In a significant shift within the decentralized exchange (DEX) sector, Solana (SOL) has recently outpaced Ethereum (ETH) in daily trading volumes, sparking discussions about its potential to challenge Ethereum’s long-established dominance in the cryptocurrency market.

As of May 8, Solana’s 24-hour trading volume reached $1.314 billion, slightly edging out Ethereum’s $1.29 billion. This development not only underscores Solana’s expanding influence in the DeFi sector but also highlights its potential to be a leading market player.

BREAKING: @solana FLIPS @ethereum IN 24H DEX VOLUME pic.twitter.com/asBpJObjjn

— DEGEN NEWS ?️ (@DegenerateNews) May 10, 2024

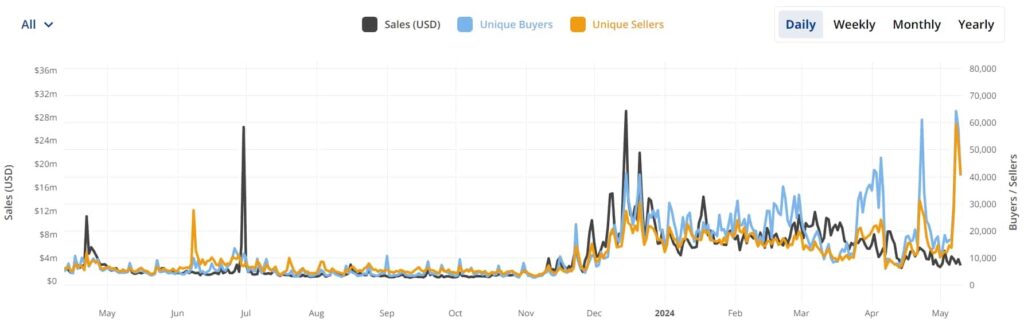

Solana NFT Sales Volume. Source: CryptoSlam

Despite this vibrant activity, Solana’s NFT market experienced a 16% decline in sales volume on the same day, totaling $3.01 million, down from $3.5 million. This drop coincided with a 7% decrease in Solana’s value between May 7 and 8, with the price standing at $153.3 at press time.

The fluctuating price potentially makes buying and minting NFTs more accessible but could deter high-value transactions, particularly from investors speculating on price appreciation.

Economic value and the potential to outpace Ethereum

Dan Smith, a senior research analyst at Blockworks, highlighted an emerging shift in economic dynamics. On May 7, he noted that Solana’s total economic value from transactions was nearing that of Ethereum, particularly in terms of transaction fees and Maximum Extractable Value (MEV).

MEV represents potential profits that validators can secure through strategic transaction orders. Solana’s advantage in MEV is bolstered by its lower fees and faster transaction speeds, which enable more frequent and cost-effective arbitrage opportunities compared to Ethereum.

Alright you guys really ran with this one without any evidence but here's the dataDefining "total economic value" (shill me better names) as total transaction fees + captured MEV returned to validators YesterdayEthereum: $3,165,772Solana: $2,803,313 https://t.co/sZAvN0MCUV pic.twitter.com/QqXStScrvk

— Dan Smith (@smyyguy) May 7, 2024On May 6, the combined figures for Ethereum stood at $3,165, while the exact figure for Solana was not far off, at $2,803. Smith’s analysis suggested that Solana could “flip” Ethereum soon, perhaps within a week. Moreover, Solana’s fees have reached 50% of Ethereum’s over recent days, a sharp increase from just 1% during the 2021 bull run.

However, this strategy is not without its drawbacks, as Solana’s network has faced congestion issues, with a high transaction failure rate of about 60%, raising concerns about reliability and consistent execution by validators.

Challenges ahead

Despite these advances, significant challenges remain for Solana. Its total value locked (TVL) as of May 10 was $4.14 billion, substantially lower than Ethereum’s $53 billion.

Solana has also suffered from multiple outages, including a notable incident on February 6 when block production halted for approximately five hours due to overwhelming demand. These reliability issues could undermine confidence in Solana’s long-term stability and operational efficiency.

As Solana’s MEV extraction capabilities grow, it presents both opportunities and challenges. Increased front-running risks and higher transaction costs could affect traders negatively, while enhanced validator incentives might spur further demand for SOL.

Watching how Solana and Ethereum will adapt and compete in this evolving market remains a critical area for both investors and enthusiasts in the DeFi space.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.