In just over a week since the United States Securities and Exchange Commission (SEC) approved spot Ethereum (ETH) exchange-traded funds (ETFs), cryptocurrency exchanges have seen substantial ETH outflow, demonstrating the impact of regulatory decisions on market dynamics.

As it happens, since the securities watchdog’s approval of Ethereum spot ETFs on May 23, 2024, approximately 777,000 ETH – valued at around $3 billion – has left crypto exchanges, according to the chart data and observations shared by renowned crypto trading expert Ali Martinez in an X post on June 2.

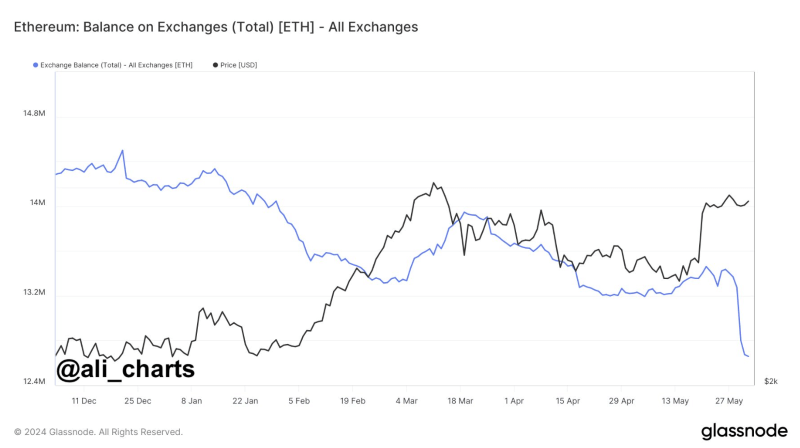

Ethereum balance on exchanges. Source: Ali Martinez

Indeed, the Glassnode chart shared by the analyst showcases the massive changes in the total balance of Ethereum on all crypto exchanges, which has witnessed a significant drop in the days following the approval to the areas of around 12.5 million ETH, coinciding with a price increase.

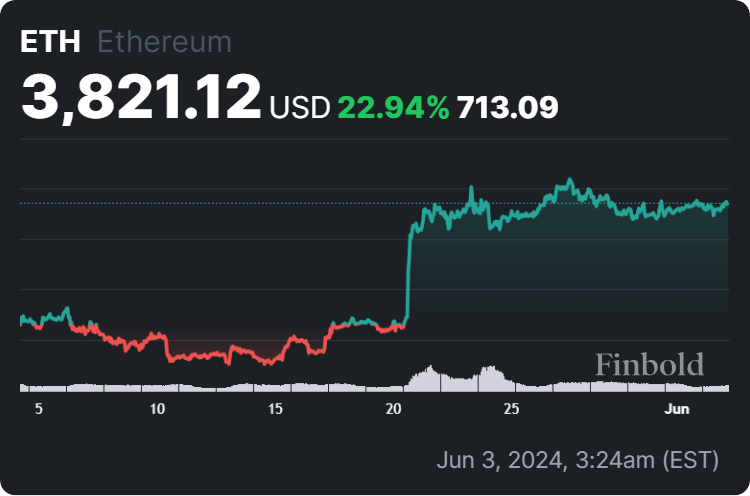

Ethereum price 30-day chart. Source: Finbold

More recently, this crypto asset has demonstrated significant strength against the market representative and flagship decentralized finance (DeFi) asset, Bitcoin (BTC), reclaiming a key trendline that has been immensely important for more than seven years, as Finbold reported on June 1.

Ethereum ETF effect

As a reminder, the price of Ethereum started to increase on May 20, not long after Bloomberg’s senior ETF analyst Eric Balchunas said that he and his colleague James Seyffart believed that the chances for the approval of a spot Ethereum ETF were 75%, as opposed to the earlier 25%.

Update: @JSeyff and I are increasing our odds of spot Ether ETF approval to 75% (up from 25%), hearing chatter this afternoon that SEC could be doing a 180 on this (increasingly political issue), so now everyone scrambling (like us everyone else assumed they'd be denied). See… https://t.co/gcxgYHz3om

— Eric Balchunas (@EricBalchunas) May 20, 2024In the same period, Martinez also noted that Ethereum whales had bought 110,000 ETH, worth about $341 million at the time, during the 24 hours leading up to his X post on May 20, indicating a major increase in interest from the market’s largest holders in the expectation of the spot ETF approval.

All things considered, the massive withdrawal of Ethereum from exchanges suggests a growing preference among crypto traders and investors to secure their holdings in anticipation of further price growth and reduced selling pressure on exchanges, which is typically a bullish sign.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.