The New York Stock Exchange (NYSE) is considering implementing cryptocurrency trading, although the current regulatory framework prevents moving forward. As the world’s largest exchange in volume, such development could positively impact the demand for cryptocurrencies—Bitcoin (BTC) included.

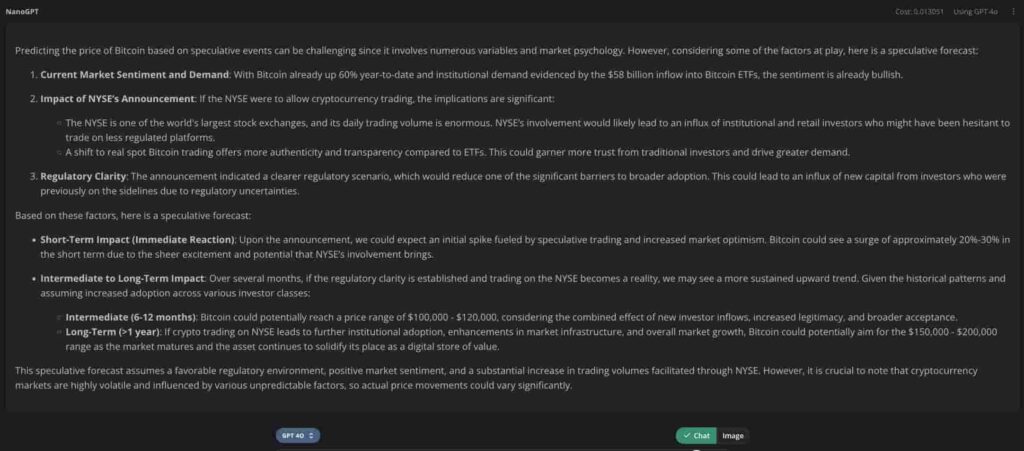

Looking for insights on the possible effects of an NYSE Bitcoin listing, Finbold asked OpenAI‘s most advanced artificial intelligence (AI) model, ChatGPT-4o, what the BTC price could be following this approval.

ChatGPT-4o model Bitcoin price prediction in the given context. Source: NanoGPT

NYSE open to crypto trading with clear regulations; CME plans spot trading

In the Consensus 2024 event, NYSE President Lynn Martin said the exchange would consider offering cryptocurrency trading if U.S. regulations were clearer. The success of U.S.-listed spot Bitcoin ETFs, amassing $58 billion, indicates demand for regulated crypto products. CME, NYSE’s rival, plans to launch spot crypto trading for clients, as also reported by CoinDesk.

Bullish CEO Tom Farley highlighted the rapid change in U.S. politics towards crypto, predicting regulatory progress in 2024-2025. Martin remains optimistic about using blockchain to improve financial processes, especially for less liquid assets.

However, Farley believes regulators’ distrust of public blockchains may push TradFi firms towards developing private blockchains for settlement. Clear regulatory guidance is crucial for the crypto industry’s growth and innovation in the U.S.

BTC price analysis

As of this writing, Bitcoin trades at $67,724, maintaining a price range between $60,000 and $72,000. Nevertheless, currently trading above the 30-day exponential moving average (30-EMA) suggests a bullish potential to challenge the range’s resistance and fight for the $82,000 as forecasted by ChatGPT-4o.

Additionally, Bitcoin’s daily relative strength index (RSI) also suggests a growing momentum that can propel this potential bull rally. BTC is up 60% year-to-date from the $42,284 exchange rate on January 1.

BTC/USD daily price chart. Source: TradingView / Finbold

In closing, the above ChatGPT-4o’s price prediction for Bitcoin will depend on a number of factors and is not guaranteed. Further regulatory developments, investors’ interest, and traditional finance offerings could significantly impact the cryptocurrency in the following years.