Tether, the world’s largest stablecoin issuer, has taken decisive action by freezing $5.2 million in USDT, distributed across 12 Ethereum (ETH) wallets, to address and mitigate phishing-related security threats.

This move is part of Tether’s ongoing strategy to combat financial crimes, including money laundering and phishing scams, which misuse its stablecoin within the growing $110 billion market.

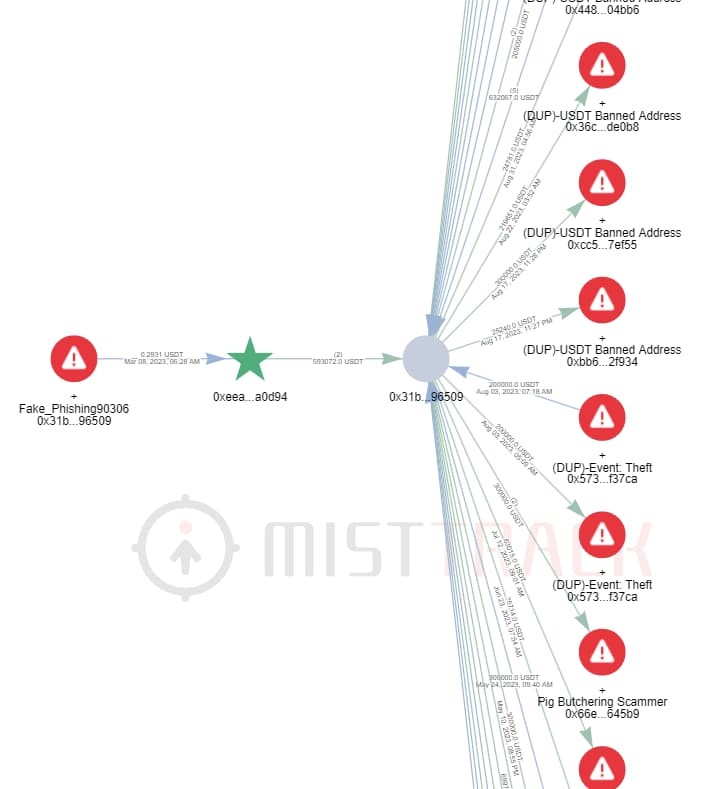

The frozen funds were identified on the blockchain security platform MistTrack, which flagged these wallets as “USDT Banned Addresses.”

Banned Addresses : Source: MistTrack

Historical context of Tether’s security efforts

Historically, Tether has been proactive in collaborating with global law enforcement agencies to block addresses involved in financial crimes. Tether CEO Paolo Ardoino, in an X post (formerly Twitter), said:

“Tether blocked more than $1.3 billion since inception, mostly related to scams, hacks, ML. Approximately $1.6 million is related to terrorist finance.”

Last year, TRM Labs, a prominent U.S. blockchain analysis company that works with law enforcement agencies, reported in their blog that Tether was frequently used as a “currency of choice” for terrorist financing.

In response, the stablecoin issuer reaffirmed its commitment to work closely with law enforcement agencies worldwide to combat crypto-funded terrorism and warfare.

Since then, Tether has been actively blocking suspicious addresses to prevent their use of USDT in committing crimes and evading government sanctions.

In April, Tether blocked wallet addresses that were using its stablecoin, USDT, to circumvent U.S. sanctions on Venezuelan oil exports.

This decision followed reports that Venezuela’s state-owned oil firm, PDVSA, is planning to boost cryptocurrency (USDT) use amid U.S. sanctions. The firm has been using digital assets for over a year to navigate economic challenges from sanctions.

Continued vigilance against illicit activities

In addition to its latest actions,Tether has a history of acting against illicit activities. For instance, last year, it froze 32 wallets involved in illegal activities in Israel and Ukraine and blacklisted 160 wallets linked to the OFAC-sanctioned list.

In 2022, it also froze an Ethereum address with over $1 million USDT, marking the highest amount seized from a single address to date.

As Tether continues to enforce strict controls on its network, it remains at the forefront of efforts to deter and mitigate illegal activities within the cryptocurrency market.

This ongoing commitment is crucial in fostering a safer ecosystem for digital transactions and enhancing the credibility of cryptocurrencies as a secure financial medium.