Bitcoin (BTC) has traded in a tighter price range in the past 18 days, marking key support and resistance levels. These key levels make for ideal and high-risk entry points in Bitcoin, respectively, as the leading cryptocurrency decides its direction.

In a post on X, the prominent Bitcoin and crypto trader who goes by Credible Crypto warns of impending volatility. According to him, BTC is currently at a high-risk entry point, trading near the range’s resistance level. Thus presenting a short-term retracement possibility, targeting the range lows, which corresponds to an ideal entry point at price support.

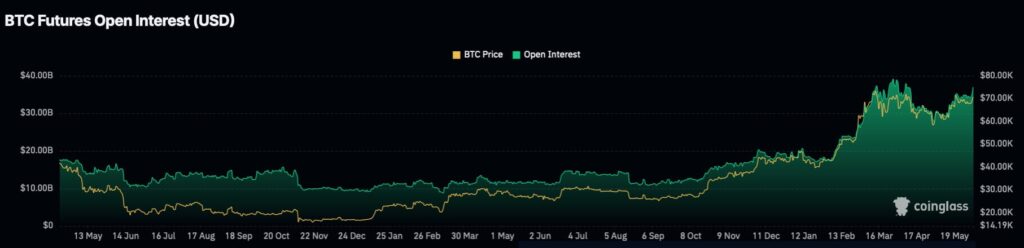

Moreover, Credible Crypto attributes the incoming volatility to a surging open interest (OI) despite the tight neutral range. Therefore, the trader foresees a short or long squeeze that could cause a deviation and possible breakout from this range.

BTC/USDT hourly chart on Binance futures. Source: Credible Crypto

Bitcoin open interest and price analysis

Finbold retrieved data from CoinGlass and TradingView on June 5 that validate the trader’s analysis on Bitcoin.

On the one hand, BTC’s open interest in futures approaches its all-time high, currently at $37.66 billion. It has a record high of $39 billion, which could soon be surpassed by the current surge, highlighting speculative demand.

BTC Futures Open Interest (USD). Source: CoinGlass

On the other hand, the BTC/USD daily chart shows a 3-month range between $60,000 and $72,000 with two deviations—one upwards to $73,805 and the other downwards to $56,535. Inside this larger range, the tighter zone Credible Crypto mentioned in his analysis.

In particular, this lower time frame range has the same resistance at $72,000 and higher support at $66,000. The second is what the trader considers an ideal entry point on Bitcoin if it ever happens.

BTC/USD daily chart. Source: TradingView / Finbold

However, Bitcoin registered an all-time low transaction volume, and its spot trading volume faded amid an increased speculative volume on BTC futures and exchange-traded funds (ETFs), as reported by Finbold on June 2.

Like any speculative market, cryptocurrencies present high volatility, especially as uncertainty takes over in finance markets. Thus, investors must look for different analyses and indicators to make better decisions and build their positions accordingly.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.