Following the approval of spot Ethereum (ETH) exchange-traded funds (ETFs), Standard Chartered Bank has projected that several other cryptocurrencies could follow suit.

Among the cryptocurrencies is Ripple’s XRP, which is currently embroiled in a legal battle with the Securities and Exchange Commission (SEC). Notably, the approval of Ethereum spot ETFs suggests that the regulatory agency does not classify ETH as a security.

Therefore, this implies that other coins previously under scrutiny may also not be considered securities, paving the way for more spot crypto ETF approvals.

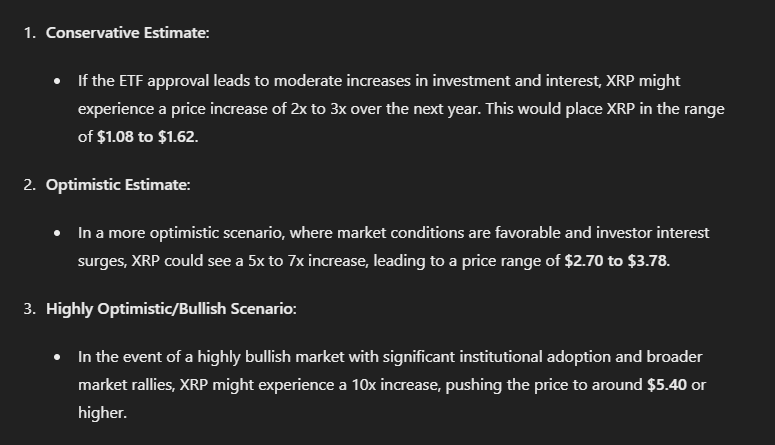

XRP price prediction. Source: ChatGPT-4o

It will be interesting to monitor how the SEC approaches a possible XRP ETF, considering the regulatory agency has been in a long-term legal battle with XRP’s parent company, Ripple.

Overall, an approval would be considered bullish for the United States cryptocurrency landscape over the ability to attract institutional investor capital into the sector.

At the moment, there are expectations that the legal matter will be resolved soon. Ripple’s Chief Executive Officer, Brad Garlinghouse, continues criticizing the SEC over its “regulation by enforcement” approach.

XRP price analysis

By press time, XRP was trading at $0.53, having rallied about 0.3% in the last 24 hours. On the weekly timeframe, XRP is up almost 3%.

XRP seven-day price chart. Source: Finbold

Meanwhile, XRP’s main hurdle is reclaiming the $1 mark, which is pivotal for competing with assets such as Bitcoin. In the short term, investors will be monitoring the price as it aims to breach the $0.60 resistance.

Disclaimer:The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.