Multiple cryptocurrency exchanges started delisting Monero (XMR) due to its privacy features, which have created arbitrage opportunities in parallel markets.

In particular, Monero is already the third most traded currency against Bitcoin (BTC) in the popular peer-to-peer no-KYC platform Bisq. The “privacy-by-default” cryptocurrency slightly loses in volume for the U.S. dollar (USD) and the euro (EUR) on Bisq.

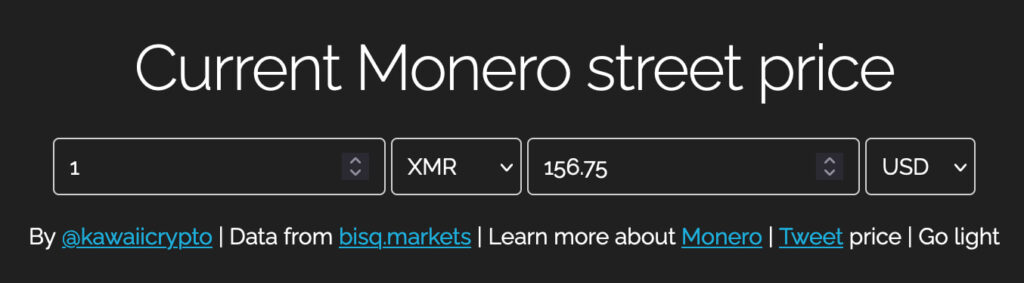

As of this writing, the “Street Price” index on monero.boats calculate a $156.75 price for XMR. This index refers to coins being traded more organically, like cash, as if they were exchanged on the street.

Monero street price index. Source: monero.boats

The street price index is calculated using the last exchange rate of Monero against Bitcoin—Bisq’s base pair. XMR is currently at 0.00224374 BTC, showing a consolidation pattern following the sell-off from Binance’s delisting.

XMR/BTC daily chart. Source: Bisq

Monero price analysis and arbitrage

Notably, the TradingView price index shows Monero trades at an average of $143.09 on major exchanges. XMR has been showing strong momentum as the price recovers from Binance‘s delisting drop to $101, testing psychological support.

Before that, Monero’s exchange rate against the dollar was above $165, with a year-to-date high of $174.36. Technical indicators suggest a bullish forecast for the leading privacy coin trading above the 30-day exponential moving average (30-EMA). Moreover, its daily relative strength index (RSI) highlights the steady growth and future projections at 67.76.

XMR/USD daily price chart. Source: Finbold

Right now, there is a 9.5% premium for Monero exchanged on the “streets” than the trading price on exchanges. This presents traders with an arbitrage opportunity that could work as fuel for an incoming price surge on the mainstream.

However, it is important to understand that low-volume markets, like Bisq, usually follow the price of high-volume markets during arbitrages.

What is an arbitrage opportunity?

An arbitrage opportunity in trading arises when an asset trades at different prices in different markets. Traders can exploit this price discrepancy by simultaneously buying the asset in the lower-priced market and selling it in the higher-priced one.

The main risk associated with arbitrage is that prices may change quickly, eliminating the opportunity for profit. Traders must also consider transaction costs, which can erode potential gains.

In the case of Monero, the 9.5% premium in street markets presents an arbitrage opportunity. Traders could buy XMR on mainstream exchanges and sell it in parallel economies like Bisq to pocket the difference.

Nevertheless, they must be cautious of the risks associated with dealing in unregulated markets. Additionally, the limited liquidity in street markets may make it difficult to execute large trades without affecting prices. Despite the risks, the significant price difference between the two markets makes this an attractive opportunity for traders willing to navigate the challenges.

Disclaimer:The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.