According to a senior commodity analyst, Bitcoin’s (BTC) volatility puts it behind gold and the U.S. dollar in some investment perspectives. Meanwhile, BTC may crash harder than the stock market during a recession.

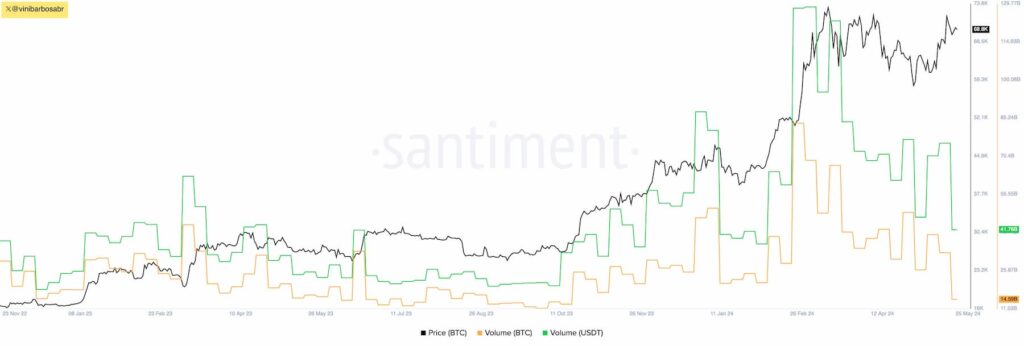

Mike McGlone, senior commodity analyst for Bloomberg, spoke about the market’s volatility in a panel at Bitcoinday Miami this week. On that occasion, McGlone highlighted how Tether’s dollar stablecoin (USDT) trades twice as much as Bitcoin on a usual day.

“Right now, I can have access to the U.S. dollar any place in the world from my phone [with] Tether. Tether is the number one trading token. It’s the number one trading crypto. It doubles the value in a typical day over Bitcoin. It’s the dollar. The whole world has gone to the dollar. Why? Because it’s the least worst of all fiat currencies.”

Mike McGlone

BTC vs. USDT trading volume. Source: Santiment / Finbold (Vini Barbosa)

In conclusion, despite being enthusiastic about Bitcoin’s long-term forecasts, Mike McGlone remains skeptical about its capacities as a solid investment asset class or recession hedge. In his opinion, volatility plays an important role. Furthermore, the U.S. dollar and gold are superior assets for different reasons.