The stablecoin Circle USD (USDC) has been growing in market share and approaching the undisputed leader, Tether USD (USDT). Ongoing regulatory developments threaten Tether’s presence in key markets, which could affect the company’s flagship product.

Notably, Circle launched the USDC in September 2018 in a stablecoin market highly dominated by USDT. Over the years, traders and investors welcomed the competition, considering growing concerns about Tether’s reserves and redeemability.

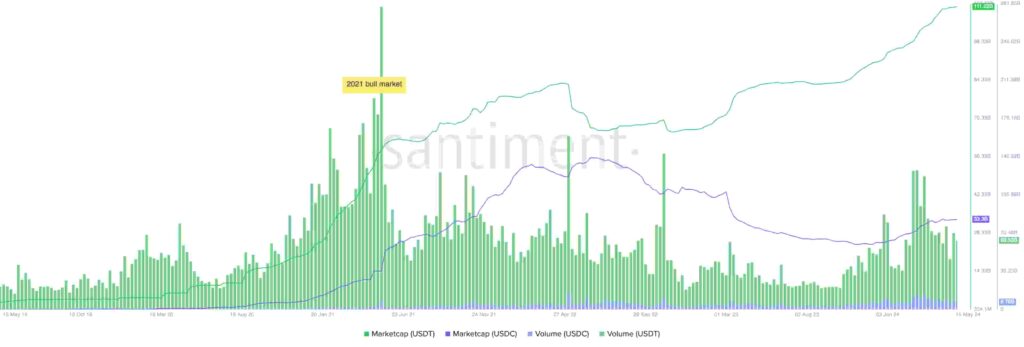

In over five years, the USDC has increased its market cap to $33.34 billion, becoming the sixth-most valuable cryptocurrency. Meanwhile, the USDT grew even more to $111.22 billion and kept third place among the most valuable cryptocurrencies.

USDT vs. USDC – Market cap and volume. Source: Santiment / Finbold

Kraken considers delisting USDT in Europe

However, Circle has a strong political presence in the United States, which the company has used in its favor against the competitor, as reported by Finbold in February 2024. Further regulatory developments outside the U.S. threaten USDT’s hegemony, opening space for USDC to take over.

In particular, Kraken is considering removing support from the USDT in Europe, according to a Bloomberg report on May 17. The possible delisting of Tether products surges amid concerns related to the European Union (EU) MiCa rules that regulate cryptocurrencies.

Kraken is one of the world’s largest crypto exchanges and the second-largest provider in the United States. The company represents a key market previously mostly dominated by Tether, and others could follow its lead.

According to crypto journalist Colin Wu, the OKX exchange recently announced the delisting of most USDT pairs. Therefore highlighting a possible trend favoring USDC over its stablecoin competitor.

According to Bloomberg, Kraken, the second largest cryptocurrency exchange in the United States, may cancel its support for USDT in the EU region in accordance with EU MiCA rules. In March, OKX announced that it delisted most USDT trading pairs in the EU. https://t.co/2PWeyoS23c

— Wu Blockchain (@WuBlockchain) May 17, 2024Interestingly, the finance giant BlackRock Inc. (NYSE: BLK) has previously disclosed “exposure to stablecoin risks” on its spot Bitcoin ETF filings with the Securities and Exchange Commission (SEC). At that time, BlackRock mentioned concerns over Tether’s reserves and Circle’s abilities to keep the $1-peg.

Now, the market awaits to see what will happen in the battle among the leading stablecoins. Losing key markets like Kraken and OKX could be a significant hit to USDT and a massive win to USDC, as capital is expected to migrate from the first to the second. As reported by Bloomberg, the new digital asset’s regime is set to take effect in July.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk