XRP whales embraced the opportunity to accumulate more tokens as the cryptocurrency market experiences a mostly neutral sentiment. Traders wonder whether this is a buy signal for the token amid developments related to Ripple, XRP’s largest holder.

In particular, the well-known trader and on-chain analyst Ali Martinez posted Santiment‘s data on X on May 15. Martinez highlighted a notable accumulation from whale addresses with a balance between 1 million and 10 million in the past 15 days.

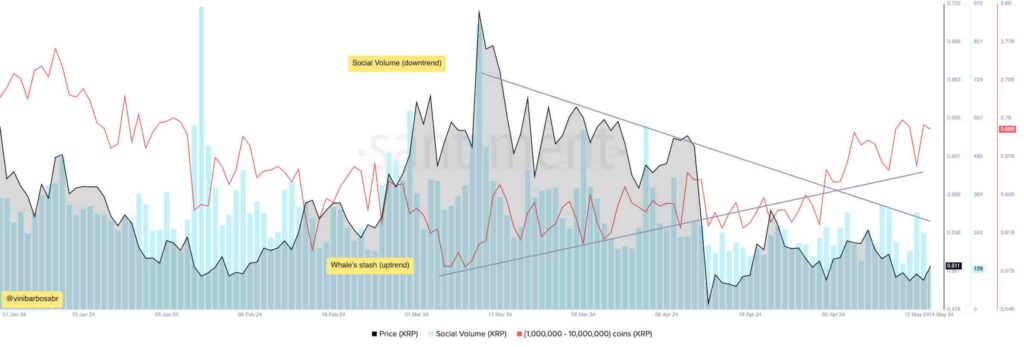

These XRP whales have increased their total stash by 110 million XRP, from 3.60 billion to 3.72 billion. Notably, this investor’s category has been accumulating more tokens in an uptrend since March, making higher lows and higher highs.

Price (XRP) + 1M to 10M coins (XRP). Source: Santiment / Ali Martinez (@ali_charts)

XRP social volume as whales accumulate

Looking for further insights, Finbold retrieved data from Santiment’s data, crossing XRP’s social volume with whale accumulation.

Interestingly, social interest and mentions for the token have been falling since a peak in March. This is another indicator of a social divergence, where whales seem bullish while the crowd has lost interest.

Usually, this asymmetry indicates a future rise in prices and a buy signal for savvy traders and investors.

Price + Social Volume + 1M to 10M coins (XRP). Source: Santiment / Vini Barbosa (Finbold)

Ripple dumps 150 million as XRP whales accumulate 110 million

Conversely, Ripple started its monthly dumps in May by selling 150 million XRP at an approximate value of $75 million. The sell-off is part of the company’s revenue model, releasing locked tokens from the genesis block and making them circulate—essentially inflating XRP supply.

Ripple unlocks 1 billion XRP on the first day of every month and sends 200 million to its treasury reserves. This activity pressures the cryptocurrency price, considering that new XRP tokens are available for whales to purchase.

For example, the company’s recent supply increase overwhelmed the recent 110 million whale demand. Meanwhile, investors actively look for further developments in the market to understand when is the best time to make a purchase, or exit a position, according to the asset’s economic dynamics.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.