end of the post-halving “danger zone,” a period typically marked by sharp volatility and price declines.

Rekt Capital, a prominent cryptocurrency analyst, suggests that Bitcoin’s ascent past $60,000 marks the end of the so-called “danger zone,” a high-volatility period following a halving event. The “danger zone” refers to the first three weeks after a Bitcoin halving event, historically characterized by market instability and prices falling below the reaccumulation range.

Post-halving price booms. Source: Rekt Capital/TradingView

Rekt Capital’s analysis finds parallels between today’s market dynamics and those from the bull cycle eight years ago, shortly after the 2016 halving, when Bitcoin’s value eventually surged by nearly 3,000%. Similarly, current patterns suggest a strong rebound and optimistic future movements for Bitcoin’s price.

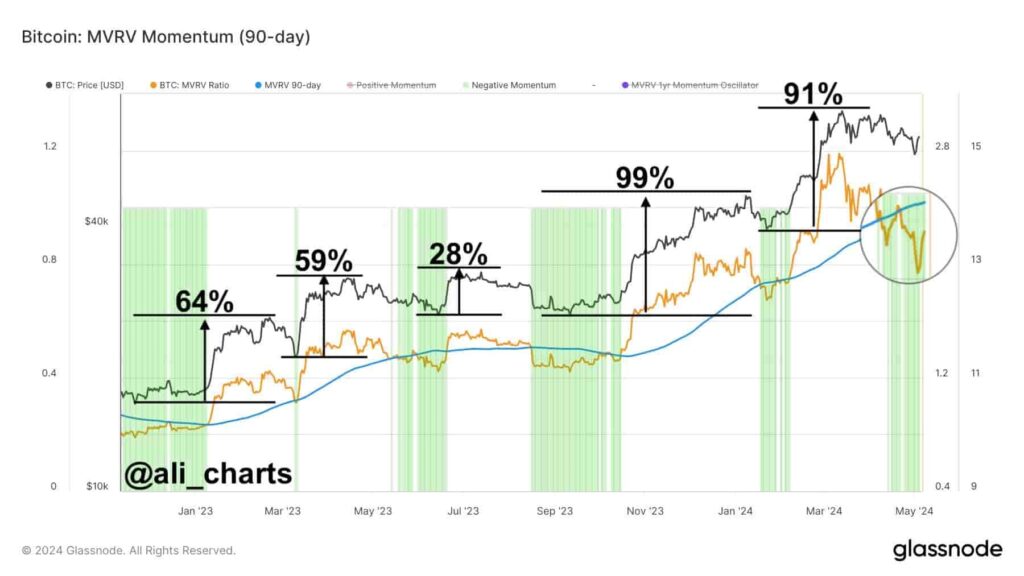

Complementing these insights, Ali Martinez on X (formerly Twitter) pointed out that despite Bitcoin’s recent rally from $57,000 to over $64,000, the MVRV 90-day ratio indicates that Bitcoin is still in a prime buying zone, suggesting that the price could climb even higher before facing any significant corrections.

Bitcoin:MVRV Momentum(90-day). Source. TradingView

Adding to the optimistic sentiment, Bitcoin analyst Willy Woo points out that the volume-weighted average price (VWAP) signals a promising horizon for Bitcoin prices.

Seems like a good setup for #BTC to reach escape velocity.Bull div with lots of room to run. pic.twitter.com/EtzGRQrg9a

— Willy Woo (@woonomic) May 6, 2024A Closer look at derivatives data

Despite the bullish long-term outlook from trading volumes, the derivatives market presents a mixed sentiment. On one hand, there’s a robust increase in the trade volume for long positions in Bitcoin futures, jumping by 63.12% to $67.54 billion, which signals a strong bullish sentiment among some investors.

On the other hand, a slight decrease in overall open interest by 1.94% to $30.25 billion suggests that some traders are opting to close their positions, potentially due to profit-taking or a strategic reduction in market exposure.

The options market is portraying a more guarded approach, evidenced by a considerable 39.73% decline in trading volume. This reduction indicates a slowdown in speculative trading, yet the concurrent 2.18% rise in options open interest to $10.24 billion demonstrates that while fewer new trades are being initiated, existing positions are largely being held. This could imply that traders are seeking clearer signals before committing to new market moves.

The complexity of market dynamics is further underscored by liquidation figures from Coinglass, with long position liquidations at $32.94 million surpassing those of short positions, which stand at $21.97 million. This highlights the risks involved despite the optimistic trading volumes, as recent higher liquidations indicate potential vulnerabilities.

Overall, the interplay of increased bullish trading activity and cautionary market behavior points to a dynamic phase for Bitcoin. As it potentially moves past the volatility linked to its latest halving, Bitcoin seems set on a path of stability and growth, drawing attention from both established and new market participants.

This balance of optimistic projections and inherent market risks sets the stage for an intriguing next phase in Bitcoin’s evolution, highlighting the cryptocurrency‘s enduring appeal and speculative potential.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk