Ethereum’s (ETH) circulating supply has increased by over 37,000 ETH in the last 30 days following the Dencun upgrade. This resulted in a 0.38% monthly inflation for the leading Web3 network, which has been deflationary since January 2023.

The Ethereum network activated the Dencun upgrade on March 13, 2024, with the EIP-4844. Dencun significantly reduces transaction costs on Ethereum’s Layer-2 through “proto-danksharding.”

Notably, this enhancement makes Ethereum more efficient and cost-effective for users, marking a major step forward in ETH’s adoption. Conversely, it also diminishes the burned amount of the supply from the gas fees, which had made Ethereum deflationary.

ETH supply change, 30 days. Source: UltraSoundMoney

Ethereum: Ultra sound money

The “ultra sound money” meme surged after “The Merge” upgrade, summed with the fee-burn mechanism the EIP-1559 implemented in 2021.

Essentially, investors expected ETH’s circulating supply to be deflationary if the amount burned in fees surpassed the issued amount. The expectations were fulfilled in the past two years as this mechanism removed over 417,000 ETH from circulation since the Merge, for a 0.21% yearly supply deflation.

ETH supply change, 603 days. Source: UltraSoundMoney

Dencun upgrade: Is this the death of “Ultra Sound Money”?

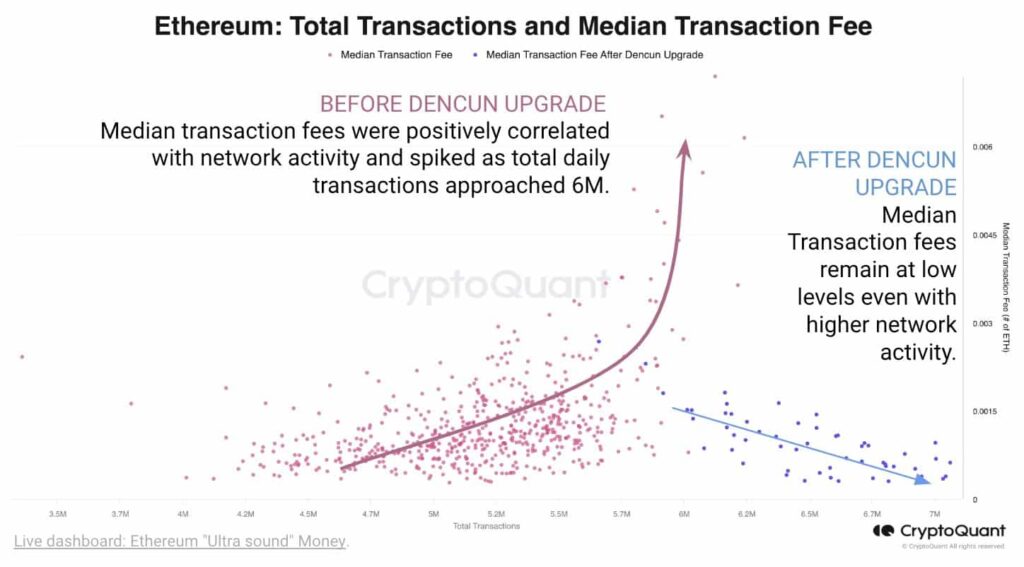

On that note, CryptoQuant analyzed the effects of the Dencun upgrade on Ethereum’s “ultra sound money” attribute. According to the analyst, median transaction fees were positively correlated with network activity before the Dencun upgrade.

However, the median transaction fees have gradually diminished since the EIP-4844 implementation.

Ethereum: Total Transactions and Median Transaction Fee. Source: CryptoQuant

“Dencun upgrade has decoupled #Ethereum’s transaction fees from network activity, reducing the burn rate even with high activity. This leads to lower user fees but challenges the deflationary mechanism set by The Merge, requiring significantly increased network activity to maintain deflation.”

– CryptoQuantNevertheless, it is still soon for the market to determine if Ethereum will again become an inflationary cryptocurrency. Investors are closely watching further developments and ETH’s economic data. On the other hand, lower fees per transaction could increase the demand for the network, increasing its overall value.