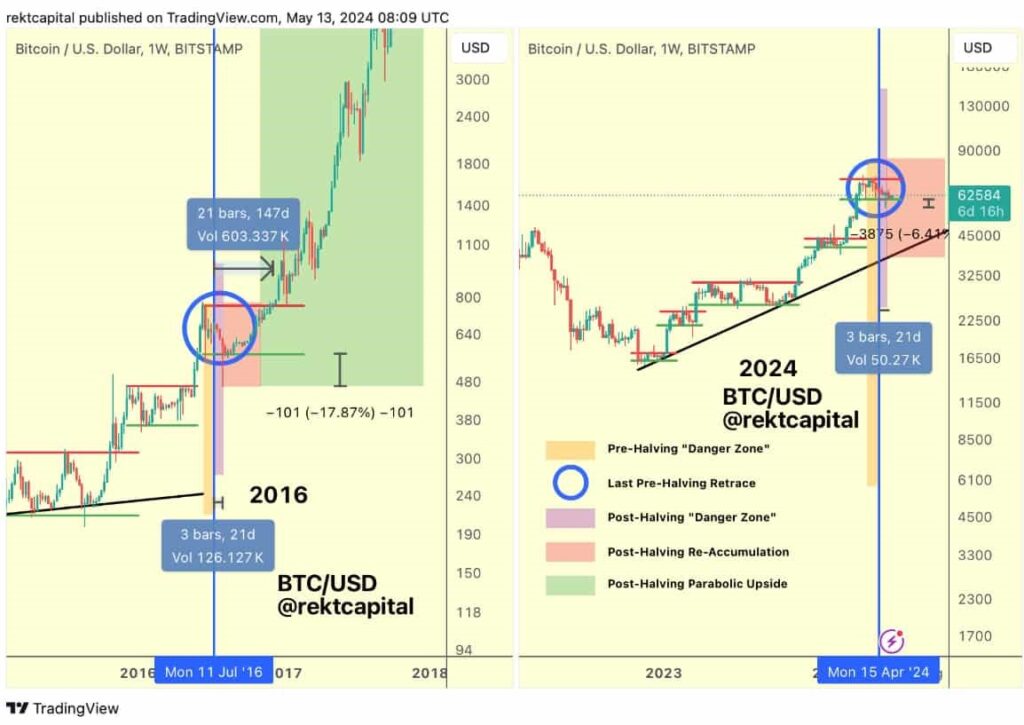

Bitcoin (BTC) has navigated through its post-halving ‘danger zone,’ a period marked by heightened volatility and price corrections.

Prominent crypto analyst Rekt Capital highlighted in an X (formerly Twitter) post that Bitcoin has now emerged from this challenging phase.

According to Rekt Capital‘s analysis, which considers historical data and recent market trends, Bitcoin is entering a reaccumulation phase. This transition suggests a potential upward trajectory in its market value and marks a significant phase in the cryptocurrency‘s cycle, indicating a shift towards growth and stabilization.

Post halving accumulation phase. Source: RektCapital/X

Following the recent Bitcoin halving event, the cryptocurrency experienced a significant price drop, declining 23% from its mid-March high of $65,000 to a low of $56,800 on May 1.

This period, known as the ‘danger zone,’ typically sees Bitcoin retreat in price as the market adjusts to the halved block rewards.

Rekt Capital noted that Bitcoin has rebounded from these lows, indicating that the asset has moved into a reaccumulation phase. He emphasized that Bitcoin had bounced back strongly from the low support levels of its reaccumulation range, suggesting the potential bottom of this period was reached on May 1.

Historical data supports this view, showing that Bitcoin typically experiences a decline around halving events. If $56,000 wasn’t the bottom, this year’s pullback at 63 days would match the longest in the cycle. However, Rekt Capital believes that the pullback concluded at $56,000 after 47 days.

Bullish signals and global economic factors

Adding to the positive outlook, prominent crypto analyst Ali Martinez highlighted a recent buy signal from the TD Sequential indicator on Bitcoin’s hourly chart, suggesting an impending upswing.

The TD Sequential presents a buy signal on the #Bitcoin hourly chart, anticipating a price rebound! pic.twitter.com/BwSwXn2mgU

— Ali (@ali_charts) May 14, 2024The broader economic landscape also plays a crucial role in shaping Bitcoin’s trajectory. A major focus this week will be on the April Consumer Price Index (CPI), set to be released today.

Forecasts indicate a CPI of 3.4% and a core CPI of 3.6%, both figures well above the Federal Reserve’s (Fed) target of 2%.

This persistent high inflation suggests that interest rates might remain elevated longer than previously expected, potentially impacting investor sentiment and financial markets.

Additionally, Raoul Pal, a renowned macro guru and CEO of Real Vision has identified the upcoming months as potentially advantageous for cryptocurrencies, describing a ‘banana zone‘—a period of enhanced global liquidity that historically correlates with strong performance in high-risk assets like Bitcoin.

This could mean that external economic conditions may align to further fuel Bitcoin’s ascent in the latter half of the year.

What’s next for BTC ?

BTC 7 day price chart. Source: Finbold

At press time, Bitcoin is trading at $62,709, with a one-day change of 1.8%.

As Bitcoin exits the danger zone and indicators turn bullish, the market appears to be entering a phase of cautious optimism. The combination of technical indicators and macroeconomic factors suggests that Bitcoin could be gearing up for a significant rally in the latter part of the year.

However, investors are advised to keep an eye on global economic trends and market signals to gauge the potential impact on cryptocurrency prices.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.