Over four years ago, the United States government voted into law the Economic Impact Payments, popularly referred to as ‘stimulus checks,’ which entitled every American to financial assistance in the amount of $1,200 to help them amid the economic fallout of the Covid pandemic restrictions.

Indeed, the US Internal Revenue Service (IRS) began issuing these checks in mid-April 2020 as part of the Coronavirus Aid, Relief and Economies Act (CARES Act), and some of the recipients chose to invest this money, and among these investments were cryptocurrencies like XRP.

XRP price on April 13, 2020. Source: CoinMarketCap

In other words, investing $1,200 in XRP when its price was around $0.19 would mean that today, the hypothetical investor in question would be holding close to $3,312 worth of the popular crypto asset, providing them with solid profit if they choose to sell it at the current price.

XRP price analysis

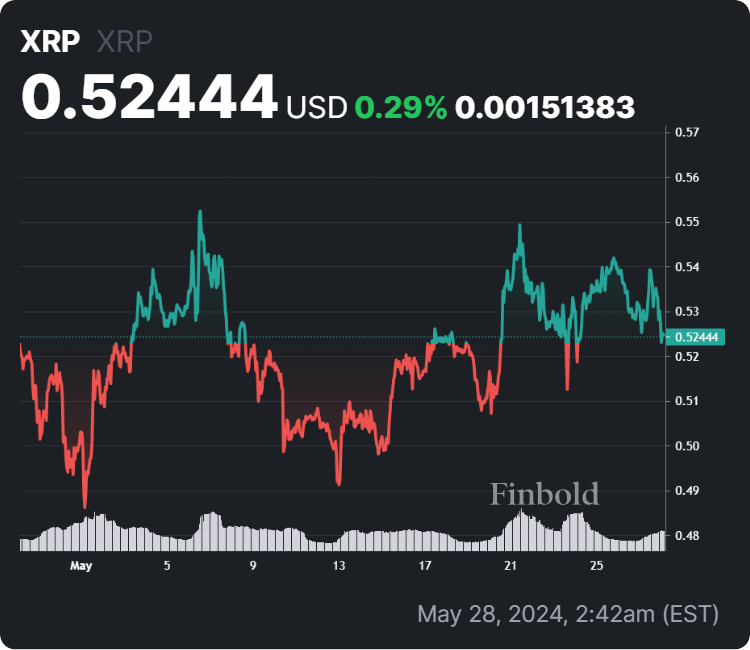

Presently, XRP is trading at the price of $0.52444, recording a 0.45% loss in the last 24 hours, as well as declining 2.79% across the previous seven days but nonetheless accumulating a 0.29% gain on its monthly chart, as per the most recent data retrieved on May 28.

XRP price 30-day chart. Source: Finbold

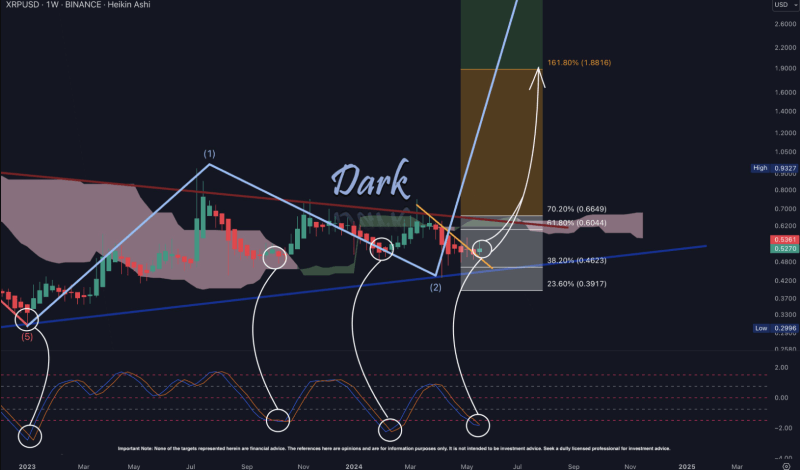

Meanwhile, a popular pseudonymous cryptoverse expert, Dark Defender, has recently provided an optimistic XRP prediction, arguing the asset was on the brink of breaking through a critical resistance zone between $0.6044 and $0.6649, which could set off a significant price surge, as Finbold reported on May 26.

XRP price action analysis. Source: Dark Defender

Ultimately, buying XRP when the government introduced the checks would have been lucrative, and indicators suggest more advances in the future, especially if the court battle between the US Securities and Exchange Commission (SEC) and Ripple ends in the blockchain firm’s favor, which would mean positive XRP news as well.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.