In a recent post on X, Justin Bons—the founder and CIO of Cyber Capital, Europe’s oldest cryptocurrency fund—raised serious concerns about the Sui Network (SUI) project’s tokenomics. Bons, a full-time crypto researcher since 2014, claims that the project’s token distribution is marred by centralization, lack of disclosure, and “unbridled greed.”

Later, the Sui Foundation issued an official communication addressing these criticisms and committing to full transparency on SUI tokenomics.

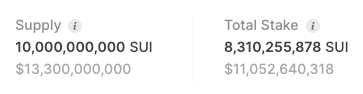

According to Bons, SUI claims to have a capped supply of 10 billion tokens, with 52% being “unallocated” until 2030. However, he points out that over 8 billion SUI tokens are currently being staked, with founders holding an alarming 84% of the staked supply.

SUI Supply and Total Stake. Source: CoinMarketCap

“SUI is centralized. The founders control the MAJORITY of supply without lock-ins and ZERO legal guarantees!”

– Justin BonsCyber Capital’s CIO accuses the team of deceptive communication, stating that “the legal fine print protects them, as the truth is sobering.” He claims that the chart published by the SUI Foundation is “a lie,” as the staked SUI implies no lock-in period at all. Moreover, the Foundation has refused to disclose the addresses controlling the “unallocated” supply, raising further suspicions.

1/16) SUI has a great design, except for its token economics:SUI claims to have a capped supply of 10B, with 52% being "unallocated" till 2030The problem is that over 8B SUI is being staked right now!Over 84% of the staked supply is held by founders! SUI is centralized: ?

— Justin Bons (@Justin_Bons) May 2, 2024Sui Network’s (SUI) alarming tokenomics

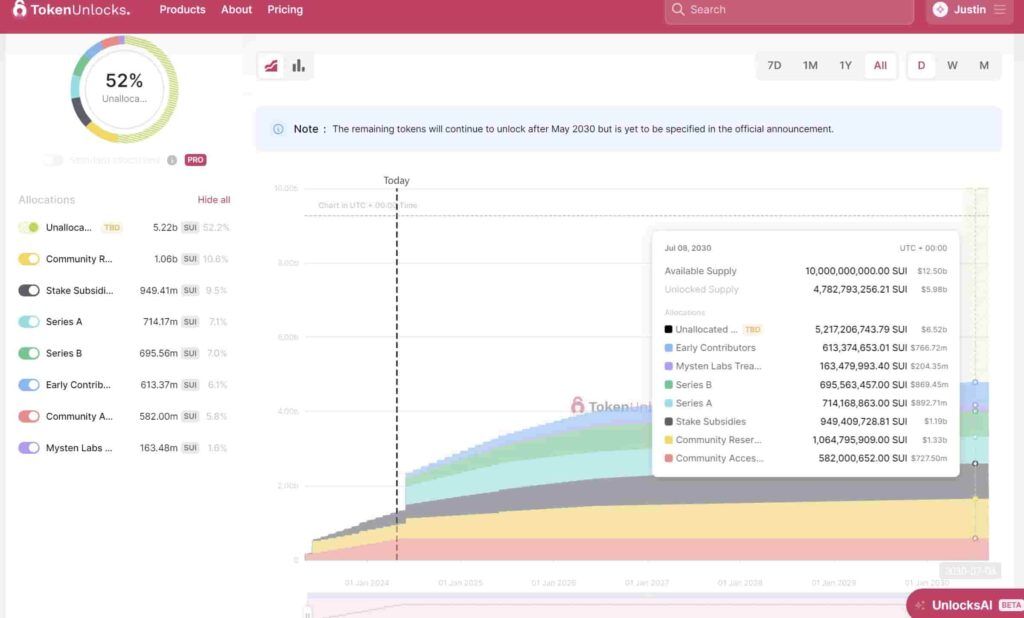

The researcher also highlights the substantial amounts of SUI tokens allocated to various entities, including 160 million to Mysten Labs (SUI’s for-profit arm), 600 million to “early contributors,” and close to 1.5 billion to VCs. Additionally, over 1 billion tokens are reserved for “stake subsidies,” which Bons claims will return to the founders who already control most of the stake.

Sui Network token unlocks. Source: TokenUnlocksApp

Justin Bons criticizes the lack of a public sale, calling SUI a “100% pre-mine.” He laments the growing trend of greed in cryptocurrencies‘ tokenomics over the past few years, with SUI being one of the worst examples.

“The sheer greed of SUI’s distribution is mindblowing,” he states, emphasizing that “SUI still refuses to give full disclosure on the MAJORITY of SUI supply…”

The researcher warns of the extreme risks posed by SUI’s centralized control, as the leadership effectively controls network consensus and has the power to crash the market overnight by selling their tokens. However, Bons suggests that a more likely scenario is a gradual selling of tokens to “slowly bleed retail investors dry.”

Justin Bons’ proposed solution

Despite his strong criticism, Justin Bons acknowledges that SUI’s technology is promising, with its object-centric model and novel solution to state bloat. He proposes two potential solutions to address the tokenomics issue:

Either burn the unallocated supply or turn control over to a decentralized on-chain governance treasury.

Yet, Bons concludes his post by emphasizing that “things are rarely black & white in crypto; nothing is all good or all bad.” He describes SUI as “a permissionless and public blockchain with a predatory supply distribution, good and evil!”

Nonetheless, he believes that SUI can redeem itself if the project’s leaders surrender control of the “unallocated” supply.

Sui Foundation’s response to Cyber Capital’s criticisms

On the other hand, the Sui Foundation issued a communication in a post on X addressing what the Foundation called “misleading posts” regarding SUI’s tokenomics. In particular, the communication explained that the tokens are locked by third-party custodians and can not be moved.

“Let’s set the record straight, starting with the basics: locked tokens are locked by third-party custodians. They cannot be moved, and are safely custodied until they are unlocked according to Sui’s token emissions schedule.”

Sui FoundationFurthermore, it disclosed that Mysten Labs does not control the Sui Foundation treasury, community reserves, stake subsidies, or any tokens allocated to investors. As explained, every further released token already has a proper allocation according to the emission schedule.

Recently, there have been some misleading posts issued about Sui’s token supply.Let’s set the record straight, starting with the basics: locked tokens are locked by third-party custodians. They cannot be moved, and are safely custodied until they are unlocked according to Sui’s…

— Sui (@SuiNetwork) May 4, 2024Nevertheless, the Foundation confirmed itself as SUI’s largest holder and that the staking rewards from the locked supply are liquid and unlocked for immediate use, adding that these rewards are “100% returned to the community and included in the public emission schedule.”

“Sui Foundation is the largest holder of locked tokens, which will be unlocked in accordance with the public emissions schedule. These tokens are used to support builders, advance the Move programming language, increase network security, and grow the ecosystem through initiatives like developer grants, hackathons, bug bounties, academic research, and more.”

Sui FoundationIn conclusion, the Sui Foundation doubled down on its commitment to full transparency and serving the SUI community. Investors, contributors, and users can now access both perspectives to complement their due diligence, research about the project, and make thoughtful financial decisions moving forward.

*Story edited to add Sui Foundation’s communication.