With the recent Bitcoin (BTC) halving failing to make an immediate bullish effect on the price of the flagship decentralized finance (DeFi) asset, cryptocurrency analyst Michaël van de Poppe has shared his doubts regarding the four-year cycle for the maiden crypto.

Specifically, van de Poppe observed that there was a widespread expectation that there would be a four-year cycle for Bitcoin but also argued that this might not be the case this time around, as “liquidity goes on both sides,” according to an analysis he shared in an X post on May 12.

In his view, the current cycle will be much shorter and may not even cross three years, after which the price of Bitcoin would enter a significant bear market, or as he noted, “this cycle is going to last until late ‘26, perhaps ‘27, and then, we’re facing a severe crisis.”

‘Opportunity cost’ investing strategy. Source: Michaël van de Poppe

Bitcoin price analysis

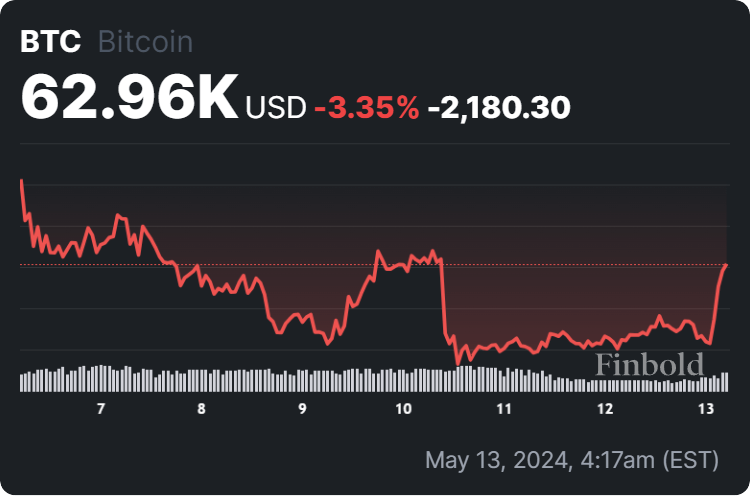

Meanwhile, Bitcoin was at press time changing hands at the price of $62,960, suggesting an increase of 3.11% in the last 24 hours, declining 3.35% across the previous seven days, and losing 6.63% over the past month, according to the most recent charts on May 13.

Bitcoin price 7-day chart. Source: Finbold

Ultimately, crypto trading experts like van de Poppe are fully aware of all the risks that come with buying and selling various assets, and they carry out all their actions at their discretion, so doing one’s own risk tolerance assessment and detailed research is necessary when investing.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.