BlackRock’s (NYSE: BLK) Bitcoin ETF, the iShares Bitcoin Trust (IBIT), has reached a significant milestone, surpassing the Grayscale Bitcoin Trust (GBTC) to become the world’s largest ETF, tracking Bitcoin (BTC).

Launched in January 2024, IBIT has seen remarkable growth, highlighting the increasing interest in Bitcoin among institutional investors.

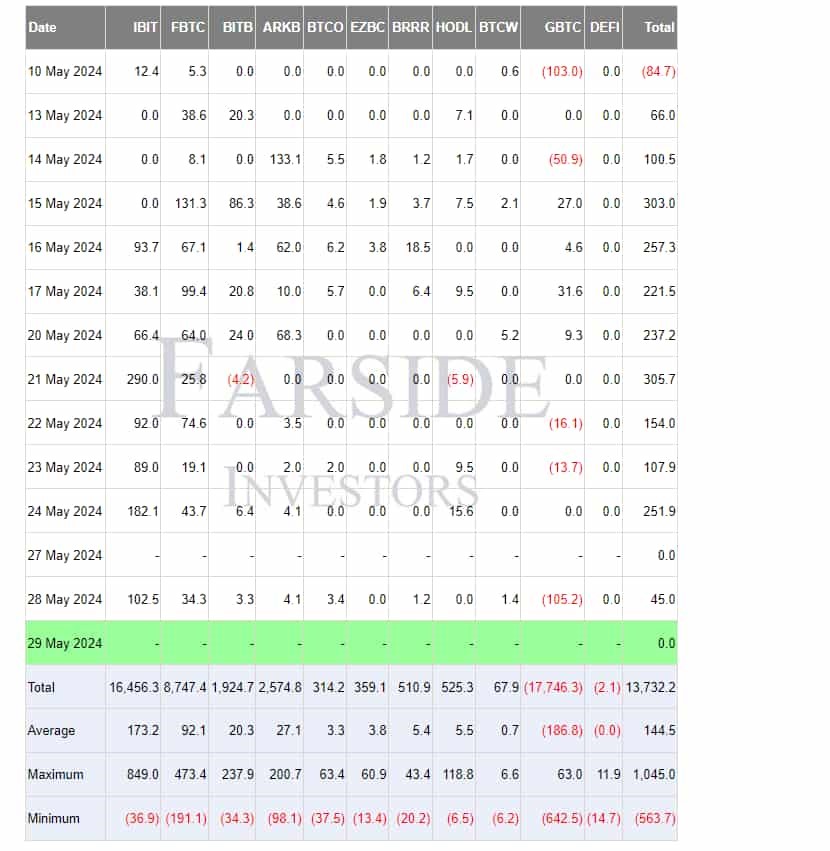

By the end of trading on May 28, IBIT recorded inflows of $102.5 million, while GBTC experienced outflows of $105 million, according to Farside data. The third largest is the $11.1 billion offering from Fidelity Investments.

Bitcoin ETF flow. Source: Farside

This achievement, realized just 96 trading days after spot Bitcoin ETFs were approved, marks a new era for crypto–financial products.

Bloomberg noted that IBIT has attracted $16.5 billion in inflows since its inception. In contrast, Grayscale’s fund saw withdrawals totaling $17.7 billion during the same period.

Analysts attribute the outflows from GBTC to its higher fees and exits by arbitrage traders. Grayscale’s 1.5% fee for GBTC is notably higher than its competitors, which has led to a decline in investor interest.

Grayscale held 620,000 BTC at the time of the conversion (1/10/2024), which was more than 3% of circulating supply, but refused to lower the fee (1.5% vs 0.2% for peers), even after investors pulled 330,000+ BTC. So much for the "differentiated" strategy.

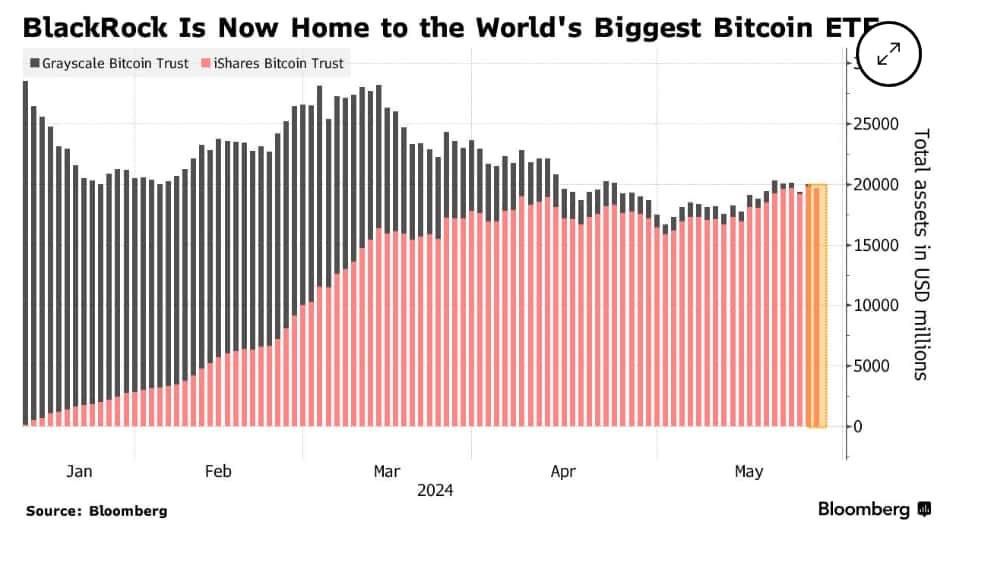

— HODL15Capital ?? (@HODL15Capital) May 29, 2024In contrast, BlackRock’s IBIT has rapidly grown, amassing approximately $19.79 billion in assets under management (AUM) within four months.

Blackrock AUM . Source: Bloomberg

Meanwhile, Grayscale’s AUM has decreased to about $19.75 billion due to significant net withdrawals.

Growing institutional support for Bitcoin ETFs

Amid strong institutional support Spot Bitcoin ETFs currently hold nearly 5% of Bitcoin’s total supply of 21 million coins.

Data from the blockchain analytics platform Dune reveals that U.S. Spot BTC ETFs collectively hold approximately 842,000 BTC, valued at around $57.2 billion.

This accounts for 4.27% of the current BTC supply. Globally, BTC ETF issuers hold about 1,002,343 BTC, according to MicroStrategy co-founder and former CEO Michael Saylor.

32 #Bitcoin Spot ETFs now hold ~1 Nakamoto of $BTC pic.twitter.com/OpHridlymc

— Michael Saylor⚡️ (@saylor) May 27, 2024Moreover, BlackRock has strategically leveraged its income and bond-focused funds to invest in IBIT. Recent US Securities and Exchange Commission (SEC) filings reveal that the BlackRock Strategic Income Opportunities Fund (BSIIX) purchased $3.56 million worth of IBIT shares, while the Strategic Global Bond Fund (MAWIX) acquired $485,000 worth.

Institutional optimism around Bitcoin has been growing, with substantial investments reported in Bitcoin ETFs.

This trend suggests a broader acceptance and integration of cryptocurrency into traditional financial markets, further solidifying Bitcoin’s position as a valuable asset class.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.