As the majority of assets in the cryptocurrency sector continue to make significant advances, Ethereum (ETH) is no exception, and the largest altcoin in the market could continue on its bullish path, according to certain artificial intelligence (AI) algorithms.

Specifically, Ethereum has moved well beyond the critical psychological price level at $3,500 and continues to record increases, which have seen it race over 18% in a single day on rumors that a spot-based Ethereum exchange-traded fund (ETF) might soon become a reality.

Indeed, Bloomberg’s senior ETF analyst Eric Balchunas recently said that he and his colleague James Seyffart now believed that the chances for the approval of a spot Ethereum ETF were 75%, as opposed to the earlier 25%, according to Balchunas’ X post on May 20.

3-month ETH price prediction chart. Source: CoinCodex

At the same time, the latest model of the OpenAI brainchild ChatGPT, known as GPT-4o, has provided its Ethereum price prediction for August 1, 2024, setting the targets between $4,000 – $4,500 in an optimistic scenario or $3,200 – $3,800 in a more conservative scenario.

Meanwhile, the recent Anthropic AI invention, Claude 3 Opus, has offered an estimate for the Ethereum price that indicates it will be trading between $4,500 – $5,500 by August 2024, considering factors like technical analysis (TA) and the recent Dencun upgrade. As the generative AI chatbot explained:

“Technical analysis of historical ETH price patterns suggests the next high in 2024 could be around $5,314, which would be a 201% surge from the last swing low.”

Ethereum price analysis

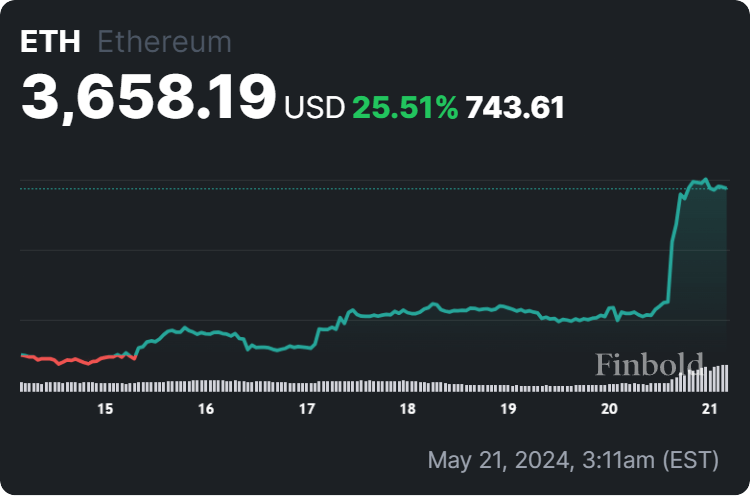

Presently, the largest altcoin in the crypto market is changing hands at the price of $3,658.19, suggesting an increase of 18.10% in the last 24 hours, adding up to the 25.51% gain in the previous seven days, and advancing 15.38% on its monthly chart, as per data on May 21.

Ethereum price 7-day chart. Source: Finbold

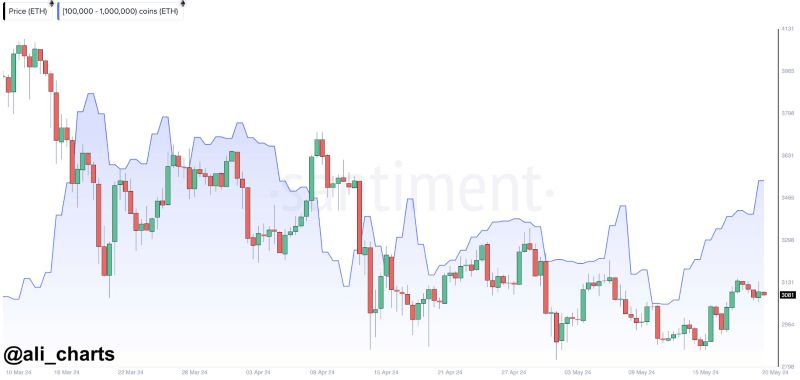

Meanwhile, popular crypto trading expert Ali Martinez has observed that Ethereum whales have bought over 110,000 ETH, worth about $341 million, in the 24 hours leading up to the time of his X post on May 20, suggesting a massive increase in interest from the market’s largest holders.

Ethereum whales’ ETH purchases. Source: Ali Martinez

It is also worth noting that another renowned crypto expert, Michaël van de Poppe, has noted that the ‘bull market is here’ and the ‘low is likely in on Ethereum,’ demonstrating his observations on a chart shared in an X post on May 21.

Ethereum price action analysis. Source: Michaël van de Poppe

All things considered, it seems that the best is yet to come for Ethereum, in the view of certain AI platforms, as well as some of the market’s most popular experts. However, doing one’s own research is still critical as things in this sector can change without warning.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.