Ethena (ENA) has been heavily shorted in the derivatives market, showing staggering negative funding rates on May 18. The cryptocurrency could suffer a short squeeze soon as the market’s open interest weighs toward short positions against ENA.

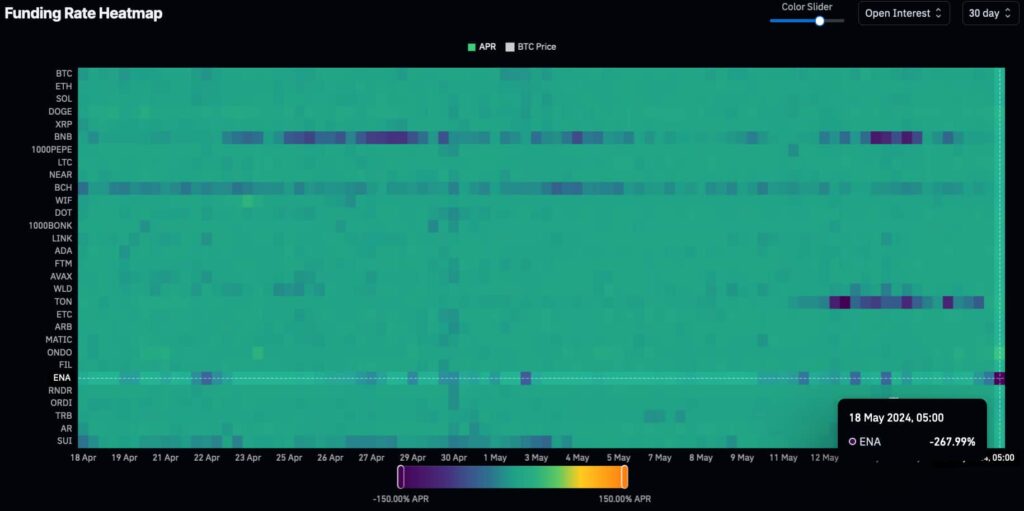

Notably, the most relevant indicator for a short squeeze alert on Ethena is its massive negative funding rate. On that note, Finbold retrieved data from CoinGlass showing ENA short-sellers are paying a 268% APR to long-position traders.

Funding Rate Heatmap: ENA. Source: CoinGlass / Finbold

Moreover, Ethena has the 25th largest open interest (OI) among all cryptocurrencies, currently with $194.21 million in open positions. ENA’s OI stands out with 16% of a $1.19 billion market cap, one of the largest OI/MCap ratios.

ENA derivatives market data. Source: CoinGlass/ Finbold

Ethena (ENA) short squeeze price target

As of this writing, ENA trades at $0.78, up 10.26% in the last 24 hours. The 24-hour open interest increased by 12.5%, while the volume increased by 35.48% to $541.55 million traded. Interestingly, $283.67 million were made of opened short positions in this period, with a 50.54% dominance.

In the case of a short squeeze, the token could target two key price zones. First, a short-squeeze liquidity pool awaits from $0.83 to $0.89, with most liquidations at $0.84. The second key level lies at $1.08.

A run to these price targets could render Ethena investors 7.7% to 38% gains from its current exchange rate.

ENA Liquidation Heatmap, 1 month. Source: CoinGlass / Finbold

However, Ethena’s long-term fundamentals are yet to be unveiled as the project has raised meaningful concerns in the crypto community.

What is Ethena (ENA)?

In summary, Ethena is a protocol built on Ethereum (ETH) that has a governance token, ENA. The protocol aims to be “the internet bond,” providing a synthetic dollar, USDe, and “internet native yield,” as described in its official communications.

Its popularity skyrocketed when Arthur Hayes personally supported the project, followed by massive support from key players. Some skeptics have compared it to Terra’s (LUNA) surge and value proposition, which later culminated in its crash in 2022.

Therefore, the current short-selling interest could be a bearish demonstration of Ethena’s fundamentals instead of short-term speculation. This could prevent a short squeeze from happening despite all the signals and technical indicators.

Nevertheless, it is impossible to know whether Ethena will be a huge success or a drastic failure. Investors engaging with ENA and USDe must understand the risks and make conscious decisions moving forward.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.