About four years ago, the American government started issuing stimulus checks to help its citizens recover from the economic fallout of the COVID pandemic and related restrictions, and investing this money in various assets, including cryptocurrencies, was among the popular choices.

Indeed, the United States Internal Revenue Service (IRS) had issued the first round of the financial aid or Economic Impact Payments, under the Coronavirus Aid, Relief and Economic Act (CARES Act), in the amount of $1,200 (as well as an additional $500 for every child) starting in mid-April 2020.

SHIB price all-time price chart. Source: Finbold

Specifically, investing $1,200 in Shiba Inu at the time of its launch in 2020, when its price was practically next-to-nothing (or about $0.00000000017) would mean that today, it would be worth close to $30.24 million, providing massive profit for those who decide to sell it at its current price.

SHIB price analysis

Currently, the SHIB price at press time reflects a decline of 5.30% in the last 24 hours while also losing 3.67% across the previous seven days, and adding up to the 3.44% drop on its monthly chart, whereas it has gained 130.65% since the year’s turn, as per data on June 4.

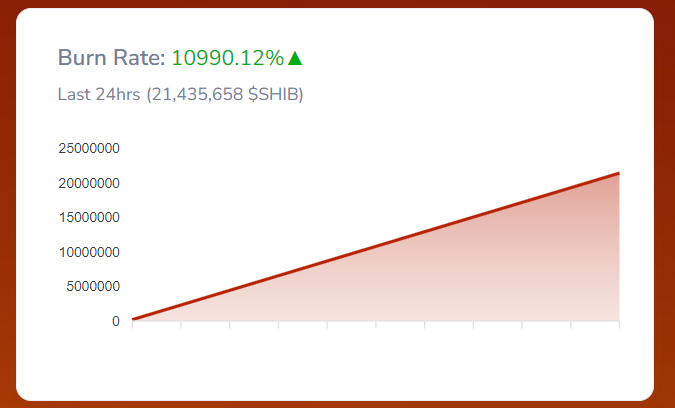

Meanwhile, the SHIB burn rate has spiked by a massive 10,990%, burning more than 21 million SHIB tokens in one transaction, according to SHIB burn rate tracker Shibburn, possibly the result of increased activity in the ecosystem and SHIB burn initiatives by the community, signaling potential price gains.

SHIB burn rate 24-hour chart. Source: Shibburn

In conclusion, investing in this crypto when the US government started issuing the $1,200 stimulus checks in 2020 would have been highly lucrative as it has since risen to become the 11th-largest asset in the crypto sector by market capitalization, and certain indicators suggest it could continue to grow.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.