Veteran trader Peter Brandt forecasts a major surge in Bitcoin’s (BTC) value compared to gold (XAU), predicting BTC could reach 100 ounces of gold within the next 12 to 18 months.

Currently, it takes 29 ounces of gold to buy one Bitcoin, suggesting Brandt’s prediction could result in a 230% increase in BTC’s value against gold.

Bitcoin has steadily gained ground against gold since its inception. In 2017, Bitcoin surpassed gold in terms of price, peaking at $19,649 on December 17, while gold traded at $1,264 per ounce, requiring 15.5 ounces of gold to buy one Bitcoin.

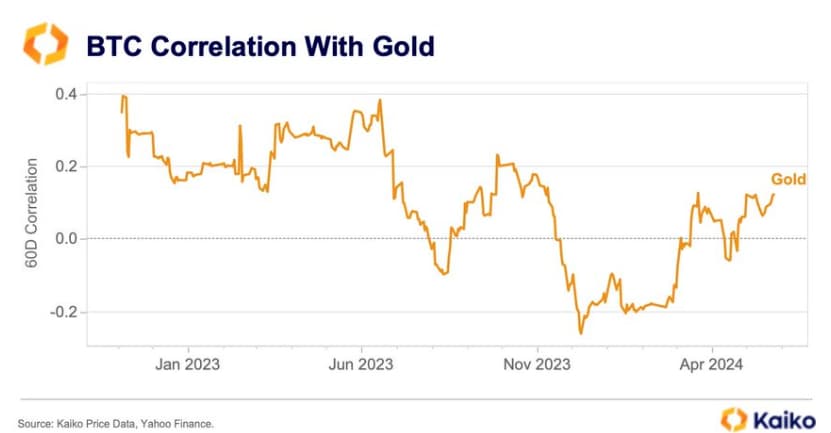

BTC correlation with gold. Source: Kaiko

This suggests that while both assets offer protection against economic uncertainties, investors view them differently, with Bitcoin potentially offering more upside.

Price analysis – Bitcoin vs. Gold

BTC and gold 1 year price analysis. Source :TradingView

Over the past year, Bitcoin exhibited high volatility, ranging from $25,036 to $73,390, achieving a 118% increase. Its relative strength index (RSI) indicated both oversold and overbought conditions, currently standing at a neutral 52. Factors such as the halving event and increasing institutional interest contribute to its optimistic long-term prospects.

Gold, on the other hand, showed steady growth, with a 17.7% increase in price and an RSI of 46, reflecting market balance. It remains a preferred safe haven asset amid economic uncertainties, expected to maintain its stability due to ongoing inflation and geopolitical tensions.

Both assets offer distinctive investment opportunities: Bitcoin for potential high returns and volatility and Gold for stability and risk mitigation

For now, the next target on Bitcoin’s list is silver, which has a total market cap of $1.8 trillion, while Bitcoin sits at $1.33 trillion in value, according to data provided by CryptoRank.

Bitcoin still has a long way to go to catch up to gold, which is estimated to have a total value of $15.5 trillion.

As Bitcoin continues to gain ground and attract investor interest, its performance against gold will be a key metric to watch in the coming months.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.