Ethereum (ETH) is making significant strides towards reaching the $4,000 mark, spurred by recent developments involving the Securities and Exchange Commission (SEC).

Speculation is rife that Ethereum might replicate Bitcoin’s (BTC) price movement, which saw a notable rally following the approval of Bitcoin exchange-traded funds (ETFs).

The introduction of new Ether ETFs has been a catalyst for significant whale activity, further boosting Ethereum’s ascent

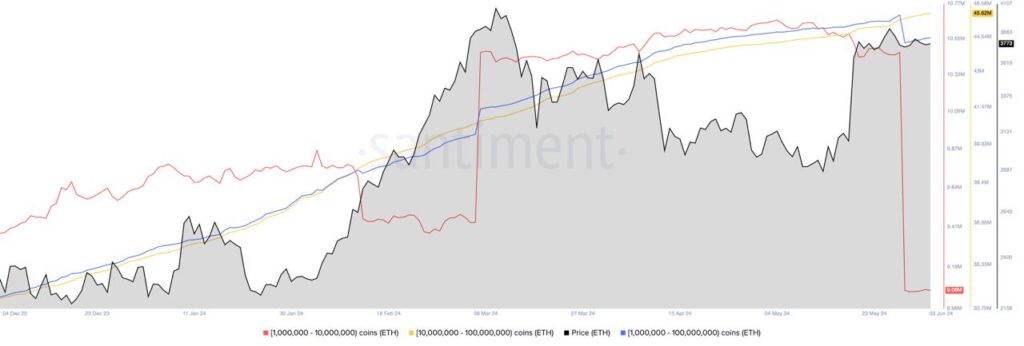

Ether supply distribution among whales. Source: Santiment

Conversely, whales holding between 1 million and 10 million ETH appear to be taking profits, while exchange reserves have significantly declined.

This suggests that investors are moving their holdings off exchanges, indicating a long-term bullish sentiment (hodling) that could potentially drive Ether above the $4,000 mark.

Ethereum price analysis amid massive whale accumulation

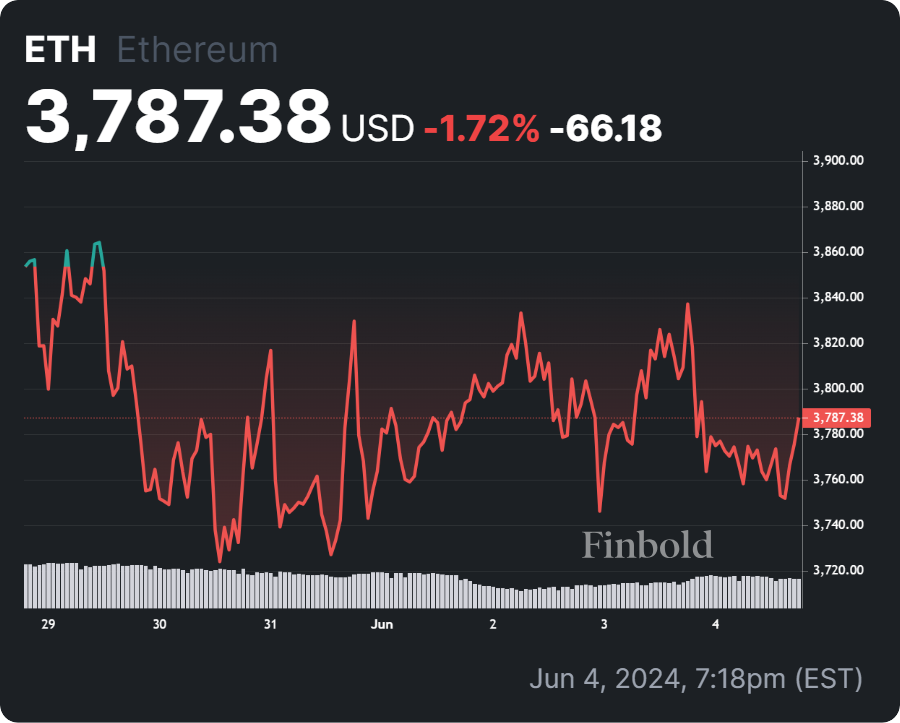

By press time, Ethereum was trading at $3,751. On the monthly chart, ETH has rallied by over 20%.

ETH 7-day price chart. Source: Finbold

The recent surge in Ethereum’s price, spurred by whale activity and the approval of spot Ether ETFs, shows strong bullish sentiment in the market.

The significant withdrawal of Ether from exchanges and accumulation by major holders suggest a promising future price trajectory.

The ETF approval is expected to attract institutional investors, motivating ETH bulls to maintain the price above $3,500

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.