As the United States grapples with inflation, renowned American economist Peter Schiff has accused the government, particularly the US Federal Reserve as one of its branches, of causing it, challenging the widely accepted viewpoint of rising salaries as the actual source of the price increases.

Specifically, Schiff has challenged the narrative of increased salaries causing inflation, arguing that, instead, inflation can lead to higher nominal salaries, whereas pointing the finger at, in his view, the real culprit – the US government and the Fed, according to his X post on May 20.

Rising salaries don't cause inflation. Inflation can result in higher nominal salaries. Inflation has only one source. The government, which includes the Fed.

— Peter Schiff (@PeterSchiff) May 19, 2024

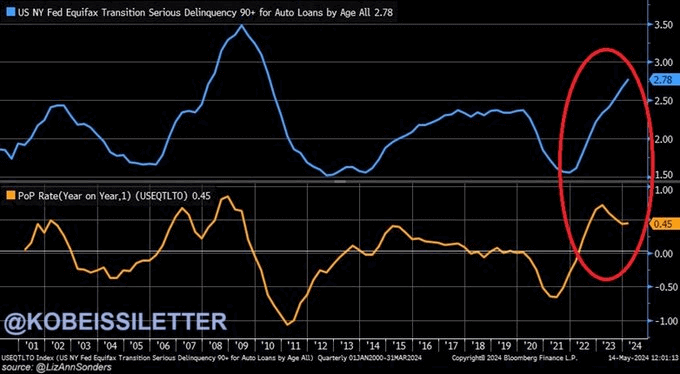

US auto loan serious delinquency rate. Source: The Kobeissi Letter

Inflation concerns

Meanwhile, Paul Dietrich, a veteran Wall Street analyst who accurately predicted the 2008 recession, has long warned about a potential downturn, pointing at several red flags, including unexpectedly high inflation in the first quarter of 2024 and increased market volatility. As he said:

“The economy and the stock market have never seen anything like this in history. (…) Everything reminds me of the Dot-com bubble in 2001-2002. (…) Since the current deficit spending is unsustainable, it will end at some point. When it does, the effect will be brutal for jobs, the economy, and the global stock markets.”

Interestingly, Schiff, a well-known Bitcoin (BTC) skeptic, has earlier acknowledged that Bitcoin holders are “right about the Fed and inflation,” arguing that other investors were largely unaware of the current financial crisis and the “far greater currency and sovereign debt crisis it will ultimately become.”

In the meantime, Bitcoin and tech stocks like Nvidia (NASDAQ: NVDA), Advanced Micro Devices (NASDAQ: AMD), Microsoft (NASDAQ: MSFT), Apple (NASDAQ: AAPL), and Alphabet (NASDAQ: GOOGL) are among the market participants that have beaten inflation in the last 10 years.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.