Cryptocurrency short-sellers have benefited in the last two months amid a short-term downtrend for the crypto market since March. Conversely, Finbold has spotted two cryptocurrencies signaling potential short squeezes and price surges for next week.

In this context, bullish diverges appeared in the price charts and among notable technical indicators, signaling a trend reversal. This fuels the usual short-squeeze alerts: negative funding rates, short-position volume increases, and leverage liquidations accumulation at higher levels.

Moreover, a rising optimism in India with reopened doors for offshore crypto exchanges validates the market potential for the following weeks from a regulatory and fundamental perspective.

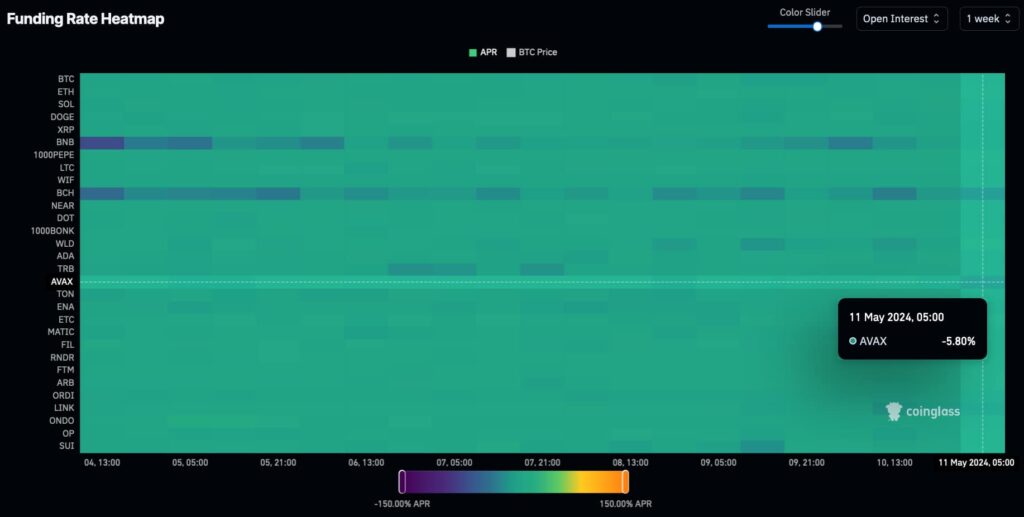

Funding Rate Heatmap: AVAX. Source: CoingGlass

Notably, Avalanche’s 1-month liquidation heatmap shows a critical liquidity pool at $40 per token, which could become a short-squeeze target. A rally to this level would reward AVAX traders with over 17% quick gains from current prices at $34.

AVAX Liquidation Heatmap, 1-month. Source: CoinGlass

Bitcoin Cash (BCH) price skyrocketing potential

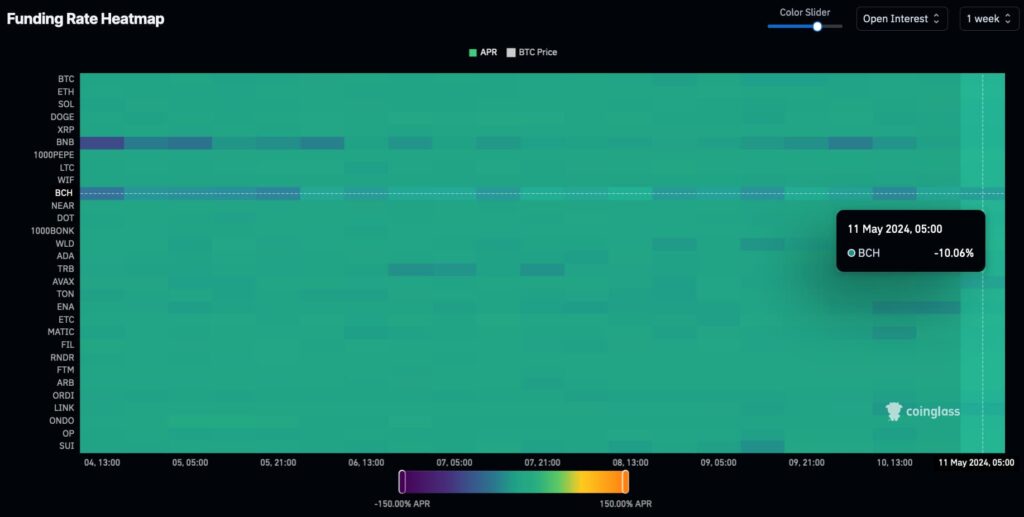

Similarly, Bitcoin Cash (BCH) has a notable negative funding rate of 10.06%, with the 10th highest open interest in the market.

Funding Rate Heatmap: BCH. Source: CoingGlass

Meanwhile, BCH could go as high as $625 after hitting the previous liquidation target of $500 in two short-squeeze events. This would result in gains from 16% to 45%, considering Bitcoin Cash currently trades at $430.

BCH Liquidation Heatmap, 1-month. Source: CoinGlass

However, other factors could prevent the forecasted trend reversal and short squeezes for AVAX, BCH, or other cryptocurrencies. Traders must remain cautious while opening leveraged positions and speculating in this volatile landscape.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.